Separation Of Volatile Merchant Business Will Lead American Electric Power To Outperform

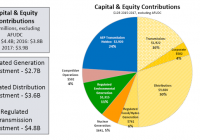

Summary Separation of volatile merchant business will lead to multiple expansion. Higher capex spend to support growth in the weaker environment. Transmission business is expected to be a significant contributor to AEP’s growth in the near future. Healthy balance sheet to trigger M&A opportunities for AEP. Above industry average dividend growth with room for growth may support stock in low power pricing environment. Company description American Electric Power (NYSE: AEP ) is one of the largest electric utilities in the United States (US), delivering electricity to more than 5.3m customers in 11 states. AEP ranks among the nation’s largest generators of electricity, owning nearly 38,000MWs of generating capacity in the US. AEP also owns the nation’s largest electricity transmission system, a more than 40,000-mile network that includes more 765-KV extra-high voltage transmission lines than all other US transmission systems combined. Investment highlights Separation of merchant generation business to improve multiples I expect AEP to sell/spin off its volatile merchant generation business later this year. The company’s management has already confirmed its commitment to make the company a pure regulated utilities business. I see the separation of merchant generation business as a positive catalyst in two ways: 1) AEP as a pure regulated utilities company commands higher multiple and 2) the current stock price doesn’t reflect the merchant generation business. At current levels, AEP trades in line with Duke Energy Corporation (NYSE: DUK ) (15.5x FY15 EPS) excluding any value for its merchant generation business (DUK has already sold its merchant generation business to Dynergy for $2.8bn). Unlike DUK, AEP has no exposure to international risk so commands higher multiple. High capex to support growth Over the next 3 years, AEP plans to invest $12bn (96% to regulated businesses), with nearly $5bn in transmission, $3.6bn in regulated distribution, and $2.7bn into its regulated generation fleet. This drives a 6.6% rate base CAGR across the regulated businesses (including transmission) for 2015-2017. The rate base growth combined with cost cutting measures will definitely help the company reach the target EPS growth of 4%-6% annually. AEP’s future capex plan: (click to enlarge) Source: June 2015 Investor presentation of AEP Transmission business to be a significant contributor to growth I believe the company’s 4%-6% EPS growth rate target is quite achievable and the transmission business is going to be the main contributor to growth, providing $0.15/yr of EPS growth through 2018. With management focused on capital allocation for its businesses, i expect transmission to get the incremental investment from any sale proceeds (sale proceeds from merchant business). AEP’s Transmission Business revenue growth estimate: (click to enlarge) Source: June 2015 Investor presentation of AEP Strong balance sheet AEP is safely levered at present, given regulatory requirements at most of its utility subsidiaries and covenants that require AEP to maintain debt/total capitalization at a level that does not exceed 67.5%. Going forward, i expect the company to remain in safer zone due to stable cash flows from the regulated business. Total debt/capital was 54.4% as of year-end 2014 and i expect it to remain relatively constant going forward despite high investment plans. In addition, AEP has ample liquidity with $163m of cash and $3.5bn of borrowing capacity under its credit facility commitments as of year-end 2014. I view AEP’s dividend as safe and expect the dividend payout ratio to remain at 60%-70%. Source: June 2015 Investor presentation of AEP Experienced management Nick Akins, the sixth CEO in AEP’s 100-year history, became the CEO in 2011. Before his promotion, Mr. Akins served as the executive VP of AEP’s generation unit. He has also led the company’s Southwestern Electric Power unit and was vice president of energy marketing services in his 30 years with the company. Brian Tierney, the executive VP and CFO, has been with AEP since 1998. The experienced management will definitely focus on growing regulated business post separation from volatile merchant business. Strong dividend growth During the 12 months ending 3/31/2015, AEP paid dividends totaling $2.09/share. Since the stock is currently trading at $54.23, this implies a dividend yield of 3.9% (higher than NextEra Energy Inc , AES Corp , NRG Energy, Inc., which have a current dividend yield between 2.3% and 2.9%). AEP has increased its dividend during each of the past 5 years (in 2009, the dividends were $1.64/share). The company has a payout ratio of 60.1% which is expected to reach 70% going forward. AEP’s dividend history and estimate Source: June 2015 Investor presentation of AEP Valuation My price target of $61.26 for AEP is based on a 3.2% premium to the industry target average P/E multiple of 15.5x on 2016 EPS estimate of $3.60. I assign the premium to reflect an improved regulatory environment in most of AEP’s service areas, a visible long-term earnings growth profile in its transmission segment, expected sale of merchant generation business , as well as benefit from PJM’s Capacity Performance proposal. I recommend investors to take position in AEP at current level of $54.23 to get a return of 16.7% (13% price appreciation+3.7% of dividend yield) in one year. AEP’s Regulated Business FY16 Adj EPS P/E multiple Price/share Utilities $2.82 15.8x $44.42 Transmission $0.74 16.8x $12.40 Other $0.04 15.8x $0.63 Total Equity/share $3.60 16.0x $57.44 AEP’s Competitive Gen. Business FY16 Adj EBITDA, $m EV/EBITDA Multiple Generation co. 360 8.0x 2,880 Debt, $m 1,006 Equity value, $m 1,874 Number of shares, m 490 Equity/share $3.82 Total Equity/share $61.26 Current trading price $54.23 Upside 13.0% Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.