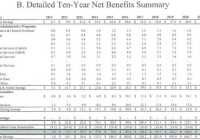

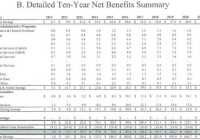

Summary Connecticut regulators issued a draft decision denying UIL and Iberdrola USA’s merger request. While unfavorable, the decision provides a roadmap for the Applicants to obtain approval with a new application. Substantial value will be created through the merger, so investors should expect the merger process to continue. Last week Connecticut’s Public Utility Regulatory Authority (PURA) issued a draft decision denying Iberdrola ( OTCPK:IBDSF ) and subsidiary Iberdrola USA’s (IUSA) proposed acquisition of UIL Holdings (NYSE: UIL ). After the draft decision UIL requested a two month extension to address PURA’s concerns. The extension was also denied, but PURA said that UIL could file a new merger application. On July 7, UIL withdrew their first merger application, and notified PURA that they will soon file a new one. While the denial was a setback, it is not an insurmountable one. The Applicants had expected the merger to be complete by year end. Considering the speed by which PURA reached this draft decision, it seems that the process could be restarted and finished in time to meet that goal. The merger agreement has a walk away date of December 31, 2015, but three-month extensions are available if all closing conditions have been met other than regulatory approvals. So this draft decision has not created a timing problem that will kill the deal. The draft decision is very critical of the Applicants, but PURA has essentially given UIL and Iberdrola a roadmap to obtaining merger approval. The value this deal creates for shareholders and customers should give the companies enough incentive to keep this deal moving forward. IUSA’s tax assets are a big value creator for this merger. Note 20 of IUSA’s 2014 financial statements shows over $1.5B in NOLs and tax credits. These credits were primarily generated by IUSA’s large investments in wind generation. Acquiring UIL gives them more income to be shielded from taxes, leading to faster monetization of these credits. The credits help explain why Iberdrola is willing to pay $10.50/share in cash to UIL shareholders to do the deal. With this huge incentive it is no surprise that the Applicants plan to come back with a new proposal. Down the road, shareholders of the combined company may also be able to benefit from turning some of IUSA’s renewable assets into a yieldco. Yieldcos such as NRG Yield (NYSE: NYLD ) and NextEra Energy Partners (NYSE: NEP ), have been hot lately, as investors hunt for opportunities with better yields. So the cash payment as well as new value streams really give current UIL investors reasons to be in favor of the deal. PURA’s issues with the Applicants are summarized in this excerpt from the draft decision: No compelling evidence was presented by the Applicants that proves this change of control transaction is the best solution for UIL’s plan to grow or become financially stronger, improve performance in a way that provides additional measurable and enforceable benefits to ratepayers, the public service companies themselves or the State. You can bet that UIL and Iberdrola will strongly address these issues in their next application. One big criticism from PURA was there was no synergy savings estimate from the Applicants. These are always tricky to develop because some savings will be from needing fewer employees, but PURA probably wouldn’t look too fondly on a big decline in jobs. Still, there should be savings that comes about from other means besides fewer workers. The NU/NSTAR merger of 2012 gives an example of a synergy savings analysis that was well received by PURA. Here is a summary of the 2012 NU/NSTAR merger estimated benefits: (click to enlarge) (Source: Exhibit 13 of NU/NSTAR merger application ) UIL should expect savings in many of these areas and should be able to come up with something similar. For example, common advertising campaigns can be developed for all of the combined utilities, eliminating duplication. Obviously this will take some work, but with merger experience at both UIL and IUSA over the last few years, a similar analysis should be possible. In the draft decision PURA lists some conditions that were included in the settlements of recent merger cases, and seemed to imply that similar commitments could get this merger over the finish line. These items were: Residential rate freeze of 36 months after the transaction closing Commitment to accelerate the pole inspection cycle Rate credit allocated to retail customer classes Commitment to improve non-storm and storm related service quality performance at a minimum of the 10-year historical average Commitment to open space land Seven year commitment to not move headquarters out of Connecticut Net benefit analysis of synergy savings So if similar commitments and information could be provided it should go a long way toward getting PURA’s acceptance. The Applicants had already proposed no rate cases for 12 months. Since the merger would likely create some type of operational savings, it should give the Applicants the ability to stay out longer than their original proposal. Subsidiary Connecticut Natural Gas (CNG) completed their last rate case in 2014, and subsidiary United Illuminating (UI) finished theirs in 2013. Southern Connecticut Gas’ (Southern) last case was in 2009, and they actually received a rate decrease at the time, so it might be a bit more difficult to extend at that subsidiary, but it seems like the other utilities should be able to last longer than one year. UIL also offered to give a $5M rate credit to some residential customers. It appears that PURA wants these credits spread over a wider range of residential customers. In the NU/NSTAR case, CL&P gave $25M of credits to all residential customers. Since CL&P is bigger than the UIL companies, the Applicants could likely get by with something smaller. One item that was a big sticking point in PURA’s argument against the merger but not in the above list was ring fencing. There was actually no ring fencing in the NU/NSTAR merger from a few years ago, and PURA’s request for these conditions is basically unprecedented in Connecticut. The Applicants did agree to some ring fencing type items in their merger request, but now that they know how important this is to PURA they will likely add a few more. PURA also implied that one primary issue led to their draft denial of the application. In their analysis they said: The Authority need only look to its Decision dated November 10, 2010 in Docket No 10-07-09, …[ UIL purchase of Southern and CNG (2010 Decision) ]… for the exact reasons why the Proposed Transaction should be denied. (emphasis mine) PURA then references P.5 of the 2010 Decision, which said immediate benefits at the time would include: Local control, long-standing record of commitment to the state and region, experience with Connecticut regulation and legislation, expertise in conservation and load management, and the change to Connecticut as the base for services currently provided to CNG and Southern from outside Connecticut. PURA also references items from the 2010 Decision estimating savings in overhead costs of over $11M. PURA then writes: The proposed transaction looks to remove these stated benefits just five years later. Therefore, to approve the Proposed Transaction would be a direct contradiction to what the Authority previously determined was in the public interest. PURA then mentions concerns about the Applicant’s commitment to their venture over the long term. They cite Iberdrola’s sale of CNG and Southern just two years after acquisition as evidence that their dedication to Connecticut could be shaky. While PURA makes some points, they should be addressable by UIL and IUSA. By taking best practices from both companies, those shared services costs that were so high five years ago during the gas acquisition should be decreasing. And if not, it seems like the merging parties could commit to limiting the allocated costs that are collected through rates for a number of years. Secondly, regarding the commitment issues, take a look at the following information from the utility operating companies of the Applicants: The three gas companies are dramatically smaller than the other three utilities Iberdrola obtained (NYSEG, RGE, and CMP) when they bought Energy East in 2008. Back in 2010 these gas companies would likely have been lost in a company focused on New York and Maine, so they were sold to UIL where they could receive acceptable attention and not fall through the cracks. Bringing all of the new UIL into the IUSA fold adds a company that is on par with IUSA’s Maine and New York operations. IUSA’s self-interest in desiring success at this now important part of the company should take care of these commitment concerns. PURA shouldn’t hold it against Iberdrola that these were trimmed back in 2010, because it really didn’t make sense for IUSA to own them at the time. PURA also seemed overly critical in a few areas, likely because the application was lacking in the areas mentioned above. For one thing, PURA criticized the Applicants for not providing any specific best practices that could be implemented. Obviously determining which companies have the best practices in different operations takes time and sharing intimate details of how companies operate probably should not be done until the merger is complete. The NU/NSTAR merger approval does not list specific best practices and says: This merger will provide the inherent benefits of bringing together two corporations … which will create opportunities to identify and implement best practices. So there is precedent that a merger can be approved before the identification of specific best practices to implement has been completed. The Applicants also committed to develop plans to optimize resources to respond to storms and emergencies. PURA said they give the applicants no credit for this because PURA “… assumes that these types of responses are a normal course of business and not an incentive to approve the transaction .” While it is true that utilities all around the country work together to help during storms, the integration of response teams can be much more thorough if they are part of the same company. So PURA really should be giving the Applicants some credit here. Conclusion: It appears that this merger will create substantial benefits for both shareholders and customers. PURA seems to want a more quantifiable commitment from the Applicants about the benefits customers will receive, and PURA has essentially given the Applicants a roadmap to do this. Investors should not consider the recent denial of the merger an overwhelming challenge to getting the deal done. Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.