The Chinese Government Just Rigged The Market In Your Favor

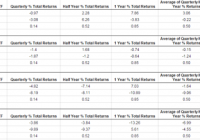

Summary The Chinese government has taken unprecedented measures to support its A-shares market. Both intuition and history indicate that these measures will likely be successful. Buy A-shares now, or on any dip. The Chinese stock market crash has been making headlines recently, with much of the focus being on the government’s unsuccessful and seemingly desperate efforts to engineer a reversal. From cutting interest rates and reserve ratios, to suspending new IPOs and directing various government entities to purchase shares, nothing seemed to work. Eventually, the People’s Bank of China began providing “unlimited liquidity” to state-owned China Securities Finance Corp in order to fund stock purchases. History has taught us that when central banks print money in order to buy publicly traded assets, the prices of those assets go up relative to the currency being printed. So this on its own was a very big deal. While it was becoming increasingly clear that the Chinese government really , really wants their mainland stock market to go up, their next move was so heavy-handed, and so fundamentally alters the risk-reward calculus for owning Chinese stocks, that it all but guarantees a profit for anyone buying A-shares (NYSEARCA: ASHR ). China makes it illegal to sell stocks On July 8, 2015, the China Securities Regulatory Commission (CSRC) announced that directors, supervisors, senior management personnel, and anyone with more than 5% of the stock outstanding in a company, are not allowed to sell their shares for the next 6 months . This is in addition to having already directed state-owned pension funds, insurance companies, securities firms and other institutions to buy and hold shares. Private companies are not allowed to sell equity because IPOs are frozen. Public companies have been instructed not to sell and are required to submit reports on measures they will take to support their share price. The 21 largest Chinese brokerages have pledged to buy stock and not sell any of it until the Shanghai Composite goes above 4500. China Investment Corporation, the country’s sovereign wealth fund, has begun purchasing Chinese ETFs. You get the picture. All of these people and entities are forbidden from selling. You’re kidding me If this sounds incredible, keep in mind that the Chinese government has immense power over its people and is not shy about exercising its authority in ways that the West might consider uncouth. This is the same government that filters internet search results and imprisons non-violent political dissidents. Recognizing that the sell-off in A-shares was caused by the fear of losing money, the Chinese government has decided to counter this fear with the greater fear of being imprisoned, tortured and sent to a forced labor camp . The Ministry of Public Security has already launched investigations into “malicious shortselling” of Ping An ( OTCPK:PIAIF ) and PetroChina (NYSE: PTR ) stock on July 8th. So who can sell? Individual investors, who hold 25.03% of A-shares by market cap , can sell unless they fall under the CSRC’s definition of an insider as mentioned above. Professional institutions make up only 14.22% of the A-shares market cap, and only some of them, including qualified foreign institutional investors, can sell. Judging from the CSRC data below, I estimate that less than 10% of professional institutions would be able to sell without being charged with a crime. The rest of the market cap is owned by general institutions, which cannot sell . We can thereby deduce that less than 35% of the A-shares market cap is held by entities which are not prohibited from selling. We then need to halve this number because more than half of all stocks on the Shanghai and Shenzhen exchanges have been halted . Thus, less than 17.5% of the A-shares market cap is now available to be sold. Supply and Demand To sum it up, the supply of A-shares available to be sold has been dramatically reduced by government edict and the demand for A-shares has been dramatically increased by government purchasing. Anyone who has taken an introductory course in microeconomics knows that a decrease in supply or an increase in demand, much less a simultaneous occurrence of both, will cause the price of the good in question to go up. Which is why on July 9, 2015, the Shanghai Composite had its biggest daily gain since 2009. If only a minority of people can sell, and the government is printing money to buy everything in sight, then the supply of stock certificates not held by the government will decrease, and thereby command progressively greater prices. In other words, China is now the mother of all “low float rockets,” a colloquialism often used in the momentum investing community. Chinese stock exchanges impose a 10% limit on daily price increases, and only three trading days have elapsed since the government first announced its ban on selling. This means that there is still plenty of upside remaining as the government continues to push share prices to levels that reflect their narrative of an intact bull market. Valuation It is worth noting that valuation metrics on the Shanghai Composite appear cheap, and are nowhere near previous highs: (click to enlarge) Legendary investor Jim Rogers began buying the dip as early as June 26th . Goldman Sachs, Fidelity, and many others have recently turned bullish. Investment Thesis However, valuation is not at all important to my investment thesis, which is instead based on two very simple premises: 1) The Chinese government wants Chinese stock prices to rise and 2) The Chinese government is capable of causing Chinese stock prices to rise. If you believe these two statements are true, then by necessity, the Chinese stock market must go up. There are a myriad of reasons for why the Chinese government wants to rescue its stock market: avoiding financial contagion , transforming into a consumer-driven economy , and keeping their citizens from revolting , to name a few. Their actions, however, are what speak volumes about how serious and committed they are to this cause. I believe that they are willing to do whatever it takes to make their stock market go up, and there are rumors that they are readying an even larger fund for direct stock purchases . The second premise, the question of capability, is even more intuitive. The Chinese government has unequivocal authority to regulate assets domiciled in China and traded on Chinese exchanges. Shares in Chinese companies only have value within the context of Chinese corporate law, and because the law is written by the government, and the higher levels of government are not accountable to voters, there is nothing to stop the government from doing whatever they want. Wealthy Chinese shareholders aren’t going to risk imprisonment just to make a few extra yuan. Even if they were stupid enough to try placing a sell order, brokerages are simply refusing to execute those orders . Historical Precedent The media has been a harsh critic of this market intervention, just as they were harshly critical of previous market interventions such as the Federal Reserve’s Quantitative Easing (QE) program and the Hong Kong Monetary Authority’s famous short squeeze of the Hang Seng Index. It’s true that market interventions such as these reduce liquidity and thereby increase fragility and systemic risk. The global asset bubble is something that keeps me awake at night. But regardless of whatever long-term consequences may arise as a result of such market interventions, no one can deny that when central banks print money to buy assets, those assets do rally. (click to enlarge) The closest historical analogue to China’s ban on selling occurred when Japan’s Ministry of Finance instructed its banks not to sell stocks on August 18, 1992. The Nikkei responded by rallying 32% over the next three weeks in a straight, almost uninterrupted line. The chart above is not exhaustive, history is littered with examples of successful market interventions. Some countries such as Taiwan have funds permanently designated for supporting stock prices. Momentum Once investor confidence is restored, rising prices will lead to more rising prices, which will catalyze a second leg to this rally and possibly even reflate the bubble. China does not yet have much of a stock market investing culture, and only 13% of household wealth is invested into its stock market versus about 50% for U.S. households. If Chinese households decide to hop on for the ride, they have ample dry powder to do so. Human beings are genetically predisposed to move in herds, and if it happened before, it can happen again. Risk Factors The government could change their mind and give up on trying to support share prices, which I truly believe will not happen, but anything is possible. It’s also possible that they could lose control of the market, especially if large shareholders figure out a way to sell their holdings without being detected. In order to combat this possibility, the government is asking brokerages to provide the names and national ID numbers of its account holders . The largest risk for foreign retail investors such as the readers of this article, is probably ETF tracking risk. It’s possible that due to half of the A-shares market being halted, ETFs such as ASHR will have trouble tracking their underlying indices. In other words, when Chinese stocks decline, the U.S. traded ETFs that track them could decline by a much greater amount. The opposite is also true. Last Friday, the ChiNext index on the Shenzhen stock exchange rose by 4.11%, but (NYSEARCA: CNXT ), the ETF that aims to track it, rose by 23.32%. A nice surprise for the traders who went long the day before. Disclosure: I am/we are long ASHR. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Additional disclosure: I am long ASHR in client accounts through my investment management company, Honey Badger Capital Management.