Vanguard Wellington Fund: Can One Fund Do It All?

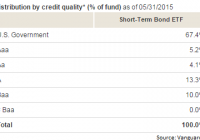

VWELX is one of the oldest balanced funds around. It has a great track record of success and is dirt cheap to own. This could be the cornerstone on which you built a portfolio, or even your entire portfolio. Vanguard Wellington Fund (MUTF: VWELX ) dates back to 1929, that puts it among an elite group of funds in the pooled investment world. And, unlike many of Vanguard’s funds, it isn’t an index fund. If you are looking for a single fund to be your portfolio or to be your portfolio’s backstop, this fund should be on your short list. What’s it do? Vanguard Wellington Fund is a balanced fund, placing roughly two-thirds of its assets in stocks and the rest in bonds. Its primary goal is long-term capital appreciation with a moderate amount of income. When selecting securities Wellington Management uses a value approach. In practice that means buying “established large companies” in which earnings, or earnings potential, is not fully reflected in share prices. On the bond side, Wellington Management, “…selects investment-grade bonds that it believes will generate a moderate level of current income.” That’s not very exciting, but the true value of the bond assets is diversification. So boring is good here. How’s that working out? So far, Vanguard Wellington’s done a great job for investors. Over the trailing 15-year period through June, the fund has an annualized total return of roughly 8%, including reinvested distributions. That may not sound all that exciting, but that’s pretty much the point of a balanced fund. Solid, but boring. That 8%, by the way, puts the fund in the top 4% of all similar funds tracked by Morningstar. But the risk/reward trade off deserves more examination than this. For example, over that trailing 15-year period Vanguard Wellington’s standard deviation, a measure of volatility, was roughly 9.5. Compare that to the S&P 500 500 Index’s 15 and you start to see the benefit. Oh, and the S&P returned roughly 4.5% a year annualized over that 15 year span… Now that makes Vanguard Wellington start to look pretty good. And, perhaps the best part, the fund is dirt cheap to own with an expense ratio of just 0.26%. That’s active management for a price that’s not much higher than an index fund. Not a bad deal at all. So what? That brings us back to what you might want to do with this fund. For starters, it’s a fund that’s appropriate for just about any investor to own, aggressive or not. For those who don’t want to bother with the work of investing it could easily be the only fund you every need to buy. A true one and you’re done offering. However, there’s a small problem here if you are looking for income. Vanguard Wellington’s trailing yield is just 2.4%. Unless you have a lot of money, that’s not going to be enough to live on. That leaves two options. First is to set up an automatic withdrawal program so that you get regular checks from the fund. In good times Vanguard Wellington’s gains will more than make up for a modest withdrawal program (say the old rule of thumb 4%). However, in bad years, you’ll be drawing down capital. Despite the fact that past performance is no guarantee of future returns, historically speaking the fund would have more than made up for its lean years. The other option, and perhaps the better choice for more active investors, is to use Vanguard Wellington as your core holding. That means you don’t have to worry too much about the base of your portfolio, allowing you to spend more time finding other investments that can provide you with more income. A core and explore type portfolio structure. And one that would allow you to take on more risk with the explore portion because of the relatively low risk of the core. For example you might pair higher distribution closed-end funds with Vanguard Wellington. In the end, Vanguard Wellington is a great fund. It isn’t right for everyone, but it could have a place in almost any portfolio. That includes being the only holding all the way to being a cornerstone of a more diverse portfolio. If you are trying to simplify, take a moment to look at Vanguard Wellington Fund. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.