Aqua America: The Water Utility To Own

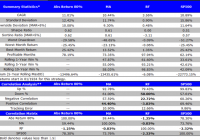

Summary Aqua America is currently overvalued relative to peers, but could be bought on dips or through the company’s DRIP. Focused on very high operational efficiency. Raised their dividend 23 years in a row. I typically shy away from highly regulated industries such as water utilities, however Aqua America (NYSE: WTR ) offers many benefits to a well-balanced portfolio. Aqua America is the country’s second largest publicly traded water and wastewater utility by market cap and serves roughly 3 million customers in the eastern United States, primarily Pennsylvania. As a company in the water utility industry, Aqua America is limited in their organic growth as their rate increases have to be approved by regulators. Therefore much of their top line growth has to come from acquisitions to add more customers. In the last 20 years Aqua America has made over 300 acquisitions . The trend towards consolidation will continue for many years due to the costs involved in operating and maintaining water and wastewater systems. The business can be run much more efficiently at scale so it is sensible that these systems be run by larger private companies than small municipal governments. Aqua America’s commitment to efficiency With top line growth limited to regulated rate increases and acquisitions it is incredibly important for utilities to manage costs efficiently and scale their businesses properly in order to provide investors adequate return. Aqua America has made many commitments to efficiency, large and small. They spent $329 million on infrastructure improvements in 2014 to improve reliability and reduce leakage. With operational cash flow and low cost debt, they plan spend another $1 billion on infrastructure improvements over the next three years. They also take pride in their use of solar energy, bi-fuel truck fleets, and efficient lighting systems to keep energy costs as low as possible. Using cash flow from operations margin (CFO divided by net sales) as a measure of efficiency, Aqua America easily trumps the other three largest publicly traded water utilities. Over the last three years Aqua America has had an average cash flow from operations margin of 48% , well above American Water Works Co. (NYSE: AWK ), American States Water Co. (NYSE: AWR ), and California Water Service Group (NYSE: CWT ), with three year averages of 33.7% , 28.5% , and 22.1% , respectively. Between 2010 and 2013 the company focused on a portfolio rationalization strategy to become more efficient. During this process the company divested in operations where there was little long term customer growth potential or they could not achieve acceptable operating results. These divestitures allowed the company to become more focused in markets in which they have already reached a critical mass of customers and have long term growth potential. This strategy helped the company grow their return on equity above levels seen in their peer group. WTR Return on Equity (NYSE: TTM ) data by YCharts Strategy results Since the early 1990’s, the growth by acquisition strategy has helped Aqua America more than quadruple its customer base. From 2005 to 2014, Aqua America raised their revenue and earnings per share at compounded annual growth rates of 5.1% and 9.7% , respectively. The successes have enabled the company to raise the dividend to shareholders in each of the last 23 years, including increases of greater than 5% per year in the last 16 years. Looking forward At the end of the second quarter Aqua America replaced its retiring CEO, Nick DeBenedictis, who had presided over the company’s growth for the last 23 years. Incoming CEO Christopher Franklin has been with the company for 22 years and was previously Chief Operating Officer, watching over all regulated operations. As a company veteran very knowledgeable of operations, Franklin should be able to transition smoothly and continue to bring excellent results. Through the end of the first quarter the company had already acquired water and wastewater systems in Illinois, Pennsylvania, Virginia, and New Jersey. With plans to acquire another 15 to 20 systems in 2015 the company is on their way to customer growth of 1.5 to 2.0% for the year, which would be their highest level since 2008. In addition to regulated operations, the company also has room to grow in non-regulated industries. The company has one subsidiary offering liquid waste disposal as well as protection and repair services for households and another subsidiary that provides non-utility water supply to firms in the natural gas drilling industry. Though these operations only accounted for 3% of company revenue in 2014, they have shown strong growth potential. Portfolio opportunity Currently Aqua America appears to be fairly valued on a P/E basis but slightly overvalued in an EV/EBITDA comparison to peers. Their current P/E ratio of just under 19 is about even with the S&P 500. However compared to the peers studied earlier, Aqua America appears to be overvalued as they trade at an enterprise value/EBITDA of 13.8 . AWK, AWR, and CWT trade at EV/EBITDA multiples of 10.5 , 10.5 , and 8.9 , respectively. I see opportunity to buy this company for the long term on the next large market dip or more preferably through the company’s dividend reinvestment program . Their dividend currently yields about 2.60%. As said earlier, management has been committed in recent years to raising the dividend rate, and I don’t see this changing any time soon. Enrolling in the dividend reinvestment program directly through the company’s transfer agent allows you to buy shares of the company at a 5% discount to market price on all dividends reinvested; another substantial bonus to holding this company. Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in WTR over the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.