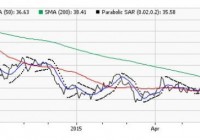

Buy-Ranked Gaming ETF In Focus

The once-thriving global gaming industry was badly hit by the slowdown in the Chinese economy that led to sluggish casino business in Macau – the world’s largest casino gaming destination. This is because the nationwide crackdown on corruption in China last year compelled Macau officials to impose restrictions on illegal money transfers in VIP gambling from mainland China to Macau. This has taken a toll on overall gambling revenues hurting the casino stocks at large. Additionally, smoking ban in casinos, tighter restrictions on visas and lower spending by high-stake gamblers added to the woes (read: 4 China A-Shares ETFs Pick Up After Gloom ). This 16-month bear trend now seems to be reversing with many casino stocks bouncing up from their lower levels. In particular, the U.S. casino giants like Las Vegas Sands (NYSE: LVS ), Wynn Resorts (NASDAQ: WYNN ), Melco Crown Entertainment Limited (NASDAQ: MPEL ) and MGM Resorts International (NYSE: MGM ) are up 4.5%, 2.6%, 5.5% and 1.5%, respectively, since the start of the second quarter. Hong Kong listed Galaxy Entertainment Group ( OTCPK:GXYEY ) added 5.6% while Sands China ( OTCPK:SCHYY ) moved higher by 15.1% so far this month. The impressive gains were brought in by the easing of tourist restrictions in Macau, and the possibility that bans on gaming-floor smoking rooms will be eased once operators maintain decorum and protect these rooms from harmful tobacco smoke. Effective July 1, mainland China passport holders transiting through Macau can stay there for two days longer and could gain entry into the city within 30 days instead of 60 days previously. This move will benefit casino operators in the months ahead. Further, the Chinese economy is stabilizing and casino operators in Macau are making efforts to diversify their businesses beyond gaming for additional revenue streams (read: ETFs to Play 3 Undervalued Sectors ). Apart from these, casino stocks seem extremely cheap at the current levels as the average valuation on Macau’s five biggest casino operators by market value has dropped to 18 times estimated earnings , about half of the peak reached in December 2013. This suggests an attractive point to enter the gaming market. Given this, investors could play this space with lower risk in a basket form rather than tilting toward individual companies. The Market Vectors Gaming ETF (NYSEARCA: BJK ) is the lone ETF providing investors global exposure to the casino gaming market. The fund has a Zacks ETF Rank of 2 or “Buy” rating with a High risk outlook (see: all the Top Ranked ETFs ). BJK in Focus This product follows the Market Vectors Global Gaming Index, holding 47 securities in its basket. It is concentrated on the top 10 holdings with the largest allocation going to Las Vegas, Galaxy Entertainment and Wynn Resorts that have combined to make up for 22.6% share. In terms of country exposure, U.S. takes the top spot at 36.8%, followed by China and Australia with 13% share each. The fund focuses on large caps at 56.2% while mid caps account for the remainder. From a style look, it has a nice mix of blend, value and growth securities, reflecting superior weightings. However, investors often overlook the fund as it has accumulated only $29.6 million in its asset base and trades in small volume of roughly 12,000 shares per day. This ensures additional cost in the form of wide bid/ask spread beyond the expense ratio of 0.65%, which is already at the higher end of the expense ratios prevailing in consumer discretionary ETF space. In terms of performance, BJK has been lagging the broad market and lost 24.2% in the trailing one-year period and 5.1% so far this year. But it recently broken its near-term range as depicted by the chart below, indicating some smooth trading in the weeks ahead. The fund’s short-term moving average (9-Day SMA) has managed to move ahead of the mid-term moving average (50-Day SMA) and is now treading toward the long-term (200-Day SMA) average, signaling upside for the fund. Further, the bullish trend is confirmed by the parabolic SAR, which is currently trading below the current price of the fund. Bottom Line Given the bullish technical indicators and improving fundamentals in Macau, investors could garner huge profits in the gaming industry with this top ranked ETF. Original post