Does Diversifying Damage Performance?

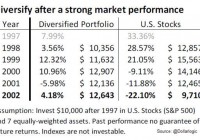

By Ronald Delegge During the 1849 California Gold Rush people sold all their possessions to chase gold. A small minority hit the jackpot, but most did not. Back then, the few people that did get wealthy by not diversifying were the hyper-extreme exception, not the rule. And it’s the same today. In retrospect, investors that overstuffed their portfolios on stocks like Amazon.com (NASDAQ: AMZN ), Netflix (NASDAQ: NFLX ), and other high-flyers have done well. Nonetheless, they’ve taken great financial risk that could’ve turned out to be catastrophic. The truth is that far more people have been damaged than helped by not diversifying their investment risk. History books are filled with people that lost everything by not diversifying. Of course, the history books are also filled with people that gained great wealth by not diversifying, but again, they are the hyper-extreme super rare exception – not the rule. And trying to join their ranks by risking everything you own is theoretically cute but drenched with hazard. Done Right An adequately diversified portfolio never concentrates market exposure to one or two asset classes, but rather spreads risk by maintaining exposure to the five core asset classes: stocks, bonds, real estate, commodities, and cash. Like a thermostat that remains on at all times, a core portfolio will always have exposure to these five major asset classes. Investors can dial up or dial down their exposure to each of these core asset classes based upon their investment goals, liquidity needs, and comfort level. Sadly, certain financial institutions and advisors – even so-called fiduciaries – operate under the false pretext they are “diversifying” client portfolios by overloading customers in “alternative investments” like illiquid securities and highly leveraged funds with juicy dividend yields. Furthermore, many of these same advisors habitually construct undiversified investment portfolios built entirely upon non-core assets like individual stocks, hedge funds, and other narrowly focused high risk securities. A Hedge for Ignorance? It’s been said that portfolio diversification is a hedge for ignorance. For anybody with this misinformed view, I’d like to familiarize you with Yale University’s endowment. Yale’s endowment returned 11% per annum over the 10 years ending June 30, 2014. Over that period, Yale’s return surpassed broad market results for U.S. stocks, which returned 8.4% annually along with U.S. bonds, which gained 4.9% annually. Even more impressive is how Yale’s endowment generated returns of 13.9% over the past two decades compared to the estimated 9.2% average return of college and university endowments. How did Yale do it? By diversifying investment risk across a variety of different assets like commodities, real estate, and stocks! Here’s the lesson: What worked for Yale can work for you. The table shown above, courtesy from our friends at Dollarlogic, further cements the point that diversification after a strong period of equity returns enhances rather than hurts a portfolio’s investment returns. Although a diversified portfolio underperformed the S&P 500 during the sizzling hot bull market from 1997 to 1999, a $10,000 diversified portfolio was worth more ($12,643) at the end of 2002 compared to just $9,710 for an all stock portfolio. In summary, portfolio diversification that is properly executed does not hinder but enhances risk-adjusted investment returns. Disclosure: No positions Link to the original post on ETFguide.com