Water: Investing In The Future

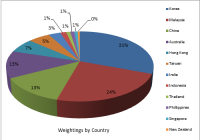

Summary Water is a scarce commodity. Water scarcity already affects every continent. Around 1.2 billion people, or almost one-fifth of the world’s population, live in areas of physical scarcity. Water Resource Portfolio ETF offers an excellent opportunity to invest in the water industry. Even though water is something which seems normal for the average Joe in a developed country, it is definitely not as normal as it seems . Water is a scarce commodity and an absolute necessity for every living creature on the planet. The United Nations indicate that roughly 1.2 billion people (around 1/5th of the world’s population) live in the areas where there is no physical abundance of water. India for example is faced with the prospect of becoming water scarce by 2025 where demand of water will exceed all the current sources of supply of water. India might seem far away, but closer to home such as in California water scarcity is becoming a serious problem. Businesses will have to treat this precious resource far more carefully in the future. Source : Getty Images (a footbridge spans a completely dry river bed in Porterville, California) One way of investing in water is to invest in the PowerShares Water Resources Portfolio ETF (NYSEARCA: PHO ) , one of the largest water ETFs in the world. This article will cover the fundamental analysis of Water Resource Portfolio. Water ETF: Main holdings Source : etfdb.com The issuer of this ETF is Invesco, a large independent investment management company incorporated in Bermuda. The expense ratio of 0.61% is a reasonable number and not incredible expensive. With 800 million assets under management it’s not a large ETF. They are currently trading 10% under its year high and 3% above its year low. ETF: Main Holdings Source : Invesco The 3 largest holdings are Ecolab (NYSE: ECL ), Pentair (NYSE: PNR ) and First Solar Inc (NASDAQ: FSLR ) which in total hold more than 1/4th of the assets. Ecolab is an American provider of hygiene, energy technologies and water. It’s a firm of considerable size with over 45.000 employees. Ecolab is currently priced only $3 underneath its 52 week high , they recently announced earnings which was roughly in line with expectations. Revenue was $3.4B, a miss of $70M. Pentair is an industrial company headquartered in Manchester delivering a variety of water, fluid and technical solutions. The firm is a bit smaller in contrast to Ecolab with revenue of around $7 billion. First Solar is an American Photovoltaic manufacturer of solar panels and supporting services which include end-of-life panel recycling. First Solar is currently trading at P/E of around 20, almost $30 dollars below its 52wk high. It has been beaten quite significantly lately. Nevertheless, corporate earnings will be announced on the 4th of August and based on a recent well informed article published on Seeking Alpha by Nir Nabar, I’m expecting a rebound. ETF: Fund Characteristics Source: Invesco It’s important to realize that the ETF does not come at a massive discount. At a P/E of over 30, it is not cheap. Yet the share price has sharply dropped over the last few weeks presenting itself as a buy. Source : Ycharts Conclusion Water is an incredibly important commodity. As it’s scarce, business can’t do without proper water management. In today’s society there are plenty of solid water management firms. This ETF provides an excellent opportunity to invest in the business flow of water related businesses: from management, production to filtering of water, this ETF has a solid mixture between small and large cap related firms. With one of its largest holdings close to a 52wk low and it will publish earnings soon, I’m expecting a rebound in this ETF. Water remains an investment in the future. PHO is a buy. Disclosure: I am/we are long PHO. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.