Tag Archives: etf-hub

Dominion Resources (D) Q2 2015 Results – Earnings Call Webcast

5 Things I Learned From Jeff Bezos On Business And Investing

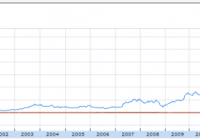

It was 18 years ago that Amazon (NASDAQ: AMZN ), the world’s largest bookseller and one of the most successful Internet companies, got listed. The company’s IPO was unique for two reasons. One, that was a period before the dawn of Internet businesses, and thus, most investors and brick-and-mortar competitors were convinced the company was a joke – an “Internet bookseller” with “no barriers to entry”. Michael Porter’s framework said it would go bust quickly. Then, Amazon’s founder and CEO Jeff Bezos was extremely frank with shareholders from the word go, which is truly unique in this world, where CEOs hide more than they reveal. So, in 1997, after the IPO, Bezos wrote an honest letter to shareholders in which he explained Amazon’s philosophy, which was (and is) quite different from the philosophies of most public companies. Why different ? Because, unlike other public companies that were (and are) obsessed with meeting and beating short-term shareholder demands, Bezos’s game plan was (and is) focused on long-term investments and value creation. And boy, see how well that strategy has paid off for shareholders who have kept their trust in Bezos’s game plan… (click to enlarge) US$ 100 invested in Amazon in its 1997 IPO is now US$ 31,036 – a 310-bagger, or a CAGR of 37.5%. That’s huge by any standards, but something just a tiny number of investors – mostly Amazon insiders – must have earned. Most others would’ve left the ship after earning a 5-, 10-, or 20-bagger. Anyway, there are many invaluable lessons I’ve learned from Bezos over the years, but these five stand out and have helped me immensely in my roles as an entrepreneur and investor. I’m sure these will benefit you too. So let me start right here. 5 Things I Learned from Jeff Bezos on Business and Investing 1) Think Really Long Term This is what Bezos said in an interview in 2011 (emphasis mine) … If everything you do needs to work on a three-year time horizon, then you’re competing against a lot of people. But if you’re willing to invest on a seven-year time horizon, you’re now competing against a fraction of those people, because very few companies are willing to do that. Just by lengthening the time horizon, you can engage in endeavors that you could never otherwise pursue. At Amazon we like things to work in five to seven years. We’re willing to plant seeds, let them grow-and we’re very stubborn. We say we’re stubborn on vision and flexible on details. In some cases, things are inevitable. The hard part is that you don’t know how long it might take, but you know it will happen if you’re patient enough. Ebooks had to happen. Infrastructure web services had to happen. So you can do these things with conviction if you are long-term-oriented and patient. What a wonderful and sustainable moat this is – long-term thinking. Whether you are an entrepreneur or an investor, by thinking and acting (investing) long term, or just by lengthening the time you stay with a good-quality business, you can create wealth you could have never thought of. Like the CEO of a privately held company who can make decisions for the future without worrying about next quarter’s earnings, you can use time arbitrage to benefit from time-tested investment processes without the worry, and often, financial damage that comes from recklessly chasing quick returns. Here is something else I read on Bezos’s long-term thinking in the amazing book Bold … (click to enlarge) 2) Focus on What’s NOT Going to Change This lesson is closely related to the first one above, i.e., long-term thinking. Here’s more on this from Bold … (click to enlarge) “What’s not going to change is what we must focus on!” I tell myself each time I think about the future of Safal Niveshak . And now, Anshul also has to bear with these thoughts, though I am lucky, because this is what he also believes in. “Stability”, as Bezos mentions above, is what causes companies to endure over long periods of time. Look at the biggest wealth creators in the history of the world or in India. Those have been the most stable businesses that have not changed for years. And I am not talking about companies that did not change despite seeing changes in their industry (Nokia (NYSE: NOK ), MTNL, Kodak (NYSE: KODK ), etc.), but rather about companies that have continued to provide tremendous value to customers (the core of any business), even as they change with changing times. So here a few checklist points you must have (on stability ) while looking at investing in businesses: Is the core of this business going/prone to too many changes? Is this business open to disruption? (Anything that can be done via the Internet can be disrupted.) Is the current management too aggressive on growth? Do the customers love this business? Have they loved it for years? Would the business be selling similar products/services 10 years later? If the answer is “No” for the first three questions and “Yes” for the last two, it’s most probably a good business to own (at the right valuations). 3) Focus Intensely on the Customer This lesson holds special relevance for the entrepreneur in me, but I also apply this while analyzing companies. “Do the customers love this business and the products/services it sells?” and “Have they loved this business for the past few years?” is what I ask. In hindsight, my biggest successes in investing have come from businesses that pass this test. Now, it may somewhat be a case of survivorship bias , because some companies that customers have loved have done disastrously for me (like Leela Hotels), but then, the probability of a business doing well for an investor is high when the customers love its products/services over long periods of time. Anyway, this is what I read in Bold … (click to enlarge) 4) Experiment, Experiment… Repeat Honestly speaking, I hate it when companies experiment a lot by venturing into unrelated areas through mindless acquisitions. But continuous experimentation within their circles of competence is an attribute of great entrepreneurs, like Bezos. So this is what I try to apply to my own business. I have had my share of failures and disbelievers – with people calling me names when I started charging a fee for my courses and newsletters, and telling me how these were “doomed to fail when everything is available for free on the Internet.” But I have learned to live with this, for as I mentioned above, my focus is intensely on the value I provide to my readers and subscribers and for a really long period of time. Anyways, here’s Bezos on “experimentation” and “living with being misunderstood and criticised”… (click to enlarge) 5) Accept Failure and Move On Now, this is not something I have learned only from Bezos, simply because I have failed so many times in life that I have been searching for inspiration all around on accepting failure (again and again) but still moving on. I have learned this lesson especially from seeing my daughter grow up. Like when she was just a year old and was trying to take her first steps and repeatedly fell down, she tried again… and again… and again. Sometimes she laughed. Sometimes she cried. Sometimes she laughed and cried at the same time. But she kept trying and trying… laughing and crying. She did not label her experience as a “failure”. She just enjoyed it. Unlike us adults, our babies don’t know the possibility of a failure, so they happily keep falling down until one day they take a few steps, and then a few more. Before long, they’re jumping and running. All their trying pays off. They fall, but never fail. As grown-ups, what if we also simply choose not to fail? What if we treat our mistakes and failures not as things to be avoided, but things to be cultivated? Like Warren Buffett said… You’re going to make mistakes. You can’t play in the game without making any mistakes. I don’t think about it, I just move on. Most business mistakes are irreversible setbacks, but you get another chance. There are two things in life that you don’t get another chance at – marrying the wrong person and what you do with your children. Business, you just go on. It’s a mistake to dwell on mistakes, it’s unproductive. It’s like Mark Twain’s story about the cat that sat on a hot stove – he never sat on a hot stove again, but he never sat on a cold one again either. Life teaches us each day that stuff happens (and sometimes shit happens!), but we don’t need to give each of our experiences a label. Good, bad, hard, easy, success, failure, etc., do not exist but as labels in our minds. All we need to do to hold our head high is to break through these labels. Like here’s what Bezos says on dealing with failure… (click to enlarge) Conclusion: Bezos’s Investing Checklist Over the past two decades, no matter how much its shareholders criticized about all the money Amazon was “wasting”, no matter how often analysts opined that it “could never make money” and “would go bankrupt”, Amazon (and Bezos) has maintained its relentless focus on the long term and on its customers. And this is seemingly the biggest reason it is the only one of the early Internet leaders that is still thriving. Amazon’s approach should be a lesson to all companies, not just Internet companies, and also to us investors (because we also wish to identify such companies that would thrive over the long run). In this regard, I believe it would pay a lot to take Bezos’s advice on where and how to invest through a thought he shared in his 2014 letter to shareholders … A dreamy business offering has at least four characteristics. Customers love it, it can grow to very large size, it has strong returns on capital, and it’s durable in time – with the potential to endure for decades. When you find one of these, don’t just swipe right, get married. This, I believe, is the shortest yet most powerful investing checklist you can ever come across. A business customers love, and which Can grow to very large size, and which Has strong returns on capital, and which Is durable in time – with the potential to endure for decades, and which If you find, you must load up and get married to. Finally, whatever people ultimately will remember Jeff Bezos for, there’s still a lot we can learn from him right now. Anything you’d like to add about him, his legacy, philosophies, or inventions? Put it in the comments section of this post. I look forward to an enlightening conversation and more lessons from one of the world’s best and brightest.