Tag Archives: etf-hub

Suez Is In A Growth Business But Is Too French

Suez is a leader in water but needs to expand beyond France and Europe. Revenues have grown well in slow growth Europe. There are so many new applications for water that Suez could be a part of. Suez Environment (OTCPK: OTCPK:SZEVF , OTCPK: OTCPK:SZEVY ), which recently changed its name to Suez, is in a growth business: water. The only problem is that Suez is too French. It relies on too much of its revenues in France and Europe and must expand globally if it wants to be a player. The company creates water and wastewater treatment plants for municipalities, mining sites, oil and gas, and many other commercial applications. 34% of sales are water in Europe and 40% European waste water. The rest is international. Suez has 553 million shares and trades at a market cap of €9.7 billion ($10.6 billion). It takes $1.10 to buy one euro. The earnings per share were €0.71 and the stock trades at a price to earnings ratio of 24.6. The dividend was €0.65 and the dividend yield is 3.7%. Free cash flow was €1.093 billion and the free cash flow yield was 11.2%. The Ebitda margin was 18.5%. Cash is €2.5 billion ($2.75 billion). This is compared to €2.9 billion ($3.2 billion) in short term debt and €7.8 billion ($8.6 billion) in long term debt. I must say that I’ve never seen a company go to such great lengths to obfuscate their balance sheet. Investor relations lists everything as a “Summary” Balance Sheet. Sales have increased from €11 billion ($12.1 billion) in 2005 to €14.3 billion ($15.7 billion) in 2014. Though sales have not increased dramatically, they have gone up every single year. The only down year was 2009 and sales were only down half a percentage point. The problem is that operating margins have decreased from 11.5% in 2005 to 6.5% in 2014. It shows in earnings per share which were up to €1.35 back then. Sales were up 7.5% in the first half of 2015 . It appears to me that even though sales have grown, expenses have outstripped sales. Only 28% of sales are outside of France and Europe. France has a reputation as being very unfriendly to employers and a tough place to do business. Perhaps it shows in Suez’s numbers. Management gets it. According to an article in the Financial Time, Suez is trying to change its brand to compete for larger corporate contracts. Suez’s waste division is very interesting. It collects and disposes of residential, medical, hazardous, and any other type of trash. The recycling division collects metals and papers. But again, it focuses on slow growth Europe. The shareholder structure is quite interesting. Holding company GBL (OTCPK: OTCPK:GBLBF , OTC: OTC:GBLBY ) holds 7.2%. Suez’s old parent company GDF Suez, now known as Engie (OTCPK: OTCPK:ENGIY , OTCPK: OTCPK:GDSZF ) holds 35.7%. A growing industry is converting methane gas at trash dumps into energy to be used as electricity. Suez has these capabilities but again, it must spread beyond Europe. With the droughts in California , many municipalities are looking to recycle waste water into drinking water. California is even going as far as recycling fracking water. Some of that fracking water is being used to water crops . This is interesting because energy companies are beginning to frack outside of the United States. It’s not just California that experiencing a drought . Brazil, Korea, and South Africa are too. Suez needs to break into these markets and use its brain power to find ways to recycle and conserve water. The United Nations estimates that by 2030, global demand for water will outstrip supply. Enter Suez. Clean drinking water is the name of the game. In municipalities all across the United States, residents can read how clean their drinking water is. It’s the first thing a city will pay for. In developing nations, this will soon to be the norm. Clean drinking water is the most basic need for healthy living. T. Boone Pickens sold his water rights to several municipalities a few years ago in Texas. I would be a buyer of Suez if they can expand their global footprint, which it has not. Their margins in Europe are just not cutting it. Water is a growth business. This isn’t a new concept. I would buy Suez when they show that they are a global player. What is impressive is that the company grew sales in a slow growth continent. This is a testament to the growth potential of water. It could be a long term buy and hold if it grows beyond Europe. Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

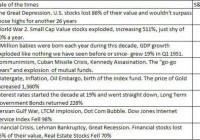

Normal Doesn’t Exist

By Andy Hyer Michael Batnick on “waiting for normal:” These are not normal times investors are living in. The Fed has held short-term interest rates at zero for six years now, a policy experiment never seen before. This has many investors eager to see what happens if and when this returns to “normal.” One of the biggest psychological challenges of investing is that there is always something out of the norm. Take a look at the table below which highlights different times investors had to live through and the extreme performances that accompanied them. I wonder at what point would somebody would have described the times as normal. Next, have a look at the chart below, which shows the S&P 500 return by decade. You’ll notice absolutely no pattern. Understanding how different it always is should be a great reminder why no strategy will work in all market environments. Knowing the limitations to what you are doing- whatever you’re doing- is critical. The ability to stick with your plan during the bad times will determine if you’ll be around for the good ones. So what is an investor to do? I see a couple options: Employ some form of static asset allocation and hope for the best. 25% fixed income, 25% US equity, 25% international equity, and 25% alternatives, and rebalance annually. Employ some type of forecasting to try to be opportunistic in asset class exposure Employ some form of trend-following tactical approach to asset allocation The static allocation approach may ultimately perform okay over long periods of time, but will investors have the risk tolerance to continue with long stretches of an asset class being out of favor / going through severe drawdowns? Maybe. Maybe not. Chances are the forecasting approach will end very badly, as forecasting usually does. The third option makes much more sense to me. Simply systematically deal with trends as they unfold. This is the approach we use with our Global Macro separately managed account, which happens to be our most popular SMA strategy. Thank goodness we gave ourselves as much flexibility as we did with the way that this portfolio is constructed, because this decade has been entirely different from the last one. As one example, consider how well commodities performed in the last decade, compared to the trainwreck that they have been so far this decade. Normal doesn’t exist. A disciplined way to be flexible is the key to successfully navigating the ever-changing financial landscape. The relative strength strategy is NOT a guarantee. There may be times where all investments and strategies are unfavorable and depreciate in value. Share this article with a colleague