American Electric Earns Bullish Thesis With Its Solid Growth Prospects

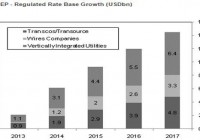

Summary Company making correct decisions to grow regulated operations. Regulated operations will provide sales, earnings and dividend stability. Aggressive capital expenditures will fuel AEP’s earnings growth in future. I reiterate my bullish thesis on American Electric Power (NYSE: AEP ); the company’s strategic growth plan focused on broadening and improving its regulated asset base will help it better its sales and attain a sustainable cash flow base through a decent increase in its rate base. As part of its long-term growth plan, the company is working to improve its competitive business results, and it will be making aggressive investments in transmission operations, which will portend well for both AEP’s top-line and bottom-line numbers. As regulated operations will gather more cash flow stability for the company, AEP will continue to reward its shareholders through dividends. Moreover, the company’s cost saving plan will positively affect its bottom-line numbers. The stock offers a potential price appreciation of 8.3%, as per my price target calculations, shown below. AEP Making Right Moves to Excel in Long Term 2014 was a good year for AEP; the stock is up approximately 35% in the last 12 months. The company’s performance has been positively affected by the low yield environment and improving demand from industrial and consumer segments. The company’s increased dependence on regulated operations has been helping it exploit the industry’s growth prospects. AEP’s strategic growth formula is centered on generating sales growth through increased capital expenditures for the infrastructure development of transmission business. The company has laid out its plan to make an investment of around $4.8 billion towards the betterment of its transmission business over the next three years. Owing to its large scale capital expenditure plan for regulated operations, especially for the transmission business, I believe the company’s regulated rate base will grow at a decent pace, delivering significant upside to its top-line numbers. The following chart shows AEP’s expected regulated rate base growth for upcoming years. Source: Power&RenewableInsights.com Along with the transmission infrastructure growth expenditures, the company is also looking at all possible options to better the results of its competitive business. AEP has made an announcement that Goldman Sachs will assist in improving and exploring the options of its competitive business operations. As utility companies like Duke Energy (NYSE: DUK ) are shedding their competitive operations , I believe AEP will also consider the option of selling its competitive energy assets to address the prevailing challenges and increase its focus on regulated asset base. Moreover, if the company opts to sell its competitive operations, the sales proceeds of competitive assets could be approximately $2.8-$3.6 billion . In addition, AEP has been actively pursuing its cost reduction plan, the “lean deployment” plan, to reduce its expense burden and support its future profitability. The plan has been rolled out to 13 distribution districts and 13 more districts are under review in order to deliver the management’s anticipated cost savings of $100-$200 million from the lean deployment plan by the end of 2016. In fact, the cost saving plan will grow the company’s bottom-line trajectory and will add towards its EPS growth. AEP have reiterated its earnings guidance for 2015 in its recent 4Q14 earnings conference call; the company expects its earnings to grow in a range of $3.40-$3.60 per share. Owing to its ramped up efforts to grow regulated rate base and healthy cost saving initiatives, I believe AEP will be able to grow its earnings at a decent base. Analysts are also anticipating that the company will deliver a healthy next five-year earnings growth rate of approximately 4.92% . Financial Performance The company recently reported 4Q’14 operating EPS of $0.48 , down from $0.60 per share in 4Q’13. The company’s quarterly earnings were negatively affected by its plan to speed up its capital expenditures and shift its O&M expenditures from 2015 and 2016, to 2014. The company’s decision to shift the future expenses to 2014, have improved earnings visibility and will positively affect its future earnings growth rate. Despite soft earnings for 4Q’14, the company reported an operating EPS of $3.43 for full year 2014, up 6% year-on-year. Investors Remain Rewarded AEP has a strong history of rewarding its shareholders through healthy dividends. The stock currently offers a safe dividend yield of 3.35% . The company’s healthy cash flow base has been supporting its hefty dividend payments and its current payout ratio of 55% indicates that AEP can increase its payout ratio to increase dividends in upcoming years. Keeping track of its impressive dividend payment policy, the company recently announced a quarterly dividend payment of 53 cents , an increase of 6%, year-over-year. Owing to AEP’s increased focus on regulated operations, I believe the company will attain more cash flow stability in the years ahead, ensuring the stability and security of its long-term dividend payment plan. The following table shows the dividend per share and dividend payout of AEP from 2012-2014, and includes figures for 2015, based on my estimates. 2012 2013 2014 2015(NYSE: E ) Dividend Per Share (In-$) $1.88 $1.95 $2.02 $2.10 Dividend Payout Ratio (In-%) 61% 60% 57% 61% Source: Company’s Yearly Earnings Reports & Equity Watch Estimates Risks Despite the company’s sturdy growth efforts, strict environmental regulations from authorities will remain an overhang on its future stock price performance. Since AEP has been making huge investments to develop its transmission infrastructure, I believe future capital expenditures could weigh on its cash flows. Price Target I have calculated a price target of $69 for AEP through a dividend discount model. In my price target calculations, I have used cost of equity of 6% and nominal growth rate of 3%. The stock offers an upside price potential of approximately 8.3%, as per my price target calculations, shown below. 2015 2016 2017 Terminal Value Dividend Per Share (In-$) 2.10 2.12 2.20 75.53 Present Value of Dividend Per Share (In-$) 1.98 1.88 1.85 63.45 Source: Equity Watch Calculations & Estimates Total Present Value of Dividend per Share = Price Target = $1.98 + $1.88 + $1.85 + $63.45 = $69/share Conclusion The company has been delivering a healthy financial performance in the recent past. The company has been making the correct decisions to grow its regulated operations, which will improve its financial performance. Also, regulated operations will provide sales, earnings and dividend stability. The company’s aggressive capital expenditures will fuel its earnings growth in the future. The stock offers a safe dividend yield of 3.35%, which makes it a good investment option for dividend-seeking investors. The stock also offers a potential price appreciation of 8.3%, based on my price target. Due to the aforementioned factors, I am bullish on AEP. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.