What The $2.1 Billion Transaction Means For NextEra Energy Partners

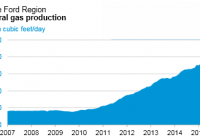

Summary The company only holds renewal energy assets right now. Pipelines are backed by long-term contracts that should provide sustainable cash flow. However, when we look at the entire company as a whole, this acquisition adds little value. NextEra Energy Partners (NYSE: NEP ) is a company formed by NextEra Energy (NYSE: NEE ) to acquire and manage contracted clean energy projects with long-term cash flows. Through a controlling general partnership interest and a 22.2% limited partnership interest in the operating company, NEP OpCo., the company owns a portfolio of solar and wind power generating assets. Given the existing assets, it may come as a surprise to you that the company recently announced a $2.1 billion acquisition, consisting of solely natural gas pipelines. Let’s learn a bit more about this transaction. The Transaction The acquisition includes seven natural gas pipelines located in Texas. The pipelines currently have capacity of 4 Bcf per day with 3 Bcf already contracted with ship-or-pay contracts. So right off the bat we can see that there is growth potential without additional capital spending. While utilization seldom reaches 100%, the current rate of 75% clearly has additional room for improvement. The management also mentioned that is already an expansion project underway and would be providing an additional 1 Bcf of volume per day. This brings the total growth organic growth potential of these pipelines to 67%. The locations connected by the major pipelines are also interesting, let’s take a closer look. The two largest pipelines are the NET Mexico Pipeline and the Eagle Ford Pipeline. Both of them deliver gas from the Eagle Ford Shale to Mexico. What is the significance of the Eagle Ford Shale? It is one of the most prolific unconventional plays in the U.S. Despite the recent commodity crash, we did not see a significant decline (see following chart from the EIA). Source: eia.gov As long as production does not stop, the company can keep its utilization rate up. To make things better, the pipeline is also under a 20 year ship-or-pay contract meaning that the company would receive payments even if production falls. To put the cherry on top, it is also the lowest-tariff transmission pipeline from Eagle Ford to Mexico. The Eagle Ford Pipeline is similar to the NET Mexico Pipeline. They both provide a cost advantageous way for production companies to transport gas to Mexico. Synergy? Although I feel that the pipelines are great and will deliver long-term cash flows to the company. I do not think that there is any synergy between this acquisition and any of the current renewal energy assets held. Now the management would have to deal with another source of risk (i.e. commodity risk). Despite the long term nature of the pipelines, ultimately their profitability will be dependent on the success of producers. No contract can protect the company if producers start to go bankrupt left and right. Although this is not an immediate concern (yet), it is still another drawback. Conclusion The assets acquired are excellent when you look them by themselves. They provide a source of long-term cash flow through decades long contracts and attractive locations. However, when you look at the entire company as a whole, there seems to be little benefit to the existing renewable portfolio. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Share this article with a colleague