Using Profitability As A Factor? Perhaps You Should Think Twice…

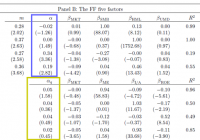

By Wesley R. Gray, Ph.D. Many investors are getting excited about the so-called ” profitability factor ,” originally posed by Novy-Marx (here is an alternative story ). Larry Swedroe has a high-level piece advocating the concept here . The basic idea is simple: Other things being equal, firms with high gross profits (revenue – costs) have earned higher expected returns than firms with low gross profits. Even market heavyweights Eugene Fama and Ken French have integrated the factor into their new ” 5-factor model ,” which consists of a market factor, size factor, value factor, profitability factor, and an investment factor. This research was not lost on Dimensional Fund Advisors (DFA), a massive quantitative asset manager that is essentially an extension of University of Chicago Finance Department. DFA has added the concept of profitability to their process (we assume it is the profitability factor identified by Fama and French). In the words of Eduardo Repetto, DFA’s CIO, regarding profitability: New research has to be very robust, very reliable and have real information that’s not already captured in the other dimensions. But how robust is the so-called profitability factor? Is it possible that the profitability factor might already be captured in other dimensions? A new paper entitled, “A Comparison of New Factor Models,” by Kewei Hou, Chen Xue, and Lu Zhang, shows that the profitability factor is not, in fact, a new “dimension,” as has been suggested. The authors find that the profitability factor highlighted by Fama and French is captured in cleaner ways by their simpler and more robust 4-factor model, which consists of a market factor, a size factor, an investment factor, and a return-on-equity factor. The authors highlight that there are “four concerns with the motivation of the Fama and French model based on valuation theory,” suggesting that the factors chosen by Fama and French are merely descriptive and/or data-mined, but not grounded in economic theory. Ouch. But the critique of the 5-factor model isn’t only on theoretical grounds, it is also based on the evidence. The Hou, Xue, and Zhang 4-factor model captures all the returns associated with the new factors outlined by Fama and French. Note the alpha estimates below. The yellow box highlights the alphas associated with the FF factors, controlling for the Hou, Xue, and Zhang factors, and the blue box highlights the alphas associated with the Hou, Xue, and Zhang factors, controlling for the FF factors. The Hou, Xue, and Zhang factors can explain the FF factors, but the FF factors cannot explain the Hou, Xue, and Zhang factors. This suggests that the “new” profitability factor may not be a new dimension at all, since it can be explained via exposures to the market, size, and Hou, Xue, and Zhang’s investment and ROE factors. (click to enlarge) The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. Profitability is also questionable in international markets. In a working paper, ” The Five-Factor Fama-French Model: International Evidence ,” by Nusret Cakici, the author looks at the performance of the five-factor model in 23 developed stock markets. There is only marginal evidence the factor works globally. In some markets, the factor is effective, but in other regions such as Japan and Asia-Pacific, the factor simply doesn’t explain returns. Our own internal research on the matter is consistent with this result. Concluding remarks regarding the profitability factor A lack of unified results often hints towards a lack of robustness and/or data-mining. Only time will tell if the out-of-sample performance of the so-called profitability factor will hold. There are certainly a lot of smart academics and investment houses leveraging the factor as a way to capture higher returns, so we can’t rule anything out. However, our advice is to tread lightly in the factor jungle, being sure to always carry a heavy machete to chop away at noisy data and the overfitting problems that accompany them. Original Post