Tag Archives: earth

Navigating Water ETFs

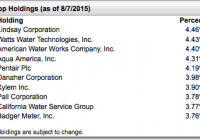

There is an impending water shortage, resulting in investment opportunities. Water ETFs provide a safer, albeit expensive, way to invest in the fragmented water industry. FIW has the best holdings, but a potentially very expensive fee structure. CGW offers nice global exposure to water investments and is my favorite of the four ETFs. PHO and PIO have a surprisingly strong emphasis on alternative energy. THE WATER OPPORTUNITY For several years I have followed an investing thesis I believe will significantly outperform the broader market: water. Water is essential to all forms of known life. Humans are particularly dependent on water. Without it we die within a week, and most die in three or four days. However, humankind’s uses for water extend way beyond drinking, or even household consumption such as cooking, bathing, or cleaning. Agriculture accounts for an impressive 70% of global water use; other vital industries such as mining , oil and gas , hydroelectric power, and general manufacturing are all highly water intensive. The dire water situation becomes even more evident when the future is taken into account. For one, shifting weather patters associated with climate change will likely cause dry areas to face more frequent and persistent droughts. Even more importantly, today’s global population is expected to jump from the current 7 billion people to 9 billion by 2040 . The extra 2 billion people on the planet, along with a rapidly growing global middle-class , will increase demand for water and the vital goods (food, energy, materials, and technology) it produces. With these facts in mind, let’s consider the global water situation . 97.5% of water is salt water in the oceans. Of the remaining 2.5% of water that is fresh, over half (~69%) is locked up in glaciers and snowpack. If global temperatures increase as expected over the next 85 years (between 2° and 11.5° F) , we can expect a significant amount of this fresh water to melt, flow into oceans, and become salt water. Of the ~0.8% of Earth’s water that is fresh and liquid, a significant amount is also polluted, especially in developing countries. So despite all the blue that you see on a picture of Earth from space, a generous estimate would render only about 0.67% of it immediately ready for human use, with several trends working to reduce that percentage even further. HOW TO GO ABOUT INVESTING IN WATER The water industry is very fragmented, meaning that investors should tread with caution-there is no “Exxon” of the water industry, where you can simply park your money with a dominant player. While there are many companies in this sector that I am very bullish on, the fragmented nature of the water industry makes it a prime candidate for ETF investments. In this article I will give my thoughts on the four water ETFs: First Trust Water Index (NYSEARCA: FIW ), Guggenheim S&P Global Water Index (NYSEARCA: CGW ), PowerShares Water Resources Portfolio (NYSEARCA: PHO ), and PowerShares Global Water Portfolio (NYSEARCA: PIO ). MEET THE ETFs FIW: This ETF is by far my favorite in terms of holdings and organization. First Trust gave FIW a strong weighting towards industrials (60%); Utilities account for 25% of the ETF, and IT, materials, and healthcare comprise the other 15% of the portfolio. I am particularly partial to this fund because Lindsay (NYSE: LNN ), my favorite play in the water industry, is its top holding. For those interested, last fall I wrote an article about Lindsay. PICO Holdings (NASDAQ: PICO ), which accounts for 1% of the fund, may raise some eyebrows because it is labeled as a financial. PICO is technically a financial (it is an insurance company), but it owns valuable water rights in Arizona and Nevada, hence its inclusion in the ETF. Source: First Trust I favor water ETF’s with strong industrial weightings, along with IT, materials, and health care, because these companies generally have reasonable OpEx and face very little regulatory oversight, meaning they are in prime condition to profit from investment in water infrastructure. On the other hand, water utilities have high OpEx and must have regulatory approval for rate increases. Granted, utilities provide income and stability, but my goal for water stocks is growth, rather than a bond substitute. This said, FIW’s organization provides some risk mitigation. Of FIW’s 37 holdings, none account for more than 4.5% of the portfolio, and none account for less than 1% of the portfolio (top 10 assets account for 41% of the fund). Almost all are American companies, and all trade on the NYSE or NASDAQ. (click to enlarge) Source: First Trust While there is a lot to like about FIW, it does have some flaws. For one, its dividend yield is only 0.74%. As I mentioned, I expect little in the ways for yield when investing in water, but a yield between 1%-2% would be better. FIW’s average daily trade volume of 57.5K is another potential red flag for investors, though PHO is the only other water ETF with a higher average volume. Finally, and most disappointingly, FIW will very likely assume a very high expense ratio. For the moment, its 0.59% expense ratio is actually the lowest of the four ETFs. However, the prospectus states that the true expense ratio is 0.84%, but that First Trust has agreements to keep the fees at or below 0.60% “at least through April 30, 2016.” Though it seems the fee reimbursement could continue beyond this date, investors need to be prepared for an almost 50% increase in the expense ratio within the next year. FIW trades 0.13% below its net asset value, so maybe the market has already factored in some degree of a discount. CGW: Guggenheim’s water ETF truly provides global exposure: only 38% of the fund is based in the US. The top domestic holdings are Pentair (NYSE: PNR ), Danaher (NYSE: DHR ), American Water Works (NYSE: AWK ), and Xylem (NYSE: XYL ). Global utility behemoths such as Veolia SA ( OTCPK:VEOEY ), United Utilities Group PLC, Severn Trent PLC, and Suez Environnement SA account for some of the top foreign assets. Although CGW has 50 holdings, it is weighted quite heavily towards the top holdings, as the top 10 account for 52% of the fund. I would prefer the allocation to be more diversified, but the majority of the top holdings fit the water theme very well (I consider IDEX a bit of a stretch, but understand Guggenheim reasoning of wanting to give water metering meaningful inclusion). Source: Guggenheim 40% of CGW’s holdings are in utilities, which is a higher percentage than I would prefer. However, the weighting towards utilities provides a nice counterbalance to the volatility that comes with investing in foreign companies. The utilities also strengthen the yield, which, for what amounts to a growth investment, comes out to a very respectable 1.75%. Unfortunately the dividend is paid yearly (on the last business day of the year), so the compounding power is reduced to annual compounding rather than quarterly. Another disappointing aspect to CGW is its low trading volume-it only averages 25.7K a day, so investors must be prepared for a relatively illiquid investment. CGW’s expense ratio of 0.65% is only slightly higher than FIW and PHO’s, but unfortunately it trades at 0.3% premium to its net asset value. This is cause for concern, but I do think that CGW deserves a premium due to its foreign holdings. Anyone who has owns foreign securities knows there is quite often an ADR fee and, quite possibly, taxes on foreign dividends. Finally, CGW owns securities that are otherwise difficult for Americans to own. For example take Guangdong Investments, which is a major provider of water in Hong Kong and China, but only trades on Hong Kong’s exchange. Finally, Schwab investors interested in water investments should give CGW a particularly close look. This is because CGW trades for free. I use Schwab, and the feature is wonderful-I have legitimately bought one share of CGW and it worked as advertised. This makes it easy to buy a few shares every payday without having to worry too much about trading fees or market timing. Out of all the options, I believe CGW to be the best. PHO: On the surface, PowerShares’ domestic water ETF seems to share a great deal in common with FIW. It has a small utility component (13%), is comprised of 35 holdings (vs. 37 for FIW), and is generally composed of industrial, life science, and materials companies. Because of this, like FIW, PHO is weighted more towards growth stocks, and has a very low dividend (0.60%). Source: Invesco However, a shallow dive into the holdings reveals a strong emphasis on energy. PHO has 15% of its assets in First Solar (NASDAQ: FSLR ) and SunEdison (NYSE: SUNE ); all together over 20% of the fund is devoted to renewable energy. Overall, I understand what PowerShares is aiming for-hydroelectric is entirely reliant on water, and oil and gas use and pollute water during extraction and refinement. Of course, PHO does have significant holdings in companies more closely related to water, such as Pentair, Ecolab (NYSE: ECL ), American Water Works, Xylem, and Valmont (NYSE: VMI ). That said, a 20% weighting in alternative energy seems like overkill to me. I would prefer to have higher weightings in desalination, filtration, pumping, irrigation, and metering, with 5-10% devoted to alternative energy. Additionally, given that the top 10 holdings account for 61% of the fund, I would favor a more balanced allocation to lower volatility and risk. Source: Invesco On the plus side, PHO’s expense ratio is a relatively reasonable 0.61%, which is slightly higher than FIW’s, but would be the lowest if/when FIW’s new fee program kicks in. As of now, PHO does not trade at any premium or discount to its net asset value. Perhaps most importantly, PHO’s daily trading volume averages 121K shares, giving it a huge advantage over FIW, CGW, and PIO in terms of liquidity. PIO: PIO is PowerShares’ international water ETF , and its 39 holdings resemble a blend of PHO and CGW. Like PHO, PIO has significant holdings in alternative energy, though the asset are limited to FSLR and SUNE, which account for 10% of the fund. Pentair, Veolia, Suez, and Severn Trent are a few major holdings in common with CGW’s. Source: Invesco Similar to CGW, PIO holds 33% of its assets as domestic companies; additionally, many of the foreign holdings overlap with CGW’s, though PIO’s exposure to the United Kingdom and France are noticeably higher. With utilities accounting for 45% of PIO’s holdings, it has the largest utility weighting of the group. Like CGW, this is a bonus for volatility, though given that people often view water as a fundamental right, I would be wary about putting too much money in utilities operating in left leaning countries. Fortunately for holders of CGW and PIO, many of these utilities, especially Veolia and Suez, are global companies that do business around the world, including the United States. Source: Invesco Despite PIO’s heavy utility holdings, it only yields 1.27%, though the strong dollar could be somewhat to blame for the muted dividend. PIO’s 0.76% expense ratio is very high, and it currently trades at a 0.1% premium to its assets. Additionally, PIO has very low liquidity, as its volume averages only 18.8K a day. Source: Investco CONCLUSION Much like individual water stocks, there are advantages and disadvantages to each of the ETFs. FIW’s holdings are by far my favorite, but if the new expense ratio rolls out, it will difficult to justify paying a 0.84% fee. Water ETFs already have high costs, and I would shy away from paying any more than necessary. At 0.76% cost ratio, PIO isn’t much better, leaving CGW and PHO as the “low fee” water ETFs. For me, PHO’s solar presence is too strong for my liking, though I may eventually buy some shares. PHO has strong liquidity, and I do like their thought processes behind the solar investments. CGW’s holdings are my second favorite behind FIW’s, and it pays an almost 2% dividend. That said, its current 0.3% premium is somewhat concerning, especially given that these specialty ETFs come with high expense ratios. Since I have a Schwab account, and can trade CGW for free, I have decided to pair CGW with individual water stocks. I will likely continue to slowly add to CGW until I reach a full position. I have no immediate plans to buy PHO, but will probably open a moderate position at some point. While there is no absolute winner, I think CGW is the best option. It offers both domestic and international exposure, is very “water focused,” has a reasonable fee structure, and pays the best dividend. That said, despite their underwhelming performance since their inceptions, I expect all of these ETFs to outperform the broader market over time. However, the high costs, low liquidity, and occasional bizarre holdings leave much to be desired. Hopefully as more investors look to invest in water, additional water ETFs with lower fees and higher liquidity will stream into the market. Disclosure: I am/we are long CGW, PNR, VEOEY, LNN, VMI. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Ormat Technologies: Overpriced In Light Of Industry Headwinds

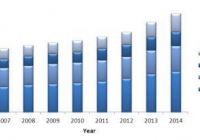

Summary Geothermal power generation will likely stagnate or outright decline in the coming years, putting Ormat Technologies in a bad position. Ormat’s strategy of expansion could backfire if subsidies/incentives dry up, which has a high likelihood of happenings given the arrival of more promising alternative energies. With stagnating revenues and industry pressures, Ormat is much too expensive at a P/E ratio of 40. The geothermal power industry has seen some impressive growth over the past few years, and is currently an important part of the renewable energy mix. By harnessing the enormous amounts of thermal energy stored in the earth, clean energy can be produced in relative abundance. Ormat Technologies (NYSE: ORA ) is a standout in the geothermal space, with approximately 2 GW in power plants supplied worldwide. Although Ormat has grown tremendously over the past few years, there are reasons to believe that it is headed for a long-term decline. While many have touted geothermal’s potential on the basis that there are terawatts of thermal energy that could theoretically be harvested, the technology it takes to actually harness this energy may be questionable in the long run. On top of this, rapid battery innovation may take away geothermal’s big advantage of having base-load qualities. Once other forms of renewables, e.g. wind, will be able to cost effectively store energy, geothermal loses its base-load edge to other potentially more promising clean energies. Ormat is especially vulnerable given that it is relatively more expensive than its peers. Technology Risks Geothermal technologies are especially capital intensive, as massive amounts of resources are needed to build geothermal plants. Ormat’s fast expansion rate could ironically be a negative for the company. If Ormat overextends its reach to more questionable regions in terms of profitability, its expensive geothermal plants could end up costing the company in lost sunk costs if subsidies dry up in the future. Given how many other forms of clean energies are showing more growth potential, namely wind and solar PV, future alternative energy subsidies/incentives will likely be concentrated on these clean energy technologies. While Ormat’s own growth projections of the geothermal electricity and product segments are optimistic, with the global geothermal markets growing eight-fold by 2020, such projections are likely overestimations given that more promising energy technologies are abound. In addition to the fact that other forms of clean energies look to have more inherent growth potential, geothermal is a centralized energy generation technology. If the future energy landscape is indeed one dominated by more distributed forms of energy, this is just one more negative for the geothermal industry. With prime geothermal locations hard to come by and costs likely to be increasingly less competitive compared to other alternative energies, Ormat is facing an uphill battle. Although geothermal technologies are nowhere near mature and still have much more room for improvement, geothermal likely remains a niche market. While the hype surrounding ORA is somewhat justified given its status as the second largest geothermal company in the U.S. and its general cost competitiveness against it peers, it is likely overvalued given its pessimistic growth prospects. With technologies as large and unwieldy as those in geothermal plants, there are much better ways to go about clean energy production. Ormat’s own geothermal growth projections are likely too optimistic in light of industry pressures. While geothermal has indeed grown over the past couple of years, as is clearly shown in the graph below, such growth is likely not sustainable. Source: Frost & Sullivan Analysis Growth Prospects At a P/E ratio of 40 , investors are much too optimistic about Ormat’s growth potential. Given how Ormat’s growth has stagnated in recent years, with both its 2013 and 2014 revenues hovering around the mid-$500M level, it seems unlikely that the company will fulfill such lofty growth expectations. With Q1 revenues at $120M, this growth slowdown trend seems to be continuing. Although Ormat is focusing on expanding by increasing its geographical reach, the company should have a hard time growing in the mid/long term. Ormat’s revenues from third-party sales, which constitute a sizable portion of the company’s total revenues, have long stagnated around the $180M-$200M range. Its products, which make up for a majority of its revenues, have just recently started slowing down. On top of this, 2015 is the first year in a long time where its product sales could actually come in lower than sales in 2014. While Ormat has considerably outperformed the broader market over the past few years, it would not be surprising to see the company underperform moving forward. Although Ormat is highly diversified on the global scene, this may not matter for much longer as the global energy market seems to be gravitating towards solar PV in particular. Many governments are increasingly looking towards solar PV as the main long-term answer to global warming and pollution, which means that geothermal will increasingly be relegated towards more niche situations. While a case could certainly be made that Ormat will have a long-term place in the energy landscape, the company does not seem to be a wise investment on balance. Conclusion Ormat’s long-term prospects are not looking too bright in the long term. While geothermal will likely end up playing a permanent role in the renewable landscape, Ormat is valued much too high. At a market capitalization of $1.89B and a P/E ratio of 40, investors are putting too much confidence in the company’s growth potential. With stagnating revenues and the rise of more promising alternative energies, Ormat will have very little chance of beating the market in the future. There is a high probability that geothermal is not the disruptive technology that many investors are hoping it to be, with Ormat likely to be one of the first to feel the effects of a possible decline in geothermal. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.