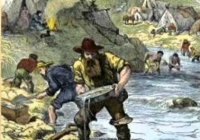

Trading Volatility: The Hunt For Disaster Is The New Gold Rush

Summary Lessons from the original Gold Rush. Trading volatility on the long side is rarely profitable. Time, math and yourself are your enemies when you are long volatility. The Original Gold Rush On January 24th, 1848, James Marshall, a carpenter out of New Jersey, found gold flakes in the American River at the base of the Sierra Nevada mountains in California at a sawmill owned by John Sutter. Word spread of the gold finding and storekeeper Sam Brannan set off a frenzy when he paraded through San Francisco with a vial of gold obtained from Sutter’s Creek. At the time, the population of California was 6,500 Mexicans and 700 Americans (not counting Native Americans). By mid-June, 75% of the male population of San Francisco left town for the gold mines and the number of miners reached 4,000 by August of 1848. Throughout 1849, people around the United States (mostly men) borrowed money, mortgaged their property or spent their life savings to make the arduous journey to California. By the end of 1849, the non-native population of California ballooned to 100,000 with San Francisco establishing itself as the central metropolis of the new frontier. This invasion of the 49ers promptly lead to California’s admission to the Union as the 31st state. By 1850 (1 year later) surface gold in California largely disappeared even as miners continued to arrive. Mining is a difficult and dangerous labor and striking it rich requires good luck as much as skill and hard work. You have to be able to canvas a large territory, pick at various locations and if they don’t produce, abandon them immediately for the next opportunity. While most gold miners didn’t succeed in getting rich from gold mining, California’s economy got off the ground and the by end of the 1850’s California’s population was north of 380,000 with a bustling economy. The Hunt For Disaster Is The New Gold Rush Trading volatility on the long end is very much like gold mining. The opportunities are very few and far in between, but when they come, they can make you money quick. The ProShares Ultra VIX Short-Term Futures ETF ( UVXY) has had the following streaks since its inception in October of 2011 (these streaks are on closing basis): As you can see, if you took the same amount and invested it with just the perfect timing and got in at the bottom and got out at the top, you would have made 800%+ in about 280 days. On average about 50% return for each winning streak which lasts about 19 days. 50% return in 3 weeks? I would take that anytime. There have been 15 winning streaks since October of 2011 or about 1 streak per quarter. But therein lies the promise and curse of the Long Volatility Trade. While the returns can be spectacular while volatility is rising, it takes a lot of waiting for the moment to come when you can strike. Only 20% of the time does UVXY rise. Only every 3 weeks out of 3 months do we get an opportunity to make a good UVXY trade. 80% of the time UVXY goes down and it plunges head first. Since its inception, the fund is down 99.99% . If you bought and held UVXY since inception and you invested $1,000,000, you right now have about a $1. That’s right, $1 for your efforts! I mean if you are going to do that, go to Vegas and at least get some free drinks. The Psychology of Being Long Volatility In 2014, after having made some good money on being short volatility in 2012 and 2013, I decided to take a portion of the winnings in the VelocityShares Daily Inverse VIX Short-Term ETN ( XIV) and go on a psychedelic world tour through the dark side. I knew full well the statistical percentages and the pain I am about to experience, but like playing with fire, you don’t really know your physiological limitations until you experience it firsthand. I wanted to experience trading pain and ultimate ecstasy via the UVXY. The neural points that are triggered during a winning trading experience release higher quantities of serotonin (happy neurotransmitter) and as such explain the addiction to hopeless trading. So I decided to be very disciplined and have a rock solid stop-loss discipline, as I knew I’ll be on the bad side of the trade most of the time so I have to cut my losses short quickly. In the beginning I did exactly that. Starting in April of 2014, I made about 10 trades, in and out, 5% stop. But the losses started to add up. May 2014 didn’t provide a drawdown. 10 trades with 5% loss, by June I had only half the capital. Still knowing that I can hit 100% pretty quickly and recover my losses, I stayed in. June, July, August. Waiting and waiting for the right moment. Finally September came and provided the draw I was looking for. But at that point, I had been burned so many times over the past 4 months, I was now more wary and judicious. The first draw came and I missed it. I then waited for a quick rip and went long UVXY again. Another move down, boom. Made 50% on the trade. But then when we nearly hit the 10% drawdown, I decided to double down. If this had gone 10% down, it’s surely heading to 20% and that is when the big money in UVXY happens. The panic after the panic. And very briefly the futures completely collapsed over night on October 15th below every technical support. I am on my way to big money. Finally! But by the morning a sharp reversal came overnight, magically the futures went from 30 down to positive by the open, the HFT algos then took it and pushed it higher. I stayed in thinking that this was just a 1-2 day bounce. But not only was it not a bounce, it was a heart stopping rip. In 3 days, it rallied 80 points. The double on the UVXY position was down 50% just like that and the original profit was now completely gone. I stayed a couple of more days hoping for another dip to bail on better terms, but a dip was not to be. V shaped snap back usually found near bear market bottoms just happened at the top of a bull market 5 years strong. It was a major shorts carnage. Never happened before, but it happened now. That was the final nail on my UVXY adventure. With pretty much 85% of the capital lost, with my stop-loss discipline in tatters by the methodical pounding of UVXY’s relentless losses, betrayed by the worthless hope of high percentage returns, I quit the experiment. It’s ok to experience pain here and there, but this is simply well-refined torture. The medieval inquisition would be proud. Disaster may be fascinating, but it is a waste of time So while it is very tempting to trade disaster, disaster in fact happens only rarely and the losses far outweigh the gains. We are all drawn to disaster. There is nothing more exciting that to watch a well-designed and complex system fall apart. As an engineer or an analyst, you can love nothing more. You get to see how all the pieces interact, how these interactions malfunction, how the different pieces themselves malfunction. It’s like performing a surgery. It’s very educational. But we need not intermingle our fascination with disaster with our trading. It is a very expensive proposition. If you want to avoid disaster, go to cash, gold, something stable and ride out the moment. Trading it for profit is fool’s gold. The iPath S&P 500 VIX Short-Term Futures ETN ( VXX) and UVXY – do not touch with a 10-foot pole. Forget they even exist. Just go back to the world prior to 2009, when they didn’t exist. If I was the NASDAQ, I would require Option Level 2 approval before letting people trade those two instruments. Just stay out. Disclosure: I am/we are long XIV. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.