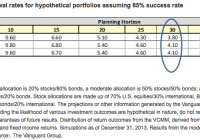

Summary Today’s environment of high equity valuations and low interest rates shouldn’t be ignored. Are investment costs a factor, and if so, how much? Embrace a dynamic spending strategy that considers market performance and allows for flexibility each year. By Maria Bruno, CFP Hardly, a week goes by without seeing some type of headline news discussing the viability of the venerable 4% spending rule. Indeed a simple internet search will yield more than 5 million results! It’s no wonder that retirees may be more confused now than ever. It’s hard to believe that 20 years have passed since William Bengen published his research about sustainable retirement withdrawal rates.[1] During this time, many researchers (including those at Vanguard) have discussed, debated, and continued to crunch the numbers. Much has occurred in the capital markets, including three bull markets, two bear markets, and historically low fixed income yields. Given the milestone anniversary, it’s a good time to reflect, and there’s no better way to start than by defining what the guideline means. Simply put, the 4% spending guideline stated that retirees with a diversified portfolio split between stocks and bonds could safely withdraw 4% of their initial balance at retirement, adjusting the dollar amount for inflation each year thereafter. This level of spending was intended to provide a stable, inflation-adjusted income stream that had a strong likelihood of being sustained for 30 years, based on historical returns for stocks and bonds. Why does the 4% spending rule get a bad rap? First, much of the earlier research was based on modeling of historical asset class returns. While this approach has its merits, the major limitation is that it doesn’t consider current market and economic conditions. In today’s environment of elevated equity valuations and sustained low interest rates, these factors can’t be ignored. To that end, Vanguard’s research incorporates the current market and economic environment in its long-term projections. (See Figure 1.) Second, most well-thought-out research frames the 4% target as a rule of thumb with trade-offs. As with anything in financial planning, guidelines are a starting point and shouldn’t be taken as much more than that. Retirees need to consider their own personal situations when in managing longevity risk-such as their goals, planning horizon, portfolio composition, and comfort level with “stress testing” different market and spending scenarios. Third, the rule of thumb assumes a dollar inflation-adjusted spending program. This means that, at retirement, the retiree spends 4% of his or her portfolio and adjusts that amount annually for inflation. In reality, very few retirees actually stick with such a strict policy. Further, and more important, following an inflation-adjusted spending strategy exposes the retiree to “sequence of returns” risk. With such a model, the spending amount is adjusted annually for inflation but completely ignores portfolio performance. In periods of sustained poor market performance, particularly at the onset of retirement, the retiree is actually spending a greater percentage and, if left unchecked, exposes the portfolio to premature depletion. Indeed, this is one of the major risks of the 4% spending rule. Sure, costs matter, but how much? Many of the published studies show simulated outcomes using benchmark returns as a proxy, with no consideration of real-life costs such as taxes and investment fees. In our studies, we further analyzed hypothetical cost scenarios to stress test portfolio durability using the 4% spending guideline. In the chart above, we highlighted sustainable withdrawal rate durability at an 85% success rate, meaning that in 85% of the simulations the portfolio lasted for at least 30 years. We simulated reductions for cost-0 cost represents the benchmark, 0.25% represents a lower-cost portfolio, and 1.25% represents a higher-cost portfolio (see Figure 2). The results are rather eye-opening. For a moderate investor, the success rates drop from 84% to 74% when higher costs were used. What this means is that the risk of running out of money moved from a 16% to 26%, and the sole factor was investment costs, which is one of the main things that investors can control! No doubt that spending in retirement will continue to be at the forefront of retirees’ minds for the next 20 years. Here’s how I suggest retirees approach the 4% spending rule. First , they should maintain the perspective that this type of analysis should only be used as a modeling tool to help gauge portfolio durability simulations, assuming you maintain a balanced and diversified portfolio. Second , portfolio management costs are a “drag” on their spending, so it’s important to minimize investment costs and follow a tax-efficient portfolio spending approach. Third , they should embrace a dynamic spending strategy that considers market performance and allows for flexibility on an annual basis. Certainly, these three principles are general in nature, but they can provide investors with a nice tailwind as they head into retirement. I’d like to thank my colleagues Michael DiJoseph and Yan Zilbering for their contributions to this research. For more information on dynamic spending, see Vanguard’s research . Footnotes William P. Bengen, 1994. Determining withdrawal rates using historical data. Journal of Financial Planning (October):171-180. Notes IMPORTANT: The projections or other information generated by the Vanguard Capital Markets Model regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time. The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based. All investments are subject to risk. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income. Diversification does not ensure a profit or protect against a loss in a declining market. The Vanguard Capital Markets Model® is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include U.S. and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, U.S. money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.