ETF Stats For June 2015 – Mid-Year Snapshot

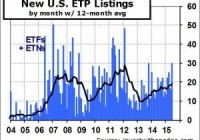

Thirty new ETFs came to market in June, and only two left. This was the largest quantity of launches since October 2013, and the net increase of 28 was the largest since February 2012. The data suggests the industry continues to recover from its 2012-2013 slump. The 133 introductions by the year’s mid-point puts 2015 launch activity on pace to be the third best ever. The record 308 introductions of 2011 appear safe for now, as does 2007’s second-best count of 291. As June came to a close, there were 1,742 products (1,534 ETFs and 208 ETNs) listed for trading. None of the launch or closure activity in June involved ETNs. The ETN segment of the market has clearly stalled. When they first arrived on the scene, ETNs offered exposure to asset classes that ETFs had been shying away from – namely commodities, MLPs, and volatility. As such, investors were able to overlook the “unsecured debt” structure of ETNs in order to get their desired exposure. However, ETFs have gradually introduced products with similar exposures that are also secured by the assets in the fund. The ETN segment takes another step backward with the July closure and redemption of all 13 of the RBS ETNs . Currency hedging remains a top theme with ETF sponsors. This sub-group of international funds gained favor the past few years as the strategy produced good results in an era of a strengthening US Dollar. It now looks like a land grab, with sponsors rushing to get currency-hedged versions of every successful international ETF to market. In June, WisdomTree added two currency-hedged funds to its lineup, Direxion brought out two with leverage, SPDR added one, and ProShares introduced its first two currency-hedged ETFs. Hedge fund replication ETFs have met with limited success, but that didn’t stop Highland from entering the arena with three such products. The frenzy over China A-shares prompted Direxion to introduce an inverse version, and the timing was nearly impeccable. iShares brought out two more factor-based ETFs. In what appears to be an unusual misstep for BlackRock and its iShares ETFs, one of its new funds claims to be a “single-factor” ETF focusing on the “size” factor, but it will track a risk-weighted index of large and mid-cap international stocks. Perhaps it should be called a “confusion-factor” ETF. For the month, industry assets shrunk 1.8% to $2.1 trillion. The quantity of ETFs with more than $10 billion in assets decreased from 52 to 50, yet these 3% of the listings control 58% of the assets. Trading activity topped $1.5 trillion in June, and the eight ETFs that averaged more than $1 billion a day in trading accounted for the majority (53.5%) of all trading activity. Given lopsided stats like these, it is much easier to comprehend the liquidity dangers lurking in the other end of the product spectrum. The 877 smallest ETPs represent 50.3% of the listings yet account for just 1% of the assets. There are 1,410 products that average less than $10 million in daily trading. While they represent 80.9% of the listings, they account for only 2.4% of trading. June 2015 Month End ETFs ETNs Total Currently Listed U.S. 1,534 208 1,742 Listed as of 12/31/2014 1,451 211 1,662 New Introductions for Month 30 0 30 Delistings/Closures for Month 2 0 2 Net Change for Month +28 0 +28 New Introductions 6 Months 119 4 123 New Introductions YTD 119 4 123 Delistings/Closures YTD 36 7 43 Net Change YTD +83 -3 +80 Assets Under Mgmt ($ billion) $2,077 $27.3 $2,105 % Change in Assets for Month -1.7% -3.8% -1.8% % Change in Assets YTD +5.3% +1.4% +5.3% Qty AUM > $10 Billion 50 0 50 Qty AUM > $1 Billion 261 6 267 Qty AUM > $100 Million 782 42 824 % with AUM > $100 Million 51.0% 20.2% 47.3% Monthly $ Volume ($ billion) $1,473 $53.8 $1,527 % Change in Monthly $ Volume +18.3% +29.9% +18.7% Avg Daily $ Volume > $1 Billion 7 1 8 Avg Daily $ Volume > $100 Million 85 5 90 Avg Daily $ Volume > $10 Million 320 12 332 Actively Managed ETF Count (w/ change) 129 +3 mth +4 ytd Actively Managed AUM ($ billion) $20.2 -1.0% mth +17.2% ytd Data sources: Daily prices and volume of individual ETPs from Norgate Premium Data. Fund counts and all other information compiled by Invest With An Edge. New products launched in June (sorted by launch date): Highland HFR Equity Hedge ETF (NYSEARCA: HHDG ) , launched 6/1/15, will follow an underlying index that seeks to track the returns of hedge funds that employ hedged equity strategies by including securities held by such hedge funds. It uses a proprietary filtering, monitoring, and quantitative selection process to select appropriate securities from a database of hedge fund holdings. Equity Hedge managers typically maintain at least 50% exposure to, and may in some cases be entirely invested in, equities – both long and short. The ETF has an expense ratio of 0.85% ( HHDG overview ). Highland HFR Event-Driven ETF (NYSEARCA: DRVN ) , launched 6/1/15, seeks to track an underlying index of event-driven strategies that take advantage of transaction announcements and other specific one-time events. It will utilize an investment process that identifies equity opportunities in companies, which are currently engaged in a corporate transaction, such as mergers, restructurings, financial distress, tender offers, shareholder buybacks, debt exchanges, security issuance, or other capital structure adjustments. DRVN has an expense ratio of 0.85% ( DRVN overview ). Highland HFR Global ETF (NYSEARCA: HHFR ) , launched 6/1/15, will track an index constructed to mimic returns of hedge funds by using a proprietary filtering, monitoring, and quantitative selection process to select appropriate securities from a database of hedge fund holdings. Equity hedge strategies involve a variety of investment styles (both quantitative and fundamental) that may include event-driven, long/short equity, macro, relative value, and other strategies. The fund will not have more than 50% exposure representing any one equity hedge strategy and comes with an expense ratio of 0.85% ( HHFR overview ). TrimTabs Intl Free-Cash Flow ETF (NYSEARCA: FCFI ) , launched 6/2/15, will track an underlying index that utilizes an equal weighting by country approach. Candidates for inclusion are first ranked by free cash flow yield. The ten global markets composing the fund are then equally weighted, with 10% allocated to each: Canada, Germany, United Kingdom, Hong Kong, Japan, France, Switzerland, Netherlands, South Korea, and Australia. The ETF has an expense ratio of 0.69% (FCFI overview ). iShares Convertible Bond ETF (BATS: ICVT ) , launched 6/4/15, seeks to track the investment results of an index composed of US Dollar-denominated convertible securities, specifically cash pay bonds, with outstanding issue sizes greater than $250 million. Its largest sector exposures include Technology 41.4%, Consumer Staples 20.0%, and Consumer Discretionary 11.2%. ICVT has an expense ratio of 0.35% ( ICVT overview ). WisdomTree Global ex-U.S. Hedged Dividend Fund (NYSEARCA: DXUS ) , launched 6/4/15, tracks an index that measures the performance of dividend-paying companies in the developed and emerging markets outside of the United States while neutralizing exposure to currency movements relative to the US Dollar. The index is dividend weighted with country weights equal to the float-adjusted market capitalization weight of the universe of the selected top 1000 stocks. DXUS has an expense ratio of 0.44% ( DXUS overview ). WisdomTree International Hedged SmallCap Dividend Fund (NYSEARCA: HDLS ) , launched 6/4/15, tracks a fundamentally weighted index that measures the performance of small-cap dividend-paying stocks in the industrialized world outside the US and Canada while neutralizing exposure to foreign currencies. It holds companies that compose the bottom 25% of the market capitalization of the WisdomTree DEFA Index after the 300 largest companies have been removed. Holdings are weighted based on annual cash dividends paid, and the fund has an expense ratio of 0.58% ( HDLS overview ). Direxion Daily MSCI Europe Currency Hedged Bull 2x Shares (NYSEARCA: HEGE ) , launched 6/10/15, seeks daily investment results, before fees and expenses, of 200% of the performance of the MSCI Europe US Dollar Hedged Index. It has an expense ratio of 0.95% and is essentially a 2X version of the Deutsche X-trackers MSCI Europe Hedged ETF (NYSEARCA: DBEU ) ( HEGE overview ). Direxion Daily MSCI Japan Currency Hedged Bull 2x Shares (NYSEARCA: HEGJ ) , launched 6/10/15, seeks daily investment results, before fees and expenses, of 200% of the performance of the MSCI Japan US Dollar Hedged Index. It has an expense ratio of 0.95% and is essentially a 2X version of the Deutsche X-trackers MSCI Japan Hedged ETF (NYSEARCA: DBJP ) ( HEGJ overview ). Market Vectors Global Spin-Off ETF (NYSEARCA: SPUN ) , launched 6/10/15, seeks to track a rules-based, equal-weighted index of spin-offs that are domiciled and trade in the US or developed markets of Western Europe and Asia. It will hold positions a maximum of five years and currently consists of 78 holdings with 68% allocated to US companies. SPUN has an expense ratio of 0.55% ( SPUN overview ). SPDR EURO STOXX 50 Currency Hedged ETF (NYSEARCA: HFEZ ) , launched 6/10/15, seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the underlying index, which is hedged against currency fluctuations. The fund has an expense ratio of 0.32% ( HFEZ overview ). Tuttle Tactical Management Multi-Strategy Income ETF (NASDAQ: TUTI ) , launched 6/10/15, is an actively managed fund-of-funds seeking capital preservation and income with a secondary emphasis on long-term capital appreciation. It is a trend aggregation-based strategy using multiple, uncorrelated methodologies to determine which phase markets are in. TUTI uses intermediate-term momentum and short-term countertrend indicators, and it sports an expense ratio of 1.28% ( TUTI overview ). WisdomTree Western Asset Unconstrained Bond Fund (NASDAQ: UBND ) , launched 6/11/15, is an actively managed bond ETF without any constraints on its investment holdings. It currently has about 45% in junk bonds, is long the Indian Rupee and Japanese Yen, and short the Euro, the British Pound, and US Treasuries. The website claims a 30-day SEC yield of 3.68% after covering the 0.55% expense ratio ( UBND overview ). Pacer Trendpilot 100 ETF (BATS: PTNQ ) , launched 6/3/15, seeks to track the NASDAQ 100 Index when it is above its 200-day moving average for five days, moves to 50% T-Bills when the index falls below its 200-day moving average for five days, and moves to 100% T-Bills when the 200-day moving average has a 5-day negative slope. The ETF has an expense ratio of 0.65% ( PTNQ overview ). Pacer Trendpilot 450 ETF (BATS: PTMC ) , launched 6/3/15, seeks to track the Wilshire US Mid-Cap Index when it is above its 200-day moving average for five days, moves to 50% T-Bills when the index falls below its 200-day moving average for five days, and moves to 100% T-Bills when the 200-day moving average has a 5-day negative slope. The fund carries an expense ratio of 0.60% ( PTMC overview ). Pacer Trendpilot 750 ETF (BATS: PTLC ) , launched 6/3/15, seeks to track the Wilshire US Large-Cap Index when it is above its 200-day moving average for five days, moves to 50% T-Bills when the index falls below its 200-day moving average for five days, and moves to 100% T-Bills when the 200-day moving average has a 5-day negative slope. The expense ratio for PTLC is 0.60% ( PTLC overview ). Direxion Daily CSI 300 China A Share Bear 1x Shares (NYSEARCA: CHAD ) , launched 6/17/15, seeks daily investment results, before fees and expenses, of 100% of the inverse of the performance of the CSI 300 Index. It is the inverse version of the Deutsche X-trackers Harvest CSI 300 China A-Shares ETF (NYSEARCA: ASHR ) and has an expense ratio of 0.80% ( CHAD overview ). iShares MSCI International Developed Size Factor ETF (NYSEARCA: ISZE ) , launched 6/18/15, seeks to track the investment results of an index composed of international developed large- and mid-capitalization stocks with relatively smaller average market capitalization. Despite having “Size Factor” as part of its name, the ETF tracks the MSCI ex-USA Risk Weighted Index that provides “exposure to large- and mid-cap developed international stocks.” Investors will pay 0.30% to own this murkily defined ETF ( ISZE overview ). iShares MSCI International Developed Value Factor ETF (NYSEARCA: IVLU ) , launched 6/18/15, seeks to track the investment results of the MSCI World ex-USA Enhanced Value Index, an index composed of international developed large- and mid-capitalization stocks with value characteristics and relatively lower valuations. IVLU has an expense ratio of 0.30% ( IVLU overview ). ProShares Ultra Homebuilders & Supplies (NYSEARCA: HBU ) , launched 6/23/15, seeks daily investment results, before fees and expenses, that correspond to two times (2X) the daily performance of the Dow Jones US Select Home Construction Index and comes with an expense ratio of 0.95% ( HBU overview ). ProShares UltraShort Homebuilders & Supplies (NYSEARCA: HBZ ) , launched 6/23/15, seeks daily investment results, before fees and expenses, that correspond to two times the inverse (-2X) of the daily performance of the Dow Jones US Select Home Construction Index. It has an expense ratio of 0.95% ( HBZ overview ). ProShares Ultra Oil & Gas Exploration & Production (NYSEARCA: UOP ) , launched 6/23/15, seeks daily investment results, before fees and expenses, that correspond to two times (2X) the daily performance of the S&P Oil & Gas Exploration & Production Select Industry Index. UOP has an expense ratio of 0.95% ( UOP overview ). ProShares UltraShort Oil & Gas Exploration & Production (NYSEARCA: SOP ) , launched 6/23/15, seeks daily investment results, before fees and expenses, that correspond to two times the inverse (-2X) of the daily performance of the S&P Oil & Gas Exploration & Production Select Industry Index and comes with a 0.95% expense ratio ( SOP overview ). ProShares UltraPro Nasdaq Biotechnology (NASDAQ: UBIO ) , launched 6/23/15, seeks daily investment results, before fees and expenses, that correspond to three times (3X) the daily performance of the NASDAQ Biotechnology Index and has an expense ratio of 0.95% ( UBIO overview ). ProShares UltraProShort Nasdaq Biotechnology (NASDAQ: ZBIO ) , launched 6/23/15, seeks daily investment results, before fees and expenses, that correspond to three times the inverse (-3X) of the daily performance of the NASDAQ Biotechnology Index. ZBIO has an expense ratio of 0.95% ( ZBIO overview ). Deutsche X-trackers Japan JPX-Nikkei 400 Equity ETF (JPN) , launched 6/24/15, seeks to track the JPX-Nikkei 400 Total Return Index, a benchmark consisting of 400 Japanese securities that pass a rigorous screening process including return on equity, cumulative operating profit, and market capitalization to select high-quality, capital-efficient Japanese companies. JPN is not currency hedged and has an expense ratio of 0.40% ( JPN overview ). Hull Tactical US ETF (NYSEARCA: HTUS ) , launched 6/25/15, is an actively managed fund-of-funds ETF guided by a proprietary, patent pending, quantitative trading model. It can take positions in ETFs that are long, short, and leveraged to the S&P 500. HTUS states an expense ratio of 1.00% consisting of a 0.91% management fee and a 0.09% acquired fund fee. Since most leveraged funds have expense ratios of 0.95%, the acquired fund fee, and therefore total expense ratio, is likely understated ( HTUS overview ). ProShares Hedged FTSE Europe ETF (NYSEARCA: HGEU ) , launched 6/25/15, seeks investment results, before fees and expenses, corresponding to the performance of the FTSE Developed Europe 100% Hedged to USD Index. It invests in large- and mid-cap European stocks and hedges against risk from six European currencies for an expense ratio of 0.27% ( HGEU overview ). ProShares Hedged FTSE Japan ETF (NYSEARCA: HGJP ) , launched 6/25/15, seeks investment results, before fees and expenses, corresponding to performance of the FTSE Japan 100% Hedged to USD Index. It invests in large- and mid-cap Japanese stocks and hedges against risk from the Japanese Yen with an expense ratio of 0.23% ( HGJP overview ). Tortoise North American Pipeline Fund (NYSEARCA: TPYP ) , launched 6/30/15, tracks an underlying index, established five years ago, representing the pipeline industry. MLP exposure is currently at 20%, allowing this ETF to operate as a pass-through Registered Investment Company (“RIC”). Tortoise is a new ETF sponsor, but the firm launched the first MLP closed-end fund in 2004. TPYP has 102 holdings and an expense ratio of 0.70% ( TPYP overview ). Product closures/delistings in June: ProShares Ultra Australian Dollar (NYSEARCA: GDAY ) Direxion Daily Gold Bull 3x Shares (NYSEARCA: BAR ) Product changes in June: VelocityShares Daily 2x VIX Short-Term ETN (NASDAQ: TVIX ) underwent a 1-for-10 reverse split effective June 23. Announced Product Changes for Coming Months: RBS will close and redeem its entire line of US-listed ETNs , which includes its Trendpilot line and the Rogers commodity offerings. The last day of trading will be July 6 with liquidation payments expected seven business days later. First Trust will switch the primary exchange listing for 10 single-country ETFs from the NYSE to the NASDAQ effective July 14. BlackRock will close 18 iShares ETFs with August 21 set as the last day of trading. The iShares MSCI USA ETF (NYSEARCA: EUSA ), a capitalization-weighted fund, will undergo an extreme makeover on August 31 becoming the iShares MSCI USA Equal Weighted ETF ( EUSA ). The iShares iBonds Sep 2015 AMT-Free Muni Bond ETF (NYSEARCA: IBMD ) is scheduled to mature and will cease trading after the market closes on September 1. The iShares Japan large-Cap ETF (NYSEARCA: ITF ), based on the S&P/TOPIX 150 Index, will undergo an extreme makeover on September 4 becoming the iShares JPX-Nikkei 400 ETF ( ITF ). Disclosure covering writer: No positions in any of the securities mentioned. No positions in any of the companies or ETF sponsors mentioned. No income, revenue, or other compensation (either directly or indirectly) received from, or on behalf of, any of the companies or ETF sponsors mentioned.