How Do You Manage Risk?

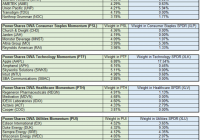

By Andy Hyer That is the question that has been top of mind for many investors over the past several weeks as the markets have done their best imitation of the Twisted Colossus at 6-Flags. As it relates to our family of separately managed accounts, the answer really differs by portfolio. Here is the overview of the approach to risk management for our 7 Systematic Relative Strength portfolios: Aggressive Owns 20-25 U.S. mid and large cap stocks. Buys stocks out of the top decile of our ranks, and sells them when they fall out of the top quartile of our ranks. Overweights sectors up to approximately 2x the weight of that sector in the broad universe; no minimum required sector exposure, so if a sector is weak, it is possible that we have zero exposure to that sector. Fully invested at all times. Core Owns 20-25 U.S. mid and large cap stocks. Buys stocks out of the top quartile of our ranks, and sells them when they fall out of the top half of our ranks. Overweights sectors up to approximately 2x the weight of that sector in the broad universe; no minimum required sector exposure, so if a sector is weak, it is possible that we have zero exposure to that sector. Fully invested at all times. Growth Owns up to 25 U.S. mid and large cap stocks. Buys highly ranked stocks, and sells when they fall out of the top half of our ranks or have sufficient trend or technical attribute deterioration. Overweights sectors up to approximately 2x the weight of that sector in the broad universe; no minimum required sector exposure, so if a sector is weak, it is possible that we have zero exposure to that sector. Can raise up to 50% cash as dictated by market conditions. International Owns 30-40 small, mid, and large cap ADRs from both developed and emerging markets. Buys stocks out of the top quartile of our ranks, and sells them when they fall out of the top half of our ranks. Overweights sectors up to approximately 2x the weight of that sector in the broad universe; no minimum required sector exposure, so if a sector is weak, it is possible that we have zero exposure to that sector. Fully invested at all times. Balanced Owns 20-25 U.S. mid and large cap stocks and U.S. Treasurys in an approximately 60% equities / 40 % fixed income weight. Buys stocks out of the top quartile of our ranks, and sells them when they fall out of the top half of our ranks. Fixed income exposure to intermediate U.S. Treasurys. Overweights sectors up to approximately 2x the weight of that sector in the broad universe; no minimum required sector exposure, so if a sector is weak, it is possible that we have zero exposure to that sector. Fully invested at all times. Global Macro Owns 10 ETFs from a broad range of asset classes, including U.S. equities, International equities, Inverse equities, Currencies, Commodities, Real Estate, and Fixed Income. No minimum constraints in asset class exposure, so that if an asset class is weak, it is possible for us to have zero exposure to that asset class. Strict buy and sell discipline based on relative strength. Tactical Fixed Income Owns 2-6 Fixed Income ETFs from a broad range of sectors of Fixed Income, including U.S. Treasurys, TIPs, Corporate Bonds, Emerging Market Bonds, High Yield, and Convertible Bonds. 40% of the portfolio will always remain invested in some form of U.S. Treasurys (Short-Term, Long-Term or TIPs). Strict buy and sell discipline based on relative strength. The chart below is based on Dorsey Wright’s opinion of the likely relationship between volatility and return in each of the different strategies over a long period of time. The actual results may differ from these expectations. Greater volatility may result in greater gains and greater losses. (click to enlarge) Life is full of trade-offs, and the financial markets are no different. Good results are likely to be achieved when a caring financial advisor takes the time to understand their clients’ needs and risk tolerance, and then to build the right allocation for that client. For those advisors using our SMAs as part of that allocation, they will find that these 7 portfolios have very different approaches to risk management. All of them employ some form of risk management. Even the fully invested portfolios are managing risk through individual position management (i.e., cutting them back when they become too large a percentage of the portfolio, or completely selling them when dictated by relative strength rank) and through sector exposure. Others, like “Growth”, can raise up to 50% cash to seek to mitigate some of the downside risk. “Balanced” benefits from the time-tested benefits of combining equities and fixed income. “Global Macro” is our “go anywhere” portfolio that can completely shift away from weak asset classes if needed. Share this article with a colleague