Dominion Resources: Strong Business Fundamentals

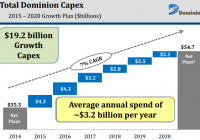

Summary Company’s strong business fundamentals will support future performance. Robust planned growth investments for next five years will allow D to expand and optimize its generational fleet. Planned investments will support company’s future EPS growth of 6%-7% and dividend growth of 8%. Dominion Resources (NYSE: D ) has a positive fundamental outlook and I think the company will enjoy above industry average earnings and dividend growth in the next five years, which makes it an attractive prospect for income-seeking investors. Going forward, the company’s growth will be mainly driven by the successful execution of its planned Cove Point LNG export facility. Also, the creation of MLP Dominion Midstream Partnership will add value for the company’s shareholders wealth through the ownership of General Partnership shares. Furthermore, I think the monetization of the merchant solar portfolio to YieldCos will also positively affect the stock price. Given the company’s strong growth prospects, I think the stock should trade at premium valuations in comparison to its competitors. Also, a pullback in the stock presents a good entry point for long-term investors to buy the stock; the stock price is down almost 13.5% year-to-date. Positive Fundamental Outlook The company has a strong business fundamental outlook, which is supported by its growth projects, including the construction of combined-cycle natural gas plants and expansion of midstream business. The company is expected to grow its earnings in a range of 6%-7% in the long run, which will be mainly driven by its robust capital spending of $19 billion from 2015-2020. The chart below reflects the company’s planned capital expenditure profile. (click to enlarge) Source: Company’s Report The company is aiming to monetize its merchant solar portfolio to YieldCos, which will positively affect shareholder wealth and will optimize cash flows from its contracted solar assets. The company’s management has stated that several YieldCos have shown an interest in its contracted solar portfolio. The company is expected to form a partnership that will allow Dominion to contribute a partial stake in solar assets to JV in exchange for cash proceeds, followed by a total sale after tax restrictions expire. Moreover, the company plans to grow its contracted solar assets from 384MW to 450MW by the end of 2015 and to 625MW by the end of 2016. The company is expected to provide an update on the merchant solar portfolio monetization in late summer or fall 2015. Given the highly competitive current merger and acquisition environment for renewables in the industry, I think there will be no shortage of interest in the company’s solar assets. The monetization of the assets will help to alleviate growth investment needs going forward, and allow it to achieve the long-term EPS growth target. Furthermore, the company announced another 11,000 acreage farmout agreement in Marcellus, extending it for two years, which will be accretive to EPS. The company is negotiating with producers to expand its farmout business into Utica. Dominion has already completed 125,000 acres, which will contribute almost $270 million of pre-tax earnings over the next five years, and the company expects an additional 180,000 acres of Utica mineral rights through 2020. Given its efforts to expand its farmout business, Dominion expects its farmout business to generate EBIT of $450-$500 million from 2015-2020, which will fuel its consolidated earnings growth in the coming years. Separately, the construction of the company’s Cove Point and ACP (Atlantic Coast Pipeline) facilities stays on track. The construction of Cove Point stays in the planned timeframe, with an expected in service date of late 2017; engineering at Cove Point Facility is almost 80% complete. Also, the construction of the company’s ACP facility is progressing nicely and is expected to be in service by November 2018. The completion of both facilities will allow the company to expand its operations, which will in return fuel earnings growth. In future years, given the healthy cash flow profile of IDR payments under its General Partnership structure with its MLP and low maintenance capital expenditure requirement for the assets, I think the company will direct cash flows not only towards growth investments, but will also use cash to grow its dividends and undertake share repurchases, which will bode well for its stock price. The company’s target dividend growth rate of 8% from 2015-2020 will be mainly driven by its growth initiatives. Also, I think the company’s future cash flows will stay strong and support its dividend growth. Dominion’s healthy dividend yield of 3.9% , along with robust expected dividend growth rate of 8%, makes it a good investment option for income-hunting investors. The stock is currently trading at a forward P/E of 17.5x , higher than the sector average forward P/E of 15.75x , which I believe is justified, given the company’s strong growth prospects. Given the company’s robust growth outlook, I believe the stock warrants premium valuation. Summation The company’s business fundamentals stay strong, which will support its future performance. The company’s robust planned growth investments for the next five years will allow it to expand and optimize its generational fleet. Also, the planned investments will support the company’s future EPS growth of 6%-7% and dividend growth of 8%. Also, once completed and operational, Cove Point and ACP facilities will increase the company’s revenues and earnings stability, which will improve the company’s risk profile. And given the company’s robust growth outlook for the next five years, I believe the stock’s premium valuation is justified. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.