My Dividend Income Portfolio Update

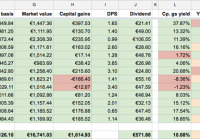

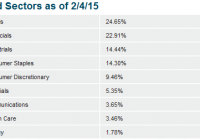

Six months ago , I decided to become a Dividend Growth Investor and become financially independent. Every month on the 8th and the 24th, I have invested €1000 in new stocks. If I keep this up, 15 years from now , my stock portfolio will grow large enough for me to be able to pay off all the monthly expenses with dividend income alone. On that day, my wife and I can retire. Today it’s February 16 . So how am I doing? Are we retired yet? Well, not yet. But my stock portfolio is doing very well. As of today, I am invested in 13 stocks with a market value of €16,741 . (click to enlarge) My portfolio is yielding a very healthy 14.46% (*) with a 3.78% yield on cost. The projected dividend for this year is €571.88, or €47.66 per month on average. (*) The total yield listed here is the sum of the capital gains yield and the yield on cost. This pretty much covers my gas bill, which is about €45 per month. So one way of looking at this income is to realize that for the entire year I will have free cooking and heating. Guess I don’t have to feel guilty about standing under the shower for more than 20 minutes. Let’s take a look at my last 3 purchases. Royal Dutch Shell (NYSE: RDS.A ) Shell caught my eye because of its high yield of 4.64% (one month ago) and low 13.8 P/E. It’s one of the cheaper high-yielding oil companies and provides me with a nice opportunity to raise the average dividend yield of my portfolio. Unfortunately, the dividend and earnings growth is not so good: respectively 2.21% and 4.56% . This is too low, as can be seen when calculating the Chowder number and Discount rate: respectively 6.49 (should be 12 or more) and 8.85 (should be 10 or more). Shell has a nice yield, but a very low dividend growth and not enough earnings growth to fund future dividend rises. So why go for this stock? I confess: I bought Shell partly out of nostalgia. My father worked at Shell for almost his entire career, and I have happy childhood memories of their bring your kids to work days at the KSLA building in Amsterdam. But another reason for buying Shell is that there is no indication that the company is in any kind of existential trouble. I take the long view and expect good results from this stock in the next 20-30 years, when worldwide oil reserves start to dry up. Oil prices will eventually rise again, Shell will flourish, and the company has a very good reputation of rewarding shareholders with dividend. I expect this stock to do fine. But it might take a few years. Philip Morris (NYSE: PM ) Now here is a stock with much better metrics. Philip Morris is the golden boy of many dividend growth investors right now. A 4.63% yield and a 17.29 P/E make this company an affordable high-yielder. But things get really interesting when looking at historic growth. PM has been growing its dividend at a healthy 18.38% (5-year CAGR), which contributes to an impressive Chowder value of 23.06 . But what about earnings? PM has got that covered too, with a 5-year EPS CAGR of 9.64% , which contributes to a discount rate of 14.32 . The DPR is 76.6% , which is in line with other tobacco companies. For example, British competitor BATS has a DPR of 74.3% . All metrics look good on this stock, and so I pulled the trigger and bought 14 shares. National Oilwell Varco (NYSE: NOV ) I bought NOV back in December at €55.90 per share, which gave me a dividend yield of 2.5%. One month later, the stock has dropped to a feeble €46.80. I lost 16% of my investment. Many people would panic at this point. Buying a stock and then seeing it drop in value is scary. You’re supposed to buy low and sell high, right? So when a stock drops after you buy, you need to get rid of it as quickly as possible, cut your losses, and try again. Actually, no. That’s a terrible strategy. At its new price, NOV has a yield of 3% , which is 0.5% higher than when I bought it. So if I buy more shares, the average yield of my NOV position actually rises to 2.75% , and I will receive €2.50 in extra dividend. This is called ‘averaging down’, and it is one of the golden rules of dividend growth investing. When the stock price drops, you buy more. Of course, this strategy fails completely if the company is going bust. So how are they doing? Well, fine actually. The 5-year DPS CAGR is an astounding 74.33% , and EPS growth a hefty 10.69% . This gives a Chowder value of 77.35 and a discount rate of 13.72 . And their DPR is only 23.50 , which is very low for an oil company. So there is more than enough earnings growth to finance NOV’s over the top dividend growth in the near future. In fact, my ranking formula places NOV just below Apple (NASDAQ: AAPL ). And remember, Apple has a 5-year dividend growth rate of 118.25% , which is just plain crazy. I don’t think you can go wrong with this stock. I bought 21 new shares. My portfolio today My portfolio today has a yield of 14.46% . The best-performing stock in my portfolio is Apple with a total yield of 39.97% . (click to enlarge) I rank my portfolio by ChowderDiscount (the sum of the Chowder number and the Discount value) and YDPR rank (which measures the spread between yield and payout ratio). My best ranking stock is Apple with a combined rank value of 2.61 . (click to enlarge) The market value of my portfolio today is €16,741 . (click to enlarge) My portfolio is well diversified over industry sectors, even though ‘Oil and gas’ is getting a bit large: I’m also diversified over three currencies. A good start, but it’s clear I need to buy more UK stock in the future: