The Market Doesn’t Matter: Vanguard Dividend Appreciation ETF

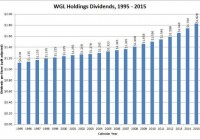

Summary Investors need to avoid decision risk. While many individual stocks can be attractive, I’ve seen to many people feel handcuffed (or married) to particular companies. Investors that held VIG and didn’t watch TV could have ignored the financial crisis. If there is one thing investors often struggle with, it is being able to pick a winner and stick with it. While picking winners in the stock market can be very difficult, I believe picking winners in the ETF market is easier. Rather than understanding every business, the fundamentals of the ETF can be used to determine the risk level and risk factors. In my opinion, there are a few ETFs that are simply born winners. It isn’t a case of looking at their performance of an arbitrary time period; it is a matter of some ETFs being designed to serve investors while other ETFs are designed to serve managers. In my opinion, the Vanguard Dividend Appreciation ETF (NYSEARCA: VIG ) is one of those born winners. The very nature of the Vanguard Dividend Appreciation ETF is what makes it such a solid choice. I’ve been asked on occasion: “If you could only invest in one ticker and had to hold it for 50 years, which ticker would you buy?” While I haven’t nailed down the answer to that question, because the premise is mildly absurd, I do believe it is important for investors to know their long term goals and to find investments that match those goals. VIG is an ETF that matches my long term goals, so it would be an extremely strong contender for that question. What does VIG do? VIG attempts to track the investment results of the NASDAQ US Dividend Achievers Select Index. The general methodology is to focus on stocks that have a history of increasing dividends over time. The ETF falls under the category of “Large Blend” and has a very high correlation with the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ). Overall the ETF has been slightly less volatile than SPY and performed slightly better during the last crash as demonstrated in the following chart: (click to enlarge) Getting married I often cover Freeport-McMoRan (NYSE: FCX ) and one of the common themes I hear from investors is that they don’t like the company anymore but after holding it while it fell so far, they feel “married” to it. They resent the investment in which they lost so much money, but they don’t want to just walk away either. That isn’t the way I like to think of marriage, but I can understand how they feel. As investors we may become attached to the investments we have selected and that emotional attachment can complicate our decision making. Since it is very difficult to mitigate emotional biases through training clients, I would rather see people select an investment that will work to protect them. While I am long FCX, I certainly don’t think that it belongs in every investor’s portfolio. On the other hand, there are very few investors that wouldn’t be well served to hold VIG over the next several decades. The risk VIG solves for investors One of the major issues investors face is decision risk. While there are plenty of other kinds of risk in the market, decision risk is one of the nastiest ones. One reason that the S&P 500 regularly beats out most investors (and even money managers) is that a comparison of SPY to actual performance is that money simply stays in SPY while people trade at the wrong time, pay more commissions because of the trading, and cross the bid-ask spread. These issues all add up and stack the deck against many investors. VIG solves a substantial portion of the decision risk problem by offering investors a different way to look at part of their portfolio. Instead of deciding what they should do with their holdings in VIG, investors need simply to turn off dividend reinvestment when they are ready for an income stream. After that, there is no need to touch the investment again. My suggestion on this would be to hold VIG in a different brokerage from other holdings. Hold VIG in an account you never log into, that way there is no temptation to kill the goose that lays the golden egg. If you were holding VIG during the financial crisis As all readers should know, we had a bit of an issue in the financial markets. We saw the economy tank, stock prices plummet, and interest rates go to 0%. On the other hand, if an investor was simply holding VIG and enjoying a nice beach, they had no need to know or care. Their dividends didn’t go away. They still had a similar payment to live on. Just look at the chart below: Investors should know about a couple issues I came across preparing the chart. The fund inception date was in April of 2006, so there are only 3 dividends included for the year. It is only may of 2015, there is only one dividend included for 2015. Yahoo Finance has incorrect information on dividend history. I verified the dividend payouts through Google and Schwab. Yahoo was missing the December 2014 payout. Holdings I put together the following chart showing the top 10 holdings in VIG: (click to enlarge) Conclusion If an investor was only picking one investment, VIG should be a strong contender. If the investor wants to build a more diversified portfolio, it makes sense to put VIG in a separate account and just leave it alone. While rebalancing accounts is very useful in maintaining the optimal risk exposures, the decision risk of accessing the golden goose offsets the benefits of rebalancing. I’m not currently holding any VIG, but my long term plan will have me buying into VIG or the very similar Schwab U.S. Dividend Equity ETF (NYSEARCA: SCHD ). I’ll probably start acquiring the position later this year or early next year. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Additional disclosure: Information in this article represents the opinion of the analyst. All statements are represented as opinions, rather than facts, and should not be construed as advice to buy or sell a security. Ratings of “outperform” and “underperform” reflect the analyst’s estimation of a divergence between the market value for a security and the price that would be appropriate given the potential for risks and returns relative to other securities. The analyst does not know your particular objectives for returns or constraints upon investing. All investors are encouraged to do their own research before making any investment decision. Information is regularly obtained from Yahoo Finance, Google Finance, and SEC Database. If Yahoo, Google, or the SEC database contained faulty or old information it could be incorporated into my analysis.