Ameren Corporation: Creating Stable Income Streams At Less Risk Than The Market

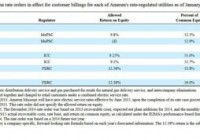

Summary The public utility sector is going through a challenging period. Experts are mixed on the long-term prospects of the stock, but median estimates give a 12.55% upside at current levels. Ameren has only reduced its dividends once, during the 2008-09 crash. Ameren Corporation (NYSE: AEE ) is a natural gas and electric utility company that operates in Illinois and Missouri. It is operating in a challenging business environment with evolving environmental regulation. The experts are mixed regarding Ameren’s future stock value; however, the median estimate provides an upside of 12.55% at current price levels. Ameren produces a stable and predictable dividend which mitigates a small amount of market risk when holding the stock. The Company is a buy for risk-averse investors who are looking for an income stream that is relatively unlinked to general market risk. Major trends in common to the electric and natural gas utility industry ( F rom the 10-K ) Political, regulatory, and customer resistance to higher rates. Tax law changes that accelerate depreciation deductions, which reduce current tax payments but also result in rate base reductions and limit the ability to claim other deductions and use carry-forward tax benefits. Cybersecurity risks, including loss of operational control of energy centers, and electric and natural gas transmission and distribution systems and/or loss of customer data. Increased competition in supply, generation, and distribution. Pressure to grow customer base in light of economic conditions and energy efficiency initiatives. The availability of fuel and fluctuations in fuel prices. Higher levels of infrastructure investments could result in decreased free cash flows. Company Positioning Ameren’s primary assets are its subsidiaries including Ameren Missouri and Ameren Illinois. Both of these subsidiaries are rate-regulated electric generation, transmission and distribution businesses as well as rate-regulated natural gas transmission and distribution businesses. Ameren’s other subsidiaries are responsible for activities such as the provision of shared services. Another of Ameren’s subsidiaries, ATXI, operates a FERC rate-regulated electric transmission business. (click to enlarge) Ameren’s profits and subsequent dividend payouts are dependent upon these regulated revenue streams. Growth Strategy ( F rom the 10-K) Renewable Mandate: Ameren is expected to increase its renewable energy resources to 10% of its total portfolio by 2015 and 25% by 2025. It is achieving these goals through IPA agreements and long-term contracts with renewable energy suppliers. Transmission and Distribution: AEE is involved in multiple transmission generation products which should alleviate congestion and bring access to new economic zones. Energy Efficiency: Ameren Missouri and Ameren Illinois have implemented energy efficiency programs. In Missouri, the MEEIA established a regulatory framework that allows electric utilities to recover costs related to customer energy efficiency programs. A MEEIA rider allows AEE to collect from or refund to customers any annual difference in the actual amounts incurred and the amounts collected from customers for the MEEIA program costs and lost revenues. Risk Management ( From the 10-K) Regulatory and Environmental Matters: Ameren is subject to a complex legal environment. The EPA is developing and implementing environmental regulations that will have a large impact on the electricity industry. Its coal-fired plants may incur significant costs to comply with these regulations. Natural Gas Price Fluctuation: AEE’s natural gas procurement strategy is designed to ensure immediate delivery of natural gas. The strategy is accomplished by optimizing storage options and various supply and price-hedging agreements that allow for diversification of supply source. Grid Reliability: Significant investment is going into making the grid more reliable. The increased use of distributed generation and the uneven output of renewable generation have complicated grid management, so the Company must invest in more sophisticated grid management systems. Dividends (click to enlarge) From dividend.com (click to enlarge) From dividend.com AEE has a very consistent dividend performance. The Company has only lowered its dividends once, and has maintained stable payouts. Since the dividend payout is stable, the dividend yield moves inversely to the price performance of the underlying stock and mitigates some of the market risk of holding the AEE stock. Expert Opinion (click to enlarge) From Yahoo Finance The expert opinion on AEE is mixed. Most analysts recommend holding the stock and not expanding positions at the current time. The median expert estimate on AEE’s stock price is $42.5, which gives the Company a 12.55% upside at the current price of $37.76 per share. AEE’s beta is 0.21. From Yahoo Finance AEE has been positively surprising the experts with its quarterly EPS releases; this usually means that analysts are undervaluing some portion of the Company. Recent News: Ameren Illinois continuing major upgrades to strengthen the region’s energy delivery network DiversityInc Ranks Ameren First in the Nation Ameren Missouri’s Callaway Energy Center Receives Extended Operating License From the Nuclear Regulatory Commission Retired Chairman and CEO of Unisys (NYSE: UIS ) Elected to Ameren Board of Directors Conclusion Ameren is a straight forward public utility play with exposure in Illinois and Missouri. Its revenues depend upon rate-making policy decisions, environmental policy and natural gas price levels. An investor who is looking for a company that produces stable dividends and has low market risk, would feel right at home with AEE. While the experts are uncertain about the future stock price levels, the median estimate does provide a 12.55% upside at current levels. If you are a risk-averse investor who wants to create a stable income stream with little market risk, Ameren is for you. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.