Southern Company: 4.8% Yield And Decades Of Dividends

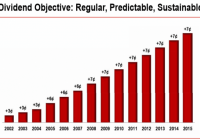

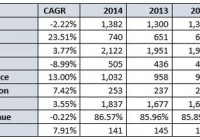

Summary Investors can expect 7.8% to 8.8% total returns from Southern Company. The company has an exceptionally long dividend history. Is Southern Company over indebted? Southern Company (NYSE: SO ) is a large cap utility that supplies electricity to 4.5 million customers in Georgia, Alabama, Mississippi, and Florida. What stands out about Southern Company is its stability and consistency. The company has paid dividends every quarter since 1948 . In addition, the company has not reduced its dividend as far back as I can find. My records stopped in 1982 – it’s been at least that long since the company has been forced to reduce its dividend payments. The image below shows its more recent dividend history: (click to enlarge) These are not small dividends either. Southern Company currently has a dividend yield of 4.8%. The company’s long history of dividend payments makes it a member of the Dividend Achievers Index. Click here to download a list of all 238 members of the Dividend Achievers Index . It’s not just Southern Company’s dividends that are stable. The company’s stock price exhibits low volatility as well. Southern Company’s 10-year average stock price standard deviation is just 16.9%. For comparison, the only other large cap stocks I’ve found with lower standard deviations over the last decade are Johnson & Johnson (NYSE: JNJ ) and Consolidated Edison (NYSE: ED ). If you are interested in high yields and stability with inflation-beating growth, then Southern Company makes a compelling investment to consider further. Business Overview Southern Company generates over 90% of its earnings from the heavily regulated utilities industry. The remaining income comes from competitive wholesale electricity sales. The image below shows the company’s current and “under-construction” portfolio of power assets. The company’s entire portfolio is spread across the Southern half of the United States – hence the name “Southern Company.” (click to enlarge) Growth Prospects Let’s be very clear: Southern Company is not a fast grower . The company has compounded earnings per share at 3.0% a year over the last decade. Dividends per share have grown slightly faster at 3.9% a year. The company currently has a payout ratio of 80%. As a result of Southern Company’s high payout ratio, investors should expect dividend growth in line with earnings per share growth going forward. One way that businesses with stable cash flows boost growth is through share repurchases. Reducing the number of shares increases earnings on a per share basis. Unfortunately, Southern Company regularly raises capital through share issuances . This dilutes current shareholder ownership and reduces earnings per share (all other things being equal). Over the last decade, Southern Company has increased its share count at 2.3% a year. Had Southern Company been able to finance its growth without increasing share count, its earnings per share growth rate would have been a more respectable 5.3% a year over the last decade. Fortunately, management does not plan to fund its current growth plans with more share issuances. The company’s financing plan ( in the image below ) aims to rely exclusively on debt through 2017. Simply halting share issuances will go a long way toward improving Southern Company’s growth. (click to enlarge) Southern Company showed earnings per share growth of 1.5% in its most recent quarter . Southern Company is expecting earnings per share growth of between 3% and 4% in fiscal 2015. This is also in line with management’s long-term earnings per share growth goals. Given the company’s history, growth of 3% to 4% a year seems likely. This earnings per per share growth, combined with the company’s current 4.8% dividend yield, gives investors in Southern Company expected returns of 7.8% to 8.8% a year. Current Troubling Issues Southern Company has experienced 2 recent setbacks , which have hurt earnings in the short-run. First, the company is building a coal gasification plant in Mississippi. The plant was originally expected to go online in May of 2014 but has been stalled due to ongoing construction delays. The plant is now expected to go online during the first half of 2016. This 2-year delay has already cost Southern Company over $1 billion. Secondly, Southern Company is also experiencing delays for the construction of its Vogtle nuclear plants. The completion date has already been delayed 18 months . Every month of delay will cost Southern Company an extra $40 million. The full 18-month delay is expected to cost over $700 million While troubling, these delays to not reflect long-term threats to Southern Company’s dominant position in the electric utility markets which it serves. Utilities form natural monopolies. They are highly regulated as well. These two factors make utility businesses in general – and Southern Company in particular – highly stable. Balance Sheet and Recessions Southern Company is heavily indebted, as most utilities are. The company has around $25 billion in debt. In addition, the company has another $1.2 billion in unfunded pension liabilities. On top of that, Southern Company has $1.3 billion in preferred stock as well. The company has $220 million in cash. The company has annual interest expenses and preferred dividends of around $870 million a year. Annual operating income is around $4 billion. While Southern Company has a large debt load, the company is not at risk of defaulting thanks to its large, stable cash flows. The company’s performance over the Great Recession of 2007 to 2009 gives an example of consistency of Southern Company’s earnings: 2007 earnings per share of $2.28 2008 earnings per share of $2.25 2009 earnings per share of $2.32 2010 earnings per share of $2.36 Final Thoughts It is very unlikely that Southern Company generates double-digit returns for investors going forward. Still, total returns of 7.8% to 8.8% a year, coupled with low risk and low volatility, make Southern Company an interesting choice for investors needing both safety and current income. The company’s high 4.8% dividend yield and extremely low stock price deviation give it an above-average rank among dividend stocks with long histories using The 8 Rules of Dividend Investing. Southern Company has a price-to-earnings ratio of 16.8 using adjusted earnings. The company is likely trading around fair value at this time given its decent total return prospects and high scores for stability. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.