SCANA Corporation: A Value Play On The Utility Sector Pullback

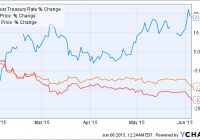

Summary The Utilities Select SPDR Fund has seen a double digit pullback from 52-week highs. SCANA Corp. has seen even greater losses, with a share price now down over 20% from January highs. This hefty pullback has brought SCANA back into fair value, and provides a nice entry point for long term investors. Background On January 21st, I wrote an article discussing the high valuations being seen among the utilities: ” Have We Reach The Point Of Irrational Exuberance In The Utility Sector? ” It turns out this article was published just one week before the 52-week high was made in the Utilities Select SPDR ETF (NYSEARCA: XLU ). Since then the sector has been in sell-off mode, as interest rates have started to rise and continued fears of a Federal Reserve rate hike looms. One of the utilities hit the hardest during the pullback has been SCANA Corporation (NYSE: SCG ), whose shares are down over 20% since the article was published. This divergence can be seen quite clearly in the chart below. 10 Year Treasury Rate data by YCharts SCANA has seen a 50% greater correction than the rest of the sector, and as a result is now trading below fair value for the first time since the end of September, 2014. (click to enlarge) For those not familiar with F.A.S.T. Graphs , the chart above shows the share price in relation to the PE trendline over the last five years. With the recent pullback, you can see where the share price has retreated to below the long term blue 14.3 PE trendline, which represents the average PE during the period. This is the first time SCANA has traded at that level since the end of September. Company Operations & Guidance SCANA Corporation is an energy-based holding company that is headquartered in Cayce, South Carolina. SCANA was formed in 1984 and currently serves over half a million electric customers in South Carolina and more than 1.2 million natural gas customers in South Carolina, North Carolina and Georgia. These service territories can be seen below, as depicted on page 9 of the company’s March presentation . (click to enlarge) SCANA has a diversified mix of power generation capabilities with assets in coal, natural gas, nuclear and renewables. Coal currently comprises roughly 50% of the mix, but that will be decreasing in the future as the company is in the process of adding two more units to its V.C. Summer nuclear plant, which will shift nuclear to 56% of dispatch power when they are completed. (click to enlarge) This has resulted in a high amount of CAPEX due to construction costs of the new nuclear facilities. These expenditures are expected to peak in 2016 and then continue downward until the new units are commissioned in 2019 and 2020. (click to enlarge) These expenditures have continually been adjusted upwards as the project progresses and this may be an item of concern in the future if there are further delays and cost overruns. However, thus far the company has maintained its stable BBB+ credit rating and appears to have these future costs accounted for with debt offerings and expected rate increases to consumers. Company Performance SCANA has been an excellent performer throughout the years, as it is a Dividend Contender from David Fish’s CCC List , and owns a 15 year streak of increasing dividends. During this period, the company has been able to grow earnings and dividends at a steady rate, with a long term EPS growth rate of 3.9% and a dividend growth rate of 4.4%. (click to enlarge) This consistent performance has led to outsized returns when compared to the market. With reinvestment of dividends, SCANA has produced annualized returns of 8.4% over the period, which crushed the S&P mark of 5.3%, and led to twice the total returns over the period. (click to enlarge) Another highlight to note is that investors who bought at the end of 2000 did so with an initial yield of 4.0%; and through the compounding power of reinvestment and dividend increases achieved a yield on cost over 10% after 10 years. Those investors would now be receiving 12.3% of their initial investment in annual dividends. Shares are yielding 4.3% with the recent pullback, and as things currently stand, investors have a good chance of seeing a similar situation play out over the coming decade. The company is currently projected earnings growth of 3-6% over the next few years. Analysts agree, and project the high end of this range was they expect 4-6% growth over the next 5 years. Using the mid-point of guidance, here are the income projections over the next 10 years with the reinvestment of dividends. Going back to F.A.S.T. Graphs and using the handy forecaster tool with a more aggressive estimated earnings growth of 6%, new investors could hope for annualized returns of nearly 12%. (click to enlarge) 12% annualized returns may not sound like much compared with what we’ve seen in recent years in the market, but it’s still well above historical returns, and doesn’t take any outlandish predictions for it to work out. Even dropping the growth rate down to the low end of guidance would lead to annualized returns of nearly 9%, which is a nice risk/reward type of investment. Investment Risks While SCANA is certainly becoming attractive at current prices, the pullback in the sector may not be over. Treasury yields have been on a steady rise since the beginning of the year, and as long as they continue rising there could be continued weakness in the utility sector. Additionally, the company does have some risk of its own with construction costs associated with the expansion of their nuclear power plant. Any further delays would lead to higher costs, and could lead to lower dividend and earnings growth rates than what is currently forecast. Conclusion SCANA Corp. appears to be an attractive income play in the current market environment. The company looks to be financially sound with a BBB+ credit rating and provides an appealing 4.3% yield that is expected to grow at a 3-6% annualized rate going forward. With shares currently below historical valuation levels, total return investors could also be looking at high single digit annualized returns. There could still be some downward pressure on shares if interest rates continue to rise, but the relatively high dividend yield pays you to wait for the rebound. Personally, I am looking to add another utility or two to my portfolio , and am strongly considering SCANA, along with several others on my watch list. I am currently looking for possible sales to free up capital for a purchase, and may be initiating a position within the next week or two. Disclosure: The author has no positions in any stocks mentioned, but may initiate a long position in SCG over the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article. Additional disclosure: I am a Civil Engineer by trade and am not a professional investment adviser or financial analyst. This article is not an endorsement for the stocks mentioned. Please perform your own due diligence before you decide to trade any securities or other products.