Templeton Global Income Is On Sale

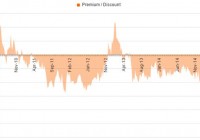

Summary Templeton Global Income trades at a -15.72% discount to NAV following last week’s market panic. This discount is historically large and most likely a limited time offer. Mr. Market seems to be rating the investment skill of Michael Hasenstab below average. I disagree. Background Templeton Global Income Fund (NYSE: GIM ) is a closed-end fund. Its investment objective in Templeton’s own words : The Fund seeks high, current income, with a secondary goal of capital appreciation. Under normal market conditions, the Fund invests at least 80% of its net assets in income-producing securities, including debt securities of U.S. and foreign issuers, including emerging markets. Discount To NAV Following last week’s market tantrum, GIM currently trades at a substantial -15.72% discount to net asset value. This discount is large historically speaking (albeit the rolling average discount has been increasing the past five years). Source: CEFconnect.com If we assume the following… NAV is fairly calculated (I do in GIM’s case). GIM’s investment mandate is sufficiently flexible (it is). … then the discount would appear to be Mr. Market’s judgment on the quality of GIM’s management skill. If management skill is well below average, the discount is warranted. If management skill is average or above, the discount represents a buying opportunity (and a margin of safety should our judgment of management skill prove incorrect). I believe management skill is above average. Michael Hasenstab Michael Hasenstab is the key man behind Templeton Global Income. (More specifically, he is the Chief Investment Officer, Global Bonds for Franklin Advisers, Inc, which manages the fund.) His long-term record speaks for itself… Source: Trustnet.com I’m a fan of the guy. He takes chances, which is to say he “actively” manages the portfolio. (Illustrating this point, GIM’s R-Squared is 0.17 vs. its benchmark over the past three years.) Unfortunately, this seems to be a novel approach in an industry where too many fund managers claim to be “active” (to justify higher fees) but in practice hug their benchmark, prioritizing career risk over the actual risks facing their investors. Sometimes Hasenstab’s chances pan out ( Ireland ). Other times they don’t ( Ukraine ). Over the last decade plus, he’s won more than he’s lost and produced solid risk-adjusted returns. I think the combination of his temperament and relatively young age makes it a decent bet GIM’s performance will remain solid. Here are his thoughts on the recent market volatility. For the record, I am far more bearish on China’s prospects than he appears to be from the video. I was short the Direxion Daily FTSE China Bull 3X ETF (NYSEARCA: YINN ) until last week and plan to short it again should government intervention artificially push it back up. That said, I have no qualms with GIM’s latest reported exposures (which do not include China)… (click to enlarge) Other Thoughts On The Merits Behind An Investment In GIM I believe the bulk of a decision to invest in GIM boils down to one’s appraisal of the manager’s skill (above average in my opinion) and the margin of safety should that appraisal be wrong (the CEF’s current -15.72% discount to NAV). Here are three more quick thoughts on the merits behind an investment in GIM though… Fees are reasonable at 0.73%. I believe it is well positioned risk-wise for the current market environment given its low duration (0.6438 years) and closed-end fund structure, which prevents forced selling from redemptions during a market panic. GIM is highly focused on emerging market bonds and currencies. I believe these are currently reasonably priced exposures relative to other asset classes. GMO’s “7‐Year Asset Class Real Return Forecasts” agrees… (click to enlarge) Conclusion The Templeton Global Income closed-end fund is trading at a huge discount following last week’s market panic. Mr. Market is suggesting Michael Hasenstab is a below average investor. I disagree. Long GIM. Disclosure: I am/we are long GIM. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.