Best And Worst Q3’15: Small Cap Value ETFs, Mutual Funds And Key Holdings

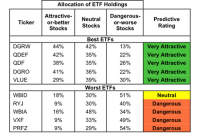

Summary The Small Cap Value style ranks tenth in Q3’15. Based on an aggregation of ratings of 16 ETFs and 187 mutual funds. VBR is our top-rated Small Cap Value ETF and RSEIX is our top-rated Small Cap Value mutual fund. The Small Cap Value style ranks tenth out of the 12 fund styles as detailed in our Q3’15 Style Ratings for ETFs and Mutual Funds report. It gets our Dangerous rating, which is based on an aggregation of ratings of 16 ETFs and 187 mutual funds in the Small Cap Value style. See a recap of our Q2’15 Style Ratings here. Figures 1 and 2 show the five best and worst-rated ETFs and mutual funds in the style. Not all Small Cap Value style ETFs and mutual funds are created the same. The number of holdings varies widely (from 14 to 1511). This variation creates drastically different investment implications and, therefore, ratings. Investors seeking exposure to the Small Cap Value style should buy one of the Attractive-or-better rated mutual funds from Figure 2. Figure 1: ETFs with the Best & Worst Ratings – Top 5 (click to enlarge) * Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity. Sources: New Constructs, LLC and company filings The Direxion Value Line Small & Mid Cap High Dividend ETF (NYSEARCA: VLSM ) and the First Trust Mid Cap Value AlphaDEX ETF (NYSEARCA: FNK ) are excluded from Figure 1 because their total net assets are below $100 million and do not meet our liquidity minimums. Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5 (click to enlarge) * Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity. Sources: New Constructs, LLC and company filings The Vanguard Small-Cap Value ETF (NYSEARCA: VBR ) is the top-rated Small Cap Value ETF and the Royce Special Equity Fund (MUTF: RSEIX ) is the top-rated Small Cap Value mutual fund. VBR earns a Neutral rating and RSEIX earns an Attractive rating. The PowerShares Russell 2000 Pure Value Portfolio (NYSEARCA: PXSV ) is the worst-rated Small Cap Value ETF and the ASTON River Road Independent Value Fund (MUTF: ARIVX ) is the worst-rated Small Cap Value mutual fund. Both earn a Very Dangerous rating. Universal Insurance Holdings, Inc. (NYSE: UVE ), is one of our favorite stocks held by Small Cap value Funds. After-tax profit ( NOPAT ) growth has picked up in recent years, and NOPAT has grown by 53% compounded annually since 2011. Universal currently earns a top-quintile return on invested capital ( ROIC ) of 43%, which is almost three times the 16% earned in 2011. Universal has dug itself a strong competitive position within the insurance industry, but the stock price does not yet reflect the strong cash flows the company generates. At the current price of $25/share, Universal has a price to economic book value ( PEBV ) of 1.0. This ratio implies that the market expects the company to never meaningfully grow profits for the remainder of its corporate life. If Universal can grow NOPAT by 16%, less than a third of the current rate, compounded annually for the next 5 years , the stock is worth $45/share – an 80% upside. Acacia Research Corp (NASDAQ: ACTG ) is one of our least favorite stocks held by Small Cap Value funds and earns our Very Dangerous rating. Since 2012, Acacia’s NOPAT has fallen from $60 million to -$42 million. The company currently earns a bottom-quintile -10% ROIC, which is well below the 22% earned in 2012. It appears that the market has not taken into account these fundamental issues, as the stock remains overvalued. To justify the current price of $9/share, Acacia must immediately achieve a 10% NOPBT margin (compared to -42% in 2014) and grow revenue by 16% compounded annually for the next 13 years . Figures 3 and 4 show the rating landscape of all Small Cap Value ETFs and mutual funds. Figure 3: Separating the Best ETFs From the Worst Funds (click to enlarge) Sources: New Constructs, LLC and company filings Figure 4: Separating the Best Mutual Funds From the Worst Funds (click to enlarge) Sources: New Constructs, LLC and company filings D isclosure: David Trainer and Max Lee receive no compensation to write about any specific stock, style, style or theme. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.