Salesforce.com Leads Software Stocks’ Harmony Up; Even Tableau Hums

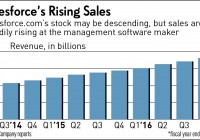

The morning bell became music to the ears of software stock investors Thursday as Wall Street used Salesforce.com’s Q4 strength and outlook to harmonize. Salesforce.com ( CRM ), an enterprise cloud pioneer and the No. 1 maker of customer relationship management software, sang soprano, its stock gapping up 11% as soon as the conductor raised the baton on the morning after its upbeat earnings report late Wednesday. Rival SAP ( SAP ) was up 1.6% in early trade in the stock market today . Fellow enterprise software stocks Ultimate Software ( ULTI ) rose 2%, ServiceNow ( NOW ) 2.8% and Manhattan Associates ( MANH ) nearly 1%. The harmony extended to database choir: Legacy leader Oracle ( ORCL ) rose a fraction, Qlik ( QLIK ) 2.7%, Splunk ( SPLK ) 3.9% and Hortonworks ( HDP ) 1.8%. Workday ( WDAY ) leapt 5% despite a lowered price target from Wedbush. Even Tableau Software ( DATA ) was up as much as 3.5% early Thursday. Tableau stock collapsed 49.5% on Feb. 5 after the company issued soft Q4 results and an outlook of slower growth, sending the entire enterprise software sector into a tailspin. “Slowdown? What Slowdown?” asked FBN analyst Shebly Seyrafi in a Thursday research note, citing “600 seven-figure deals” signed by Salesforce.com during Q4. Salesforce set off a sectorwide rebound, but will it last? By midday, Salesforce had eased to an 8% gain, near 67.50. Most of the other stock also had eased, but remained up. Hortonworks, though, was down more than 1% and Manhattan and Splunk were down a fraction. Canaccord Genuity maintained its buy rating, but without explanation lowered its price target on Salesforce stock to 88 from 95 while praising the company. FBR, too, reportedly lowered its price target, to 82 from 88, but maintained its outperform rating. “We have pushed back against the pessimism that has permeated investors’ imaginations for the past 50 days,” wrote Canaccord analyst Richard Davis in a research note issued Thursday morning. “Salesforce decisively demonstrated that the world is far from ending, and for well-run, well-positioned companies with talented salespeople, growth is still coming in large chunks. “There was literally nothing wrong with this quarter’s print or longer-term outlook. We believe the stock’s 9% after-hours (Wednesday) pop is just the beginning of a year in which the stock delivers price appreciation that is materially better than the overall stock market.” For its fiscal Q4 ended Jan. 31, Salesforce said adjusted EPS rose 36% to 19, matching analyst consensus, on revenue up 25% to $1.81 billion vs. Wall Street’s $1.79 billion model. For fiscal Q1 2017, Salesforce expects adjusted EPS of 23-24 cents, up 47% at the midpoint and ahead of analysts’ 21-cent estimates, on sales up 25% to $1.89 billion, whereas analysts expected $1.86 billion. Brian Wieser, an analyst with Pivotal Research, noted that deferred revenue growth was up 29% in Q4, foreshadowing sales to come. “By segment, Marketing Cloud was up by 31%,” he wrote in a Thursday research note. “App Cloud and other (formerly the Platform segment) was up by 43%, Services Cloud was up by 35% and the flagship Sales Cloud was up by +12%. “Commentary about activity in the most recent quarter included reference to the company’s signing of a new nine-figure transaction as well as a renewal of another large customer, also with a nine-figure sum.” Image provided by Shutterstock .