Income ETFs, Funds And MLPs: Tide Going Out

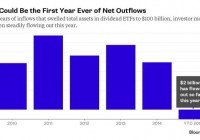

Low interest rates, relentless central bank confidence pumps and a runaway investment sales machine have all served to herd income-searching investors into income-producing assets over the past 3 years. In the process, unit valuations that were already high in 2012 moved to outrageous by 2014. The trouble is that capital risk rises in lock step with price, even as income products have been sold to those who can least tolerate losses. The marketing mantra is that income/dividend paying securities are ‘defensive,’ ‘stable’ places to park savings. Just as in previous investment cycles, fund cos and issuers ramped up sales campaigns as prices rose, rolling out an ungodly barrage of artfully wrapped products. Sadly many customers who had bitten similar baits in 2005-08, lost heavily and swore off the risk-sellers for a few years after that. Then in the past couple of years as finance trolled for suckers, many hopefuls have been lured back in, just as the price cycle crested once more. Some of the most reckless financial advisers and firms (unfortunately, there’s lots of them) have been looking after their own sales targets by recommending that their customers borrow to “invest.” With loan rates so low, they argue it’s a no-brainer to use a lender’s money to increase buying power. In truth, the strategy is more typically a recipe for financial disaster. The fall out of this cycle is just starting to show as high yield debt, preferred shares and MLPs (Master Limited Partnerships) concentrated on the energy sector, have been selling off over the past 9 months. See: MLPs yield headaches for advisers who bought them for income. The capital tide is retreating. As usual it starts slowly at first; then all at once, as losses shock the hearts and minds of holders. See: Is this the beginning of the end for dividend funds? Dividend ETFs are on fire, and not in a good way. Exchange-traded funds that employ a variety of strategies to invest in dividend-paying stocks have been a no-brainer since the financial crisis, as income investors have confronted artificially low interest rates. But after years of inflows that swelled assets to $100 billion, dividend ETFs have seen an outflow of $2 billion this year.1 If that isn’t quite apocalyptic, it is scary, and if it keeps up, this will be the first year of outflows ever. The outflows aren’t from just one ETF or the result of one massive trade. It’s a slow and steady burn from most of the largest and most beloved dividend ETFs. (click to enlarge) When dividend products from the Big Three in ETFs – Vanguard, BlackRock, and State Street – are hurting, it shows that no product is safe when investors anticipate a big change in the markets. Not even dividend ETFs.