Did Schwab Just Kill The Non-Human Robo Advisor Services?

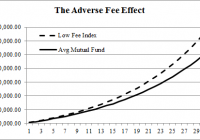

Bonds, dividend investing, ETF investing, currencies “}); $$(‘#article_top_info .info_content div’)[0].insert({bottom: $(‘mover’)}); } $(‘article_top_info’).addClassName(test_version); } SeekingAlpha.Initializer.onDOMLoad(function(){ setEvents();}); Charles Schwab (NYSE: SCHW ) launched a new service recently called Schwab Institutional Intelligent Portfolios. The service is a fully customizable automated portfolio management product that will give every advisor on their platform the same tools and options that the other Robo Advisory services have (automated rebalancing, tax loss harvesting, etc). In other words, it’s given every human advisor the option to copy what the Robo Advisors are doing while COMBINING fully customized portfolios and other advisory services. Schwab is really ahead of the curve here. In essence: Schwab is already offering a free Robo service which means that anyone using a competing Robo is basically paying fees for no reason (unless you’re a small account below the free minimum). Schwab’s Institutional offering is fully customizable which means that you don’t have to be restricted to the cookie cutter Modern Portfolio Theory style portfolios that most of the Robos currently offer. Schwab’s Institutional offering combines humans with automation which means that you don’t have to worry about poor risk profiling and having your existence reduced down to a number based on a 5 question profile form. This is a big trend change. Every human advisor can now offer Robo Advisory services. And advisors with low fees can offer the same services combined with the human touch. This, in my opinion, is the best of all worlds. And it will force the other Robos to change their offerings. My guess is we’ll see a few big trend changes from the other Robos if they want to compete: They have to combine humans into their offerings. Schwab’s new service is simply too competitive. A reasonable advisory fee combined with the Robo automation makes the Schwab offering a no-brainer if you’re looking for automated portfolio services. The purely automated services tried to differentiate themselves by removing the human advisor, but you can’t be a real “advisor” and remove the human element. Robo “Advisor” was always a misnomer because of this. Schwab has completely fixed this problem. The other Robos will need to create their own ETFs. Schwab has checkmated the other Robos who don’t have their own ETFs because they are forced to charge higher fees. That is, they have to charge you a management fee AND they have to charge you the ETF expense ratios. Since Schwab uses their own ETFs they can make money on their free Robo service without charging you a management fee. We should start seeing some consolidation in this space. The smaller robos can’t compete with Schwab because they’re not banks and they don’t have their own ETFs. This means Schwab is able to use their cash sweep program to boost profits AND they can charge fees on their underlying ETFs. The other Robos don’t have this same degree of flexibility because most of them aren’t banks with their own ETFs. In order to compete the other Robos have to expand their operations and the easiest way to do that is to either gobble up other firms or hope to get gobbled up. The fully customizable portfolios that the Schwab Institutional platform allows for means that the “passive” trend in Robo portfolio management is dead. The other services will have to start offering full discretion in their portfolios at some point. My guess is we’ll start seeing “active” management with Robo services embedded. I have to say that I am still not sold on this sort of automated portfolio management. As I’ve discussed on many occasions (see here and here ) I think that portfolio management should be personalized and requires some discretion. So, Schwab hasn’t totally changed the game here. But I have to admit that I am pretty impressed with how far ahead of the curve they are here. For a firm that hasn’t generally been known for their tech savvy they seem to be beating Silicon Valley at their own game. Share this article with a colleague