New Year 2016: Looking Back, Moving Forward

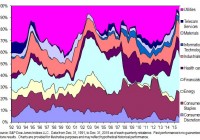

The Facts: There were lots of ups and downs in the markets in 2015. Unfortunately, by the time December came to close, there were a few more downs than ups. Although the S&P 500 actually posted a slight gain, it was the index’s softest performance in seven years. We’ll show you what it all means. The Impact: U.S. large caps finished the year up 1.38% (including dividends), while small caps retreated. International stocks fell, with emerging markets dropping almost 15%. Fixed-income markets were relatively flat, though moves by the U.S. Fed triggered unusual volatility. What It Means for Investors: Where some see weakness, there may be opportunity. With a well-diversified portfolio, a simple rebalancing strategy may help investors capture opportunities almost automatically. Read on for what this might mean for each of the major asset classes. A Closer Look As Shakespeare said, “All the world’s a stage,” and a dramatic year for both domestic and international markets may have once again proven him right. It was central banks that took center stage in 2015: The U.S. Federal Reserve (the Fed) made a small but significant step toward tighter interest rates, while looser monetary policy ruled the day in Europe, Japan, China, and elsewhere. The markets were unusually volatile, too, buffeted by several international flashpoints, including financial instability in Greece, a slowdown in China, and terrorist attacks in Paris that grabbed the world’s attention. The end result? Most markets came under pressure in 2015. U.S. stocks ended the year mixed, international markets sagged (especially those in emerging economies), and U.S. bonds ticked slightly higher. Before we take a closer look, let’s quickly review the economic highlights for December. Fed raises rates-finally: The odds makers finally got some rest. On Wednesday, December 16th, the Federal Open Market Committee voted to raise its benchmark interest rate, the federal funds rate, by 0.25%. This was the first interest rate increase in nearly a decade, and the first time in seven years the rate has exceeded the zero to 0.25% range. Projections by Fed governors also suggested that the Fed may increase rates by another 1% through the end of 2016. U.S. economy keeps chugging along: The U.S. showed slow but steady growth throughout 2015. The unemployment rate dropped from 5.6% in December 2014 to 5.0% in November, the most recent month for which we have data, and the workforce expanded by 2.6 million employees. While gross domestic product grew by just 2% through the third quarter, the housing market and other indicators pointed to an economy that continues to expand. Domestic Equities There’s a lot to cover this month, so let’s go straight to the numbers. The large-cap-oriented S&P 500 shed 1.58% in December, but finished the year up 1.38%, the smallest total return for the index since 2008. Without dividends, the S&P actually posted a modest annual decline. The tech-heavy Nasdaq Composite performed significantly better for the year, gaining 6.96% (also including dividends). The month and year were much tougher for U.S. small caps. The small-cap-oriented Russell 2000 shed 5.02% in December-and finished 2015 with an annual decline of 4.41%. Among the sectors that make up the U.S. equity markets (based on the S&P 500 sector indexes), consumer staples, utilities, and health care stocks were the biggest gainers in December, while the energy, materials, and consumer discretionary sectors lagged. The top performers for the year were consumer discretionary stocks, perhaps partially due to lower oil prices leaving more money in consumers’ pockets. Health care and consumer staples stocks also outperformed. On the downside, the energy sector was by far the weakest, falling by 21.12%, followed by materials and utilities. It may be helpful to take a quick look at the energy markets, which struggled considerably in 2015. A glut in global oil supplies triggered a decline of 30.05% in the benchmark New York Mercantile Exchange in 2015-for a total loss of 64% over two years. The last time that crude dropped two years in a row was in 1997-1998. During the course of the year, oil plunged from a high of $61 a barrel to a low of $35, and more than 250,000 jobs in the energy sector were lost on a global basis. For the equity styles, both growth and value stocks were lower in December, though growth slightly outperformed. (We track style performance using the Russell 3000 Growth and Value Indexes.) This theme played out through most of 2015, as growth led value by more than nine percentage points for the year. What to Consider for 2016 : In the spirit of New Year’s resolutions, the start of the year can be a great time to consider rebalancing one’s portfolio to its target allocations. Because U.S. small caps performed relatively poorly in 2015, this could mean adding exposure to small caps by redirecting funds from cash or other assets. (Of course, there’s no guarantee you’ll be reallocating assets at an advantageous time-and tax consequences could be triggered if the transactions are made in a taxable account.) As for U.S. sectors, it’s almost impossible to predict how things will play out. It might be tempting, for instance, to call a bottom in energy at these levels, but even more pain could be ahead, as U.S. crude inventories expand, Iran comes online, and Saudi Arabia fulfills its pledge to meet any increases in demand. Among other sectors, consumer stocks could continue to benefit from the spending power generated by oil price weakness, while higher interest rates could lift financials. International Equities Volatility ruled international stocks in 2015-to vastly different results. Developed markets ended the year just fractionally lower, while emerging markets dropped sharply. The MSCI EAFE Index, a widely followed measure of developed market performance, fell 1.35% in December, finishing the year down 0.81%. Among the component regions that make up the index, Japan was the year’s star performer, while stocks in other Pacific countries and the UK fell sharply. Many Pacific economies were weighed down by the ripple effects of slowing growth in China and depressed commodity prices. Emerging markets saw no reprieve in December. The MSCI Emerging Markets Index fell 2.23% for the month, and ended the year with a loss of 14.92%, the worst annual performance of any index we track. (This was also the index’s third consecutive yearly loss.) Latin America was the weakest region in the index, dropping sharply on lower pricing for some of the region’s biggest exports-oil and other natural commodities. What to Consider for 2016 : Given the underperformance of emerging markets over the past three years, many investors might find that their emerging market holdings have grown smaller relative to other asset classes. If this applies in your situation, now might be a good time to consider adding funds to the category to bring it back to desired target allocation. Investors might even want to reconsider the split in your international allocation-specifically, the amount you hold in emerging vs. developed markets. Valuations for emerging markets are now more attractive than they’ve been in quite some time, and emerging economies still offer the world’s highest (albeit declining) growth rates. Fixed Income The U.S. fixed income market had a relatively flat year, as the Fed finally put an end to the question of “when,” and voted to raise its benchmark interest rate. The Barclays U.S. Aggregate Index was down 0.32% in December, to end the year with a gain of just 0.55%. In the U.S. Treasury arena, the yield on the benchmark 10-year note closed the year at 2.27%. This represented a gain of six and 10 basis points for the month and year, respectively. (A basis point is one one-hundredth of a percent.) For the full-year period, while rates increased across most maturities, the shape of the yield curve remained essentially unchanged. Among the various U.S. fixed income sectors, Treasury bills were the strongest performers in December, while high-yield bonds (also known as “junk” bonds) were the weakest. For the full-year period, intermediate-term U.S. Treasuries led the pack, while high-yield bonds, TIPS, and long-term U.S. Treasuries lost the most. For both periods, high-yield bonds were hit by a number of factors, including the category’s overexposure to the energy sector, and new competition for income from bond sectors that are generally considered less risky. What to Consider for 2016 : While more rate increases are expected by the Fed this year, the bond market may have already priced in some of these moves. Short-tem rates may continue to rise, though this could be tempered by surging demand from yield-starved investors. Long-term rates, which are more influenced by inflation and economic growth than by rate policy, could stay at current levels or rise slightly. If this scenario plays out, the expectation would be for longer-term bonds to outperform their shorter-term counterparts. The Bottom Line Like every year before it, 2015 was full of surprises. But what will happen in 2016? Of course, we can’t predict the future, but there’s one thing we know for certain. Because 2016 is an election year (and there’s no incumbent on the ballot), a new American president will be elected. Other themes that may play out in 2016 include: divergent monetary policy across developed economies (some countries loosening, others tightening); the consequences of higher domestic interest rates, whether intended or not; the effect of higher rates on corporations, particularly those that need to seek funding in the volatile high-yield market; and continued conflict in the Middle East. Plus, we’re sure there will be plenty of new surprises, which makes the financial markets so fascinating to watch and participate in. So what can investors do to prepare their portfolio for the changes ahead? As always, our best advice is fairly straightforward: Stay focused on the long term . Stick to a long-term investing plan by maintaining a risk-appropriate, well-diversified portfolio. This may help prepare one’s investments no matter which way the election goes, or whatever the news may bring. Consider rebalancing periodically to maintain target allocations . January can be a great time to review and refine one’s portfolio to stay in line with pre-set target allocations. This may mean selling some holdings that were relatively successful in 2015, and investing in sectors or regions that underperformed, while keeping in mind that there’s no guarantee of future performance. (If making transactions in a taxable account, it also helps to be mindful of any potential tax consequences.) While it may feel uncomfortable selling winners to buy losers, this strategy follows one of the basic tenets of investing for the long term.