AusNet Should Not Be Bought By Conservative Investors

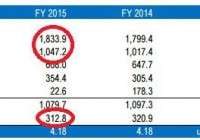

Summary AusNet has been a steady dividend payer but it actually cannot afford the dividend as in the past two financial years it had to borrow cash to cover the dividend. Despite considering half of the capex as ‘growth’ capex, there won’t be a clear revenue increase further down the road. I consider my investment profile to be a bit too conservative to invest in AusNet right now as it isn’t self-funding the dividend (if you include growth capex). Introduction AusNet Services ( OTCPK:SAUNF ) operates a gas and electricity distribution network in Melbourne and Victoria (Australia) as well as high voltage power lines supplying Victoria. The company is known for its relatively generous dividend payments, but in this article I will discuss whether or not these dividends are sustainable. AusNet is an Australian company and you should trade in AusNet shares on the Australian Stock Exchange for liquidity reasons as the average daily dollar volume is almost $4M. The stock’s ticker symbol in Australia is AST . Is AusNet spending too much cash on dividends? In order to answer this question, we obviously need to have a closer look at the company’s financial situation, so we will focus on the results of its financial year 2015 (the most recent numbers available to the general public). Source: press release At first sight, AusNet had a pretty decent year as its revenue increased by 1.9%, resulting in a 2.9% increase in its EBITDA to just over A$1B. You immediately notice the strong EBITDA conversion as in FY 2015, no less than 57% of the company’s revenue was converted into EBITDA, which is pretty strong! However, this trend was discontinued at the bottom line as AusNet’s (adjusted) net profit decreased by approximately 2.5%. But of course, net profits and net losses don’t have any importance when you’re trying to find out whether or not a company can afford its dividend policy and that’s why I will switch to the company’s cash flow statements. AusNet generated an operating cash flow of A$768M (a very nice increase compared to the A$730M last year), but unfortunately the company had to spend A$800M in capital expenditures resulting in a negative free cash flow of almost A$40M (US$30M). So there wasn’t any free cash flow, but AusNet decided to spend A$180M (US$135M) in dividend distributions anyway. That’s not a good sign. Source: financial statements But okay, maybe this was a one-time bump in the road, so let’s pull the 2014 numbers as well. In the previous financial year, AusNet generated A$730M in operating cash flow but spent A$925M on capital expenditures, so AusNet hasn’t had a positive free cash flow in two financial years, but nevertheless decided to reward its stakeholders by paying out cash dividends to the tune of US$330M (keep in mind this does NOT include the additional dilution caused by shareholders accepting their dividend in new shares. If everybody would have elected a cash payment, the cash outflow would even be $100M higher!). This cash shortfall was compensated by issuing more debt. Why I’m not interested in buying AusNet at the current valuation I’m obviously not narrow-minded nor short-sighted (at least, I try not to be), and it does look like AusNet’s future will improve a bit as its capital expenditures are coming down. This should be the last year of heavy capex investments (estimated at A$900M), but from FY 2017 on the capital expenditures should be reduced to A$725M per year. Taking an expanding operating cash flow into consideration, this means I would expect AusNet to generate a positive free cash flow but his will be insufficient to cover the current 6% dividend yield. There’s an additional reason why I’m not very keen on adding AusNet to my portfolio. It’s quite common for utilities companies to have a lot of debt on its balance sheet and AusNet isn’t any different. As of at the end of March it had A$5.8B in net debt. That shouldn’t be a huge problem given the strong operating cash flows and EBITDA (and as said, it’s very normal for a company in this segment to have an above-average net debt). However, if you’d look at the cost of this debt, you’d be surprised at how this leverage could kill this company. AusNet paid A$326M in finance costs, so let’s now assume its average interest rate it has to pay is approximately 5%. If the average cost of debt would increase by 1%, AusNet’s bill would increase by A$50M and this will have a further negative impact on its ability to generate a positive free cash flow. But I don’t want to be too negative I always get a little bit nervous when I see a company telling its shareholders ‘the dividend is fully backed by the operating cash flow’. Whilst this is essentially true, I prefer to look at the free cash flow/dividend ratio. Whilst this is ratio is negative in AusNet’s case, there is also something working in its favor. (click to enlarge) Source: company presentation Of the A$800M it spent on capex in FY 2015, only A$380M was maintenance capex whilst the remaining A$420M capex was spent on projects to ensure further growth. However, looking at the average analyst estimates , there’s no clearly visible increase in the revenue expected within the next few years so even though A$420M is being spent on ‘growth’, I’m cautious until I indeed see a revenue increase. Investment thesis AusNet is paying a handsome dividend – which it promises to increase once again this year – but it’s only able to afford the dividend by raising additional cash through issuing more debt and that’s a dangerous game to play. I’m fine with AusNet spending A$420M on ‘growth’, but it’s a bit disappointing the company hasn’t released updated revenue growth targets for the next few years so it’s difficult to check if the ‘growth capex’ is really paying off. Don’t get me wrong, I’m not saying AusNet is a bad company, not at all. But I personally wouldn’t feel comfortable with a continuously increasing net debt profile which has the potential to erode the majority of the future free cash flow should the interest rates increase (which isn’t really unlikely). Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.