Bottom-Digging During Market Tops

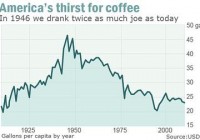

Summary Finding investing opportunities when the market reaches all-time highs. What industries currently offer value in the market. Managing your portfolio. The S&P 500 has nearly tripled from a 2009 low of 735 to 2113 currently. Just as a rising tide lifts all ships, so too does a rising stock market lift all stocks. At greedy times like these, investors should be fearful and reexamine their portfolios. …if [investors] insist on trying to time their participation in equities, they should try to be fearful when others are greedy and greedy only when others are fearful. -Warren Buffett Now, I’m not saying the market has reached its peak (though some do make compelling arguments ). I am not a market timer. I’ve written about the folly of forecasting in the past. I’m merely saying a prudent investor should not let greed get the better of him. The following strategy is one that is more likely to be applicable during market highs as investors are more likely to have a preponderance of stocks trading at prices much higher than their actual values (aka, the rising tide theory mentioned above). So what to do? Well, I believe the prudent investor should lock in gains on stocks pushing well beyond their valuations (close to 52-week or all-time highs) and replace them with stocks trading at reasonable valuations. Mr. Market is offering attractive prices for your stocks, let him have them. But then we’re left with the problem of finding alternative investments. As markets keep pushing higher and higher, investors are often left scratching their heads wondering where to find value. Admittedly, this can be challenging, however, opportunities do still exist. One place to look as stocks reach all-time highs are stocks reaching new 52-week lows. Some noteworthy examples include PriceSmart (NASDAQ: PSMT ), SodaStream (NASDAQ: SODA ), Turtle Beach Corp. (NASDAQ: HEAR ), and Fossil (NASDAQ: FOSL ). PriceSmart is the Sam’s Club of Central America and the Caribbean. It’s trading at a small discount to its sales, has high insider ownership, and has consistently grown sales, 15% on average, over the past ten years. At its current price of $17.07 after-market, SodaStream trades at a large discount to sales (72% of sales) and is nearly trading at its book value of $16.59. Turtle Beach has near-total domination in the gaming headphone market with 50% of both the UK and US markets. It trades at 60% of sales (which it looks to nearly double sales this year) and is led by smart management with a solid near-term plan, and patents, to enter industries such as health, automotive, TV and mobile. I’ve already written my take on Fossil, you can read it here . The next place to look is at overlooked stocks (often smaller capitalization, less than $100m) in industries where there is a low supply of investment opportunities. One such industry is the coffee industry. Now, before going into individual companies, let me preface this discussion by first noting some interesting dynamics at place in this market. For one, coffee consumption is not nearly what it used to be. In fact, in 1946 consumers drank 46.4 gallons of coffee per person ( Figure 1 ). Today, even with a coffee shop on every corner, consumers drink less than half as much at only 20-25 gallons of coffee per year as coffee was replaced predominantly by soda. As consumers become more health-conscious, pop consumption should decrease and coffee, as a viable, healthy alternative, should have an increased level of consumption. Secondly, there is a shift taking place where high-quality shade-grown coffee (high cost to grow) is being overtaken by the rise of poorer quality shade-free coffee (cheaper to grow). This makes coffee plants much more susceptible to climate change and topsoil erosion. As climate change concerns begin to grow, the downfall we’ve seen in coffee prices from $300 in 2011 to a current 52-week low of $140 is not likely to last. Figure 1 Now, opportunities in this market surely exist in the form of large companies. There is, of course, Green Mountain Coffee Roasters (NASDAQ: GMCR ) and Starbucks (NASDAQ: SBUX ), but investors in those companies will soon bail when they see these companies for what they are-overvalued. Starbucks trades at an all-time high ($94.30) and the highest price-to-sales ratio it has ever seen in the last ten years of 4.12. Starbucks also trades inversely to coffee prices. Green Mountain Coffee Roasters ($124.10) shares trade even higher at a price-to-sales of 4.31 and, like Starbucks, it is also inversely correlated to coffee prices. As coffee prices rise investors will bail on these two companies (and valuations will come back down to earth). So when investors bail, where will they look? On the conservative end is Coffee Holding Co. (NASDAQ: JVA ), trading at 28% of its total sales. This company is well-managed by its owners, experienced coffee industry veterans who have a 10% stake in the company’s shares. They also support and believe in sustainable practices. These beliefs lead to production of higher quality coffee (shade grown) that is not as susceptible to soil erosion and climate change. Furthermore, as experienced coffee experts, they are well-hedged against fluctuating prices. On the risky end is Jammin Java ( OTCQB:JAMN ), better known by its Marley Coffee, which is trying to force itself to turn things around before it does a complete nose-dive. If company-estimated year-end sales are to be believed, the company trades at a 10% discount to expected year-end sales. However, this company is only for high-risk-oriented individuals who don’t mind getting cleaned out if things turn south. Then, there’s the oil industry. I don’t think I need to go into this as many have already witnessed the price collapse at the pumps, so suffice it to say that there are many opportunities to be had in this sector, both large cap and small, and everything in between. (Check out Cale Smith’s recent notes about the oil price phenomenon). I’m pretty sure you could throw 10 darts at oil stocks right now and make at least 8 solid investments. Another interesting idea is James O’Shaughnessy’s strategy of looking for stocks that he calls Reasonable Runaways . These are stocks that have a high relative strength, greater than $150m in market cap and trade at a price-to-sales ratio less than 1. I’ve modified this strategy a little bit by including companies that have large amounts of cash in excess of debt. Some notable examples include FreightCar America Inc. (NASDAQ: RAIL ), BeBe Stores (NASDAQ: BEBE ), Men’s Wearhouse (NYSE: MW ), LSI Industries (NASDAQ: LYTS ) and FujiFilm Holdings ( OTCPK:FUJIY ). While I have not had time to look into each of these companies it doesn’t matter- the theory of the Reasonable Runaways strategy is one of investor agnosticism. The theory says that you are buying $1 worth of sales for less than a dollar (low P/S) just as investors are realizing the company is undervalued (high relative strength). You simply run the screen, buy agnostically, and diversify your portfolio by giving equal weight to the top 20 or so companies with the highest price appreciations. Sell after a year then repeat the process. Since 1951 this strategy had a compound annual growth rate of over 18%. While the S&P 500 may have reached its top, your portfolio doesn’t have to top out. You can simply shift your current best performers to companies that offer greater opportunity and more attractive valuations. Employing several different search techniques, such as those mentioned above, can get you on the right track to optimizing your portfolio towards value and thus reducing your overall risk by increasing your margin of safety. But don’t forget to hold on to a fair amount of just in case cash for when the market does plummet. You’ll want to have that cash in your back pocket to snatch up undervalued companies when the falling tide lowers all the ships again and more opportunities abound. Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks. Disclosure: The author is long FOSL, JVA. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The author has no business relationship with any company whose stock is mentioned in this article.