Stocks And Gold: A New Balanced Portfolio

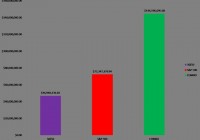

High valuations and low rates make it necessary to build balanced portfolios. Gold can be a good diversifier for US stocks. Trend following approaches can add value. Leonardo Da Vinci is credited with stating that “simplicity is the ultimate sophistication.” Daniel Khaneman added credence to Da Vinci’s belief in his book, Thinking Fast and Slow . Khaneman pointed out that “complexity may work in the odd case, but more often than not it reduces validity.” In essence, Khaneman made the case that simpler is in fact better. The same is most likely true for investing. Despite the fact that our financial system is filled with complex financial products, and often chaotic feedback mechanisms, simple investment strategies tend to work better over the long run. For example, over the last decade, an investor would have been better served to buy a low cost S&P 500 index fund over investing in active managers. Over 80 percent of the active managers failed to outperform their respective benchmarks over that period. This is despite their large research teams, sophisticated investment strategies, and years of training. The simple process of buying an index fund and holding it over the ten year period would have been superior. Index funds are great, but buy and hold is hardly the optimal investment strategy. The macroeconomic environment, valuations, and the prevailing price trends should be considered. Simple, rules-based approaches can be used to adequately account for dynamic markets. The article, Value and Momentum: A Beautiful Combination , is a great example of using two simple, yet opposed systems, to formulate a sound overall investment methodology. The purpose of this paper is to explore a new twist on a balanced approach to investing through a simple system. Courtesy of Doug Short US stocks are severely overvalued by most measures that demonstrate historical accuracy. Chart 1 gives a pretty good summary of the overvalued state of stocks using several respected measures of market valuation. Thus, long-term investors should diversify their investment in the US equities market with other asset classes. The first thought that normally comes to mind is to diversify in different asset classes of equity. Many value investors would point to the undervalued emerging and international stocks suggesting that they may offer better future returns than the US stock market. The problem with this idea is that global stocks tend to be highly correlated with US markets during periods of stress. During the summer months of 2008, most stock market asset classes fell together. Correlations between different classes of equity moved towards one, signifying a lack of diversification and an increase in portfolio risk. Bonds are also typically referenced as a good diversifier when paired with equity investments. This is normally the case as bonds have a tendency to dampen the volatility of the overall portfolio over time. The problem with diversifying into bonds in a long-term portfolio is the fact that interest rates are historically low and we are thirty years into a bond bull market. At some point, in the next twenty years, one would expect interest rates to be higher than the current rates. That expectation could lead to poor returns for bonds, especially if all the monetary stimulus turns around to haunt us with inflation. Consequently, it made sense to us to scour other asset classes with historically low correlations to stocks but with the ability to protect a portfolio against inflation or rapidly rising interest rates. With the backdrop of accommodative central banks, record debt levels in developed nations, slow growth, and deflationary conditions, gold became the asset class of choice. Partly for the controversy, as investors hate and love the yellow metal. Our view of gold is primarily price related as we are quantitative investment managers. However, from a fundamental perspective, gold makes a lot of sense as a portfolio hedge. It is a currency in its basic form and hedges against the fall of other global currencies. Therefore, we decided to test out a new balanced investment approach where we diversified US stocks with gold. Since we do not believe that volatility is risk, we did not determine our weightings to stocks and gold through volatility targeting or risk budgeting approach. Living up to our heretic ways, we instead equally weighted the two asset classes and ran a comparison versus the S&P 500 from 1972 through 2014. The hypothetical results were as follows: (click to enlarge) Chart 2: Stocks vs. Stocks & Gold Clint Sorenson, CFA, CMT Data Courtesy of NYU Stern School of Business, Global Financial Data, Morningstar1 The two strategies did a good job growing the initial investment over the time period. Although, the drawdown was much less for the portfolio of 50 percent stocks and 50 percent gold. The S&P 500 fell more than 55 percent during the time period referenced above. The 50 percent stock and 50 percent gold portfolio fell a maximum of 31 percent. Growth was similar between the two strategies. $1 million invested in 1972 would have become over $72 million in the S&P 500 through 2014. The same amount put into the balanced portfolio would have turned into almost $59 million. Obviously, the S&P 500 would have been the overall winner in a competition of growth over this period of time. We decided to apply a simple trend following method to the balanced portfolio for further comparison. The rules are as follows: Measure each asset class (US Stocks and Gold) against their 8 month simple moving averages If the closing monthly price is above the moving average, the portion of the portfolio would be invested in the asset class (Buy Signal) If the closing monthly price is below the moving average then the portion of the portfolio would be invested in the 10 year US Treasury (Sell Signal) The following table embodies all possible portfolio allocations: Allocation Range Stocks (NYSEARCA: SPY ) 0-50% Gold (NYSEARCA: GLD ) 0-50% US Ten Year Treasury (NYSEARCA: IEF ) 0-100% Applying the simple buy and sell discipline to the balanced portfolio makes all the difference historically. Since 1972 $1 million invested in the trend following approach grows to over $286 million. This is significantly more than the S&P 500 or the static 50/50 (Stock/Gold) portfolio. Furthermore, the growth comes on the back of reduced drawdown. The maximum drawdown of the trend following portfolio is only slightly more than 18 percent. Applying the simple trend filter allows for enhanced return and reduced risk. Historically, it has made sense to rent bonds during periods where stocks and gold have entered negative trends. (click to enlarge) Chart 3: Trend approach to Gold and Stock portfolio Clint Sorenson, CFA, CMT Data Courtesy of NYU Stern School of Business, Global Financial Data, Morningstar2 It is our opinion that we are in the third equity market bubble in the past fifteen years. Historically high valuations, large amounts of public and private debt, unprecedented monetary support, and negative real interest rates have challenged the common approaches to portfolio construction. We hope we have demonstrated a way to simplify diversification using a portfolio of stocks and gold. A sound investment approach does not have to be complicated to generate attractive results. 1. For the 50/50 strategy of Stocks and Gold, we used index data through 2005 and then ETF data from 2006 through 2014. We used SPY to replicate the S&P 500 and GLD to replicate gold. 2. For the trend following strategy of Stocks and Gold, we used index data through 2005 and then ETF data from 2006 through 2014. We used SPY to replicate the S&P 500, GLD to replicate gold, and IEF to replicate the 10 year Treasury bond.