Tag Archives: chinese

Despite The Mid-Week Attack In Belgium, Investors Are Net Purchasers Of Risk-On Assets

By Tom Roseen Soaring commodity prices, a weakening dollar, and dovish Federal Reserve comments helped push the Dow Jones Industrial Average into positive territory for the first time this year. The energy, materials, and industrials sectors got a boost early in the flows week after crude oil futures rose above $40/barrel for the first time since December 3, 2015. The major indices continued to rally after the Fed’s decision to leave interest rates unchanged and reducing the number of slated increases from four to two for 2016. On Friday, March 18, on the heels of a strong run-up in healthcare and financial stocks, the Dow and S&P 500 booked their longest winning streaks since early October, staying on the plus side for the fifth consecutive week. Investors appeared to have been cheered by the Fed’s positive outlook on interest rate hikes at a slower pace. M&A news in the middle of the flows week overshadowed a disappointing existing home sales report for February. However, the Dow snapped its seven-session winning streak when investors learned of the deadly terrorist attacks in Belgium that left 34 dead and numerous injured. Safe haven plays such as U.S. Treasuries and gold rallied on Tuesday as the news unnerved global equity markets. Financial stocks took the brunt of the decline as investors also began to reevaluate the impact negative interest rates will have on banks’ earnings. Crude oil prices dropped below $40/barrel, closing the flows week out at $39.79, after weekly oil supplies jumped by 9.4 million barrels, weighing heavily on the markets and erasing the S&P 500’s year-to-date plus-side return. For the flows week ended March 23, 2016, the year-to-date return for the S&P 500 Composite Price Only Index was minus 0.35%. Most pundits don’t expect a lot of movement in the last day of trading of this Easter holiday-shortened week. For the week, fund investors were net redeemers of fund assets (including those of conventional funds and exchange-traded funds [ETFs]), pulling out a net $10.0 billion for the fund-flows week ended March 23. However, the headline number was misleading. Investors padded the coffers of taxable bond funds (+$5.9 billion), equity funds (+$2.0 billion), and municipal bond funds (+$0.9 billion), while being net redeemers of money market funds (-$18.7 billion). For the fourth week in a row, equity ETFs witnessed net inflows, taking in $3.5 billion. As a result of rises in oil prices and good economic news during the week, authorized participants (APs) were net purchasers of domestic equity ETFs (+$0.6 billion), injecting money into the group for the fourth consecutive week. Despite global markets’ concerns about the attacks in Belgium and perhaps as a result of Chinese authorities considering loosening margin-trading requirements, APs – for the second week in three – were also net purchasers of non-domestic equity ETFs (+$2.9 billion). APs bid up some out-of-favor names, with the iShares MSCI Emerging Markets ETF (NYSEARCA: EEM ) (+$2.8 billion), the iShares Russell 2000 ETF (NYSEARCA: IWM ) (+$1.2 billion), and the SPDR Gold Trust ETF (NYSEARCA: GLD ) (+$1.0 billion) attracting the largest amounts of net new money of all individual equity ETFs. At the other end of the spectrum the SPDR S&P 500 ETF (NYSEARCA: SPY ) (-$1.1 billion) experienced the largest net redemptions, while PowerShares QQQ Trust 1 (-$0.8 billion) suffered the second largest redemptions for the week. For the second week running conventional fund (ex-ETF) investors were net redeemers of equity funds, redeeming $1.5 billion from the group. Domestic equity funds, handing back $2.2 billion, witnessed their seventh consecutive week of net outflows, while posting a weekly gain of 0.28%. Meanwhile, their non-domestic equity fund counterparts, posting a 0.24% return for the week, witnessed net inflows (although just +$668 million) for the seventh week in eight. On the domestic side investors lightened up on large-cap funds and mid-cap funds, redeeming a net $2.0 billion and $135 million, respectively. On the non-domestic side, international equity funds witnessed $222 million of net outflows, while global equity funds took in some $890 million net. For the fifth week in a row, bond funds (ex-ETFs) witnessed net inflows, taking in a little under $2.8 billion. Balanced funds witnessed the largest net inflows, taking in $1.1 billion (for their fourth week of net inflows in five), while corporate high-yield funds witnessed the second largest net inflows (+$0.6 billion). Despite the late-week flight to safety, government-Treasury funds witnessed the only net redemptions of the group, handing back $124 million for the week. For the twenty-fifth week in a row, municipal bond funds (ex-ETFs) witnessed net inflows, taking in $0.8 billion this past week.

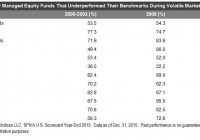

Does Market Volatility Favor Active Management?

By Aye Soe Twice a year, S&P Dow Jones Indices releases the SPIVA U.S. Scorecard. The scorecard measures the performance of actively managed equity and fixed income funds across various categories. Since the initiation of the report in 2002, the results have consistently shown that managers across most categories overwhelmingly underperform on a relative basis against their corresponding benchmarks over a medium-to-long-term investment horizon. The Year-End 2015 SPIVA U.S. Scorecard reveals little surprise. The second half of 2015 was marked by significant market volatility, which was brought forth by plunging commodity prices, a strengthening U.S. dollar, growing global concerns over Chinese economic growth, and the subsequent devaluation of the Chinese renminbi. Market volatility, in theory, favors active investing, because managers can tactically move out of their positions at their discretion and park themselves in cash. Passive investing, on the other hand, has to remain fully invested in the market. Investors in actively managed strategies should therefore realize fewer losses during periods of heightened volatility, all else being equal. Given this theoretical background, recent volatility in the market has supporters of active investing proclaiming that active management is back in favor. However, over a decade of experience in publishing the SPIVA Scorecard has painfully taught us that active funds don’t always perform better than their passive counterparts during those precise periods in which active management skills seem to be called for. Exhibit 1 compares the performance of actively managed equity funds across the nine style boxes during the 2000-2002 bear market, the financial crisis of 2008, and 2015. As the data clearly show, there is no consistent pattern across most of the categories. Large-cap value managers appear to be the only exception to the losing trend, outperforming their benchmark in both bear markets. Again in 2015, mid-cap value is the only winning equity category, with the majority (67.65%) of them outperforming the S&P MidCap 400® Value . Disclosure: © S&P Dow Jones Indices LLC 2015. Indexology® is a trademark of S&P Dow Jones Indices LLC (SPDJI). S&P® is a trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a trademark of Dow Jones Trademark Holdings LLC, and those marks have been licensed to S&P DJI. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI and to see our full disclaimer, visit www.spdji.com/terms-of-use .