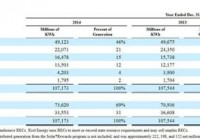

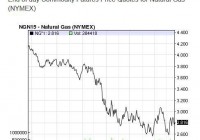

Summary There are major trends impacting the Utility sector: Fuel fluctuations, renewable energy targets, increasingly connected customers and innovations in distributed generation. The interest rate environment is favorable for highly leveraged Utility companies to refinance at attractive rates. NRG is using this drawdown period to shift their business to benefit from these trends in the future. The utility sector is going through a period of margin compression and market disruption which is challenging for a group of companies which are expected to pay stable dividends. The sector is being impacted by changing trends in renewable energy, increasingly connected retail customers, fluctuations in fuel costs and the increasing economic validity of distributed generation. NRG (NYSE: NRG ) is using this challenging business environment and the current low interest rates to pivot all of the Company’s businesses to benefit from these trends going forward. Make no mistake, NRG is undergoing major restructuring of their business model. The Company taken a hard look at all facets of the company and is making broad changes. One major change is that NRG has reorganized their company organizational structure, which is summarized in the Business Overview section below, to fit their view on trends in the Utility sector. Another major change is how NRG is approaching regulatory risks regarding the environment. 31% of NRG’s generation fleet is “dirty” coal-fueled power plants, the Company is currently burning cash upgrading these plants to bring them on pair with cleaner Combined Cycle Gas Turbine plants which are fueled by Natural Gas. The bottom-line benefits of the coal plant upgrades have yet to be seen. By analyzing the NRG’s current business environment, future trends in the sector, growth plan, risk management strategy and expert opinions we can tentatively postulate that the Company will produce sub-par results in the near-term, but has positioned itself as a Utility sector leader in the long-term. (click to enlarge) *from Yahoo Finance Business Overview: NRG Energy, Inc. is a competitive power company that produces, sells and delivers energy and energy products and services in major competitive power markets in the United States. Further the Company is a leader in the Utility sector and is 48th in the Fortune 100 Largest Companies in the United States. NRG owns and operates around 52,000 MWs of generation and engages in trading of wholesale energy, capacity, fuel and transportation services. Further the Company directly sells energy and sustainable services to retail customers. There are three major grouping within NRG: NRG Business: Was traditionally known as the Wholesale Power Generation Business, but now also includes business-to-business solutions. These solutions include, demand response, commodity sales, energy management and energy efficiency. Further this branch includes the distributed generation team for NRG. NRG Home: Is the consumer facing retail power operations, including solar. The branch serves 2.8 million recurring customers and is the largest retail energy provider in Texas and one of the largest in the United States. NRG Renew: The branch of NRG which develops mirco grid solutions as well as renewable products and services for large clients. In 2014, NRG Renew became one of the largest domestic wind-operators after an acquisition from EME . NRG Yield: A publicly traded dividend growth-oriented company formed to serve as the primary vehicle through which NRG owns operates and acquires contracted renewable and conventional generation. NRG Carbon 360: Consists of the Company’s carbon capture business. The branch plans to develop carbon capture technologies for NRG with an aim to prolong the life of NRG’s coal fleet and convert the carbon emissions to a marketable asset. (click to enlarge) * from 10-k Trends: The NRG has stated that the U.S. energy industry is going to be increasingly impacted by a long-term societal trend towards sustainability. Further the company stated that the information technology revolution, which has enabled greater personal choice, will increase churn in the U.S. retail energy sector. The sector specific trends above need to be considered in context with two current trends in the Natural Gas Market and Credit Markets which directly impact NRG’s business results. The Natural Gas Market has been in a downward price trend since its peak in 2007. While it might seem counter intuitive, downward Natural Gas prices actually reduce margins for NRG’s power generation portfolio, this relationship is explained further in the Risk Management section below. If Natural Gas reverse trend and begin rising, NRG will see an expansion of margins from their generation fleet. (click to enlarge) * Henry Hub Natural Gas Prices, Monthly from WSJ The Credit Markets have been in a decreasing interest rate environment since 2007. Like many Utilities, NRG is heavily leveraged, which means the company has significant exposure to interest rate risk, these risks are explained further in the Risk Management section below. If the Credit Markets reverse their trend and NRG cannot hedge adequately, the Company will be forced to devote much of their operating capital to debt repayments. (click to enlarge) *from the US Treasury Database Growth Plan: from the 10-k Enhance Generation: Continue to invest in upgrading the Company’s coal-fueled generation fleet. Expand Retail : NRG has increased its exposure to the Texas retail energy market in order to gain access to the competitive pricing structure of the ERCOT market. Further the company is diversifying its retail brand names to capture more segments of the market. Go Green: The company recently acquired the largest wind farm in north America. See it here . Smart Capital Allocation: NRG has hedged a portion of its coal and nuclear capacity with decreasing hedge levels through 2019. As a result of the GenOn aquisition , the majority of the Company’s generation is in forward capacity markets that extend three years into the future. As of December 31, 2014 the Company had purchased fuel forward under fixed price contracts, for approximately 50% of its expected coal requirement from 2015 – 2019. Risk Management: from the 10-k Many of NRG’s Power Generation Facilities Operate Without Long-term Power Sale Agreements: The Company’s “merchant” generation fleet operates without long-term power sales agreement, and therefore are exposed to market fluctuations. Without long-term agreements NRG cannot be sure that these facilities will operate profitability in future energy price environments. Exposure to Fluctuation in The Natural Gas Markets: In many of the markets NRG operates in the price of power is typically set by natural gas-fired power plants which have traditionally had higher variable costs than NRG’s coal-fired plants. Decreases in natural gas prices have resulted in a corresponding decrease in the market price of power which significantly reduces the operating margins of the Company’s baseload generation assets. At extremely low natural gas prices, gas plants become more economical than coal generation, in such environments NRG coal-fired units cycle more often or even shut down. 31% of NRG’s generation fleet is coal-fueled. Disruptions of Fuel Supplies: NRG relies upon coal, oil and natural gas to fuel a majority of its generation facilities. Delivery of these fuels depends upon continuing viability of counterparties as well as upon the infrastructure available to serve each facility. There are many risks which can disrupt the distribution of fuel such as, weather conditions, demand levels, changes in market liquidity, etc. For an example of these risks please read this article on well freeze-offs. Competition in the Wholesale Power Markets: Many of the Company’s facilities are old, newer plants owned by the competition are often more efficient than NRG’s aging plants. In order to compete effectively NRG seeks to use its scale and aggregate fuel supplies, efficiently utilize transportation services and transmission services from other Utilities and third-parties. Power Outages: Old facilities require periodic maintenance, and unexpected outages are extremely costly for NRG. Government Regulation: NRG’s business is subject to extensive U.S. federal, state and local laws and foreign laws. Except for ERCOT (Texas), most of NRG’s generation companies are considered ‘public utilities’, which subjects these generation companies to FERC oversight, ratemaking and environmental oversight. There are many ongoing regulatory issues, here are a few examples that the Company is currently dealing with: Cross-State Air Pollution Rule , MATS , CO2 Emissions , and Byproducts, Wastes, Hazardous Materials and Contamination. Interest Rate Risk: NRG’s substantial debt could have negative consequences including: Increasing NRG’s vulnerability to general economic and industry conditions Requiring large portions of NRG’s cash flow from operations to be dedicated to the payment of interest, reducing the Company’s ability to pay dividends Limits NRG’s ability to enter into long-term power agreements Limits NRG’s ability to obtain additional financing for working capital Limiting NRG’s ability to adjust to changing market conditions and placing it at a competitive disadvantage compared to its competitors who have less debt. Expert Opinion: (click to enlarge) * from Yahoo Finance The experts are currently bearish on the prospects of NRG’s near-term stock price. Most experts are providing a “Neutral” or “Hold” rating to NRG. However with NRG’s current price of $25 per share, there is still an upside of 22% to the median price estimate of $30.50. (click to enlarge) * from Yahoo Finance The experts expect NRG to have a difficult year during 2016. EPS is expected to decay from $0.83 for 2015 to $0.17 during 2016. Further the revenues are expected to stagnate between 2015 to 2016 with estimated revenues of $15.33B and $15.31B respectively. Recent News: The California Public Utilities Commission approved the SDG&E Power Purchase and Tolling Agreement for the NRG Energy, Inc Carlsbad Energy Center. The Center is a 500 MW, five unit natural gas peaking plant in southern California. Reliant launches integrated home security, automation solutions. CEO David Crane wins 2015 C.K. Prahalad Award for Global Business Sustainability Leadership. NRG moves to spot 48 on the Fortune 500 List. The Company acquired Goal Zero , a leading provider of portable solar power and battery packs. Through the acquisition NRG hopes to increase cross selling between mass market system power, residential solar and personal power. Conclusion: In conclusion NRG is going through a difficult business pivot. Low Natural Gas prices have hurt NRG’s margins for the electricity generation fleet. However, the low interest rates in the Credit Markets have given NRG financial flexibility to restructure the Company into position which benefits from the major trends in LNG technology adoption, renewable energy, distributed generation and increased energy connectivity of retail customers. NRG is a massive company, so these changes are going to be slow and relatively painful for the company’s bottom line in the near-term. However, if NRG and David Crane can weather this challenging business environment then the Company will be able to apply its scale to capture increasing margins as the Natural Gas Markets bounce back. I recommend NRG as a near-term Short, but a long-term Buy, because the Company’s margins are tied to the fluctuations in the Natural Gas Markets. The Company will refinance at currently attractive interest rates and the global Natural Gas Markets are slowly moving towards parity with one another as the adaptation of LNG technology allows for easier transportation of Natural Gas. These two factors should allow NRG to boost their cash flows from operations and reward long-term investors. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.