NextEra Energy, Part 2: Leadership Seen In Diversity, Community, And Renewable Energy

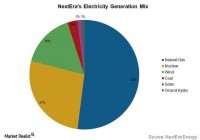

Summary The company ranks very well in diversity hiring, community involvement, and renewable energy. The company does not rate well in women hiring, green productivity, and has limited information in other places. We believe NEE is overall a strong leader in social responsibility. In Part 1 of this article, we saw that NextEra (NYSE: NEE ) is, at this time, not a “buy” for us. We see the upper limit of 2015 pricing in the $105-$110 range, and that the company’s fair value sits in the mid-$80s. Essentially, the company is not a buy for us from a purely financial standpoint. In this part of our research, we will focus on the socially responsible aspects of the company. Our findings are very promising. Yet, failing to see an upside in general, we cannot make an overall positive comment. The company should be respected for its work in socially responsible ways. Socially Responsible Scorecard There are many ways to understand and develop socially responsible investing (SRI). What is “responsible” for each person is vastly different, and what might be “responsible” to one person might be “irresponsible” to others. That is the toughest part of investigating companies for SRI. While pure capitalism to some is the most responsible approach to business, others may see that this could harm other areas such as environmental stewardship or economic development. Others may believe too much capital invested into socially conscientious programs could hurt profits and investors. Therefore, we will try to present as much information as we can to render the best opinion possible. Overall, socially responsible investments are more about leadership and paving the way, rather than compliance. Compliance is doing what is required, while corporate responsibility is about leading and doing more than is required. Companies that lead are always the most respected in the long term, and we believe provide both a safe investment platform as well as peace of mind. The criteria we use to examine the company’s overall social responsibility theme are gender equality, employment and diversity, environmental stewardship, leadership values and community involvement. With all research, some areas have more quantifiable parts, while in other areas, there is not as much. We base our research in taking an aggregate look at leading think tanks, research firms and important websites that cover these topics. We split this research into the aforementioned topics to help create a more holistic opinion. Overview NextEra appears to be a leading firm in the SRI space with strong showing in many key areas. The company was rated as a coveted Ethisphere World’s Most Ethical Companies in the 2014 edition, which shows a dedication to be a leading firm that goes above and beyond compliance. They lead in a number of areas with diversity hires, green energy, and a clear intention for community involvement. The company’s CSR Hub rankings did not show a strong lead, but they were above average. Their “Overall” rating comes in at 60, while Employees and Environment lead the way at 66 and 64, respectively. The company is above average, according to the Hub. The company, though, has won many awards and is a leader in a space that is one of the largest polluters. When we search for companies, we look for the ones that are leaders in various areas of business. NEE appears to be that way. Take a look at the company’s awards here . Some of the most interesting awards we have seen are: — ServiceOne Award for Exceptional Customer Service — Best Employees for Healthy Lifestyles – The Fortunes’s Most Admired Companies Award: In 2014, NextEra Energy was named No. 1 among electric and gas utilities for an unprecedented eighth straight year on Fortune magazine’s listing of “Most Admired Companies.” In that same Fortune survey, the company was named No. 1 electric and gas utility in innovation, No. 1 in social responsibility and No. 1 in quality of products and services. Workforce – Diversity, Compensation, Gender Equality NextEra’s is actually quite strong in their approach to diversity, equality, and compensation, serving as a leader in the way companies should approach their workforce. We believe this is very socially responsible and commendable. The company has been recognized as a top leader in hiring veterans and Hispanics. The company has been recognized by Hispanic Business magazine since 2010 as one of the leaders in diversity hiring. As the award states, “(they) determine the list, the magazine analyzed data on companies’ boards of directors and leadership, recruitment, retention and promotion, marketing and community outreach, and supplier diversity.” As for veterans, ” Vetrepreneur magazine, the voice of the National Veteran-Owned Business Association, gave FPL honorable mention in its compilation of the 2011 Best 10 Corporations for Veteran-Owned Businesses.” The company rates well in other areas of its workforce as well. The Human Rights Campaign rates the company as a 70, which is a rating system for a companies rights to gay, lesbian, and transgender employees. The company has the same rights for same-sex partners as opposite-sex partners and spouses outside of relocation assistance. The company’s 70 rating puts them at the upper end of the rating scale. The company is recognized as well as being one of the companies to have non-discrimination policies for sexual orientation as well. The company didn’t have much information on gender equality for hiring, but the diversity aspect is very positive. As for worker compensation, the company rated a 58 by CSR Hub for worker compensation. The company, though, has positive ratings for safety and health benefits. The company won Best Employers for Healthy Lifestyles for the eighth time for “its ongoing commitment to promoting a healthy work environment and encouraging its workers to live healthier lifestyles. The company was one of just two Florida-based companies and one of only two companies in the energy sector to receive the 2013 Best Employers for Healthy Lifestyles® Award in the prestigious Platinum category.” What we are seeing from the company is a dedication to a workforce and a dedication to policy that promotes safety, diversity, and compensation. We believe this is a leader in this arena, and it complements well their placement as a leading green energy utility. Green Initiative The company has been most recognized for its leadership in green energy. The company is in one of the dirtiest industries, and their reputation is strong. Yet, there are some weaknesses/improvements that need to be made. For as many green awards as the company has won, there are still improvements to be made. Just take a look at this chart to start: (click to enlarge) Despite being labeled the “green” utility, the company is using nearly over 50% in natural gas still, and they also use over a quarter in nuclear, which has some very negative consequences on society if not managed properly as well as waste concerns. In face, the company is really only about 17% actual “green” energy. Further, the company is not the cleanest utility out here. (click to enlarge) The company is definitely one of the cleanest, but it is not as clean as some of the best, and that mix could continue to improve. The company is a “leader,” but we should also understand that this is a company that still uses 50% of their fuel in natural gas. Newsweek’s Green List ranked the company 209th on its Green List, which is one of the most comprehensive looks at companies in the marketplace. This list, though, ranks companies fairly across the board and does not quantify their industry. Naturally, a utility company is going to struggle. The company rated at only 10%, 18%, and 13%, on their energy, carbon, and water productivity out of 100%. The company rated very well, though, on reputation. Out of utilities, the company ranked 15th, which is not exceptional especially given their reputation. Also troubling was the company’s decision not to respond to the Carbon Disclosure Project since 2010. The company did rate an 82 in 2009, which is a decent rating. What is troubling, though, is the CDP is one of the leading, respected firms for rating company plans for carbon versus actual carbon productivity. It is not rating on a single scale but looking at all companies individually. Yet, the company has won numerous awards as you can see here . The company is continuously rated in the Dow Jones Sustainability Index and was rated the best utility for renewable energy by EI New Energy. The company has been rated well for its top electric fleet, and it is rated well for their care and dedication to trees. Overall, the company has solid awards and is rated decently, but we are not as sold as these awards given that some of the leading research gatherers have not gotten necessary information or rated it as well when compared to its competition. What is definitely positive is the company’s leadership that they are the top renewable energy producer. It is an industry that is still mostly based in coal, oil, and natural gas, so the company is better in that regard. Yet, the company’s efficiency ratings aren’t as strong, which is something to consider. Additionally, the nuclear energy angle is considered part of renewable energy, but we are not high on this form of energy due to the direct social risk from it that may be even higher than non-renewable sources. Overall, we would like to see a continued reduction in natural gas and increases in wind and solar power. The company is very low on coal, which is great, and they do help bring other utilities into the mix into these renewable sources. There is still much work to be done. Community Involvement NextEra appears to have a pretty comprehensive strong approach to community. Not only do they rate quite well on their diversity hiring, but they are also leading the renewable utility energy game, which is also positive for the community. Yet, the company also has a very comprehensive direct community plan to volunteer, donate, and be involved in their communities. The company’s 22,000 hours of volunteer time in 2011 in their community and a whole week called Power to Care show some definite leading energy being put back into the community. You can read more about the company’s difference making here . The company has a very progressive hiring plan also for military volunteers that falls into the company’s Diversity Inclusion division that we believe is really respectable. In November, the company was awarded an “Above and Beyond” award in Florida for their strong military hiring program. As a retail company as well, the company has won numerous awards for their customer satisfaction and service. The information we collected here was more limited, but the company definitely appears on the right track. The unseen benefits are what excite us most with their efforts in renewable energy and diversity leadership. Conclusion As you can see, NextEra is a leader in quite a number of areas of social responsibility, but we do have concerns in some areas. We would note they are one of the top companies that are public today, though. Right now, they rate high for us in social responsibility, but we are not as high on their price analysis. We would love to add them on any slight dip in valuation to a socially responsibly crafted investment plan. Disclosure: The author has no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.