So Exactly What Is Insider Trading? When Is It Unlawful? Lawful Or Unlawful, What Does It Cost You As An Investor?

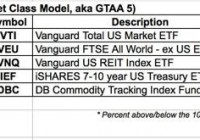

A recent federal appeals court decision has consequences for investors in publicly-traded securities. The decision raises the bar for the successful prosecution of insider traders who are “remote tippees.” The decision is likely to imposes additional, mostly unquantifiable costs on many investors. Costs associated with investing in publicly-traded securities aren’t always apparent. Examples of non-apparent investment costs include (1) the expenses of your trades being “front-run” via flash orders, (2) collusive bid-ask spreads, (3) excessive executive compensation, and of course (4) seemingly small intermediary fees that in fact are unreasonably large. These costs add up. And they reduce investment returns, sometimes significantly. Another investment cost is the amount by which through an imbalance in available investment-related information between parties to a securities trade an investor pays more than he or she should to buy securities. Or receives less than he or she should to sell securities. The key word in the foregoing sentence is “should.” “Should” in this context encompasses a notion of fairness. What information should an investor expect to be available relative to the information available to the person or institution on the other side of the trade? What is fair? Recently, the influential United States Court of Appeals for the Second Circuit, in the case of United States v. Newman and Chiasson , overturned insider trading convictions of two Wall Streeters who received tips of material non-public information – third- and fourth-hand – about stocks. The Wall Streeters then traded on that information and profited. Substantially. The Second Circuit overturned the convictions because the government did not demonstrate two elements that the Second Circuit stated must exist to convict a person for unlawful insider trading: one, that the original source of the material non-public information received a personal benefit in exchange for providing illicit tips and, two, that the individuals who traded profitably knew of that personal benefit. The Second Circuit cited the United States Supreme Court case of Dirks v. SEC , 463 U.S. 646 (1983) as precedent for the required demonstration of these two elements. Despite the Second Circuit’s view that its decision only follows existing law, an upshot of the decision is that trading in American public securities markets on the basis of material non-public information will increase. There are too many gray areas in securities trading fact patterns for an increase to not result. So, if you and I as investors trade without access to that information, then with correspondingly increasing probability the person or institution on the other side of our trade will be “informationally-advantaged.” That advantage is another investment cost to you and me. How should an investor in publicly-traded securities respond to United States v. Newman and Chiasson ? As a practical matter not much can be done. (All increases in non-apparent investment costs, quantifiable or unquantifiable, further erode confidence in our public securities markets. Eroded confidence decreases the liquidity and vitality of those markets. That’s a subject for another day however.) From an optimist’s perspective here’s a suggestion, which isn’t new and just reinforces existing good investment practices: minimize the informational disadvantage – and resulting costs – by trading as infrequently as practical. Trade only to rebalance or put excess cash to work for the long term. When trading in funds such as ETFs, trade very infrequently – again, only to rebalance or put new cash to work – and try to identify funds with low internal turnover. Now that you’ve read this, are you Bullish or Bearish on ? Bullish Bearish Sentiment on ( ) Thanks for sharing your thoughts. Why are you ? Submit & View Results Skip to results » Share this article with a colleague