Best And Worst Q4’15: All Cap Blend ETFs, Mutual Funds And Key Holdings

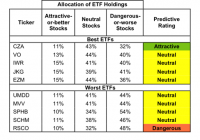

Summary The All Cap Blend style ranks third in Q4’15. Based on an aggregation of ratings of 60 ETFs and 585 mutual funds. QDEF is our top-rated All Cap Blend style ETF and RMUIX is our top-rated All Cap Blend style mutual fund. The All Cap Blend style ranks third out of the twelve fund styles as detailed in our Q4’15 Style Ratings for ETFs and Mutual Funds report. Last quarter , the All Cap Blend style ranked third as well. It gets our Neutral rating, which is based on an aggregation of ratings of 60 ETFs and 585 mutual funds in the All Cap Blend style. See a recap of our Q3’15 Style Ratings here. Figures 1 and 2 show the five best and worst-rated ETFs and mutual funds in the style. Not all All Cap Blend style ETFs and mutual funds are created the same. The number of holdings varies widely (from 8 to 3796). This variation creates drastically different investment implications and, therefore, ratings. Investors seeking exposure to the All Cap Blend style should buy one of the Attractive-or-better rated ETFs or mutual funds from Figures 1 and 2. Figure 1: ETFs with the Best & Worst Ratings – Top 5 (click to enlarge) * Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity. Sources: New Constructs, LLC and company filings Seven ETFs are excluded from Figure 1 because their total net assets (TNA) are below $100 million and do not meet our liquidity minimums. Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5 (click to enlarge) * Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity. Sources: New Constructs, LLC and company filings The Jensen Quality Value Fund ( JNVIX and JNVSX ) is excluded from Figure 2 because its total net assets are below $100 million and do not meet our liquidity minimums. The FlexShares Quality Dividend Defensive Index ETF (NYSEARCA: QDEF ) is the top-rated All Cap Blend ETF and the Royce Special Equity Multi-Cap Fund (MUTF: RMUIX ) is the top-rated All Cap Blend mutual fund. Both earn a Very Attractive rating. The State Street SPDR SSgA Risk Aware ETF (NYSEARCA: RORO ) is the worst-rated All Cap Blend ETF and the Chou Opportunity Fund (MUTF: CHOEX ) is the worst-rated All Cap Blend mutual fund. RORO earns our Dangerous rating and CHOEX earns our Very Dangerous rating. Cisco Systems (NASDAQ: CSCO ) is one of our favorite stocks held by RMUIX and earns our Very Attractive rating. Since 2005, Cisco has grown after-tax profits ( NOPAT ) by 7% compounded annually. Over this same timeframe, Cisco has consistently earned a return on invested capital ( ROIC ) above 14% and currently earns a top quintile ROIC of 16%. Despite the strong fundamentals, CSCO shares are up only 1% year-to-date. At its current price of $28/share, Cisco has a price-to-economic book value ratio ( PEBV ) of 0.8. This ratio implies that the market expects Cisco’s NOPAT to permanently decline by 20%. This expectation seems unlikely considering the steady profit growth throughout the company’s history. If Cisco can grow NOPAT by 5% compounded annually for the next five years , the stock is worth $38/share today – a 36% upside. Sears Holding Corps (NASDAQ: SHLD ) is one of our least favorite stocks held by CHOEX and earns our Dangerous rating. Since 2011, Sear’s NOPAT has fallen from $668 million to -$1.1 billion in 2015. The company’s ROIC followed suit as it fell from 3% to a bottom quintile -7% over the same timeframe. While many investors may be aware of the problems that caused SHLD to fall over 50% in the past two years, they may not realize just how high the expectations baked into the current stock price remain. To justify its current price of $24/share, Sears must immediately achieve 3% pre-tax margins (a level last seen in 2008) and grow revenue by 4% compounded annually for the next 11 years . This expectation seems awfully optimistic given that Sears hasn’t grown revenue at all since 2007. Figures 3 and 4 show the rating landscape of all All Cap Blend ETFs and mutual funds. Figure 3: Separating the Best ETFs From the Worst ETFs (click to enlarge) Sources: New Constructs, LLC and company filings Figure 4: Separating the Best Mutual Funds From the Worst Funds (click to enlarge) Sources: New Constructs, LLC and company filings D isclosure: David Trainer and Thaxston McKee receive no compensation to write about any specific stock, style, or theme.