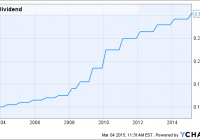

None of the three firms has outperformed the Morningstar index of diversified utilities over the previous 5-yr and 10-yr timeframes. Exelon is most undervalued based on an anticipated 12% EPS growth rate, but fairly valued based on historic P/E ratios. Even with depressed earnings due to weak power markets, Exelon has generated 3-yr average returns on invested capital above their cost of capital while the other two firms have not. Avista has the best regulatory environment assessment profile and is the greatest “pure-play” regulated utility of the three. Recently, a newsletter subscriber and avid SA reader requested I review and update a few utilities, and I am obliging him by evaluating small-cap Otter Tail Corp. (NASDAQ: OTTR ), small-cap Avista Corp. (NYSE: AVA ) and large-cap Exelon Corp. (NYSE: EXC ). These are very different utilities, each with its own attributes and performance. However, they all have one common attribute – each is classified as a diversified utility. As the Morningstar performance graph shows below, 5-yr performance is vastly different, from a 13% annual total return to a -2.2% annual total return. Total Return Performance OTTR 5-Yr Total Return Performance AVA 5-Yr Total Return Performance EXC 5-Yr Total Return Performance As shown, AVA would have been the best pick of the three in 2009 and EXC the worst. However, none of them has outperformed the Morningstar index of diversified utilities over the previous 5-yr and 10-yr time frames. Business Description What do these companies do? From their boilerplate descriptions on their website: OTTR Otter Tail Corporation is engaged in electric and non-electric operations primarily in the United States, Canada, and Mexico. It operates in four segments: Electric, Manufacturing, Plastics, and Construction. The Electric segment produces, transmits, distributes, and sells electric energy in Minnesota, North Dakota, and South Dakota, as well as operates as a wholesale participant in the Midcontinent Independent System Operator, Inc. markets. This segment serves approximately 130,000 customers. AVA Avista Corp. is an energy company involved in the production, transmission and distribution of energy as well as other energy-related businesses. Avista Utilities is our operating division that provides electric service to 368,000 customers and natural gas to 325,000 customers. Its service territory covers 30,000 square miles in eastern Washington, northern Idaho and parts of southern and eastern Oregon, with a population of 1.5 million. Alaska Energy and Resources Company is an Avista subsidiary that provides retail electric service in the city and borough of Juneau, Alaska, through its subsidiary Alaska Electric Light and Power Company. EXC Exelon Corporation is the nation’s leading competitive energy provider, with 2013 revenues of approximately $24.9 billion. Headquartered in Chicago, Exelon does business in 48 states, the District of Columbia and Canada. Exelon is one of the largest competitive U.S. power generators, with more than 35,000 megawatts of owned capacity comprising one of the nation’s cleanest and lowest-cost power generation fleets. The company’s Constellation business unit provides energy products and services to more than 2.5 million residential, public sector and business customers, including more than two-thirds of the Fortune 100. Exelon’s utilities deliver electricity and natural gas to more than 7.8 million customers in central Maryland (BGE), northern Illinois (ComEd) and southeastern Pennsylvania ( OTC:PECO ). Fundamental Ratios Below is a table outlining a few current fundamental ratios: Source: Morningstar, MyInvestmentNavigator.com While EXC has the lowest historical returns, it also has the lowest forward PEG ratio, or the 2015 PE ratio divided by 5-yr anticipated growth rate, and is valued at about 1/3 of its peers. This is due to the doubling of its anticipated EPS growth rate compared to peers. EXC also trades at half the price to cash flow ratio of OTTR. Reviewing two important 15-yr FASTgraph charts for each firm would provide the following comparison: OTTR: Earnings, Dividends and Price OTTR: Return on Invested Capital (click to enlarge) AVA: Earnings, Dividends and Price AVA: Return on Invested Capital (click to enlarge) EXC: Earnings, Dividends and Price EXC: Return on Invested Capital (click to enlarge) Based on historic PE ratios, OTTR could be considered slightly undervalued with AVA and EXC at fair valuations. However, both EXC and OTTR have not yet recouped their stock price highs reached prior to the recession of 2008. Both OTTR and AVA have generated Return on Invested Capital in line with the industry average of 5% while EXC has historically outdone its peers by a wide margin for generating returns on its total capital structure. Even during its current depressed power-pricing environment, EXC has generated at a minimum peer-like returns on invested capital. Return on Invested Capital, Weighted Average Cost of Capital, Net ROIC Using the work of ThatsWACC.com as a source for easily finding a company’s weighted average cost of capital WACC, below is a table outlining the average ROIC, WACC , and Net ROIC (ROIC minus WACC) for each company: Source:ThatsWACC.com, MyInvestmentNavigator.com It becomes obvious EXC has generated 3-yr average returns on invested capital above their cost of capital while the other firms have not. Distributed Generation Policy A utility’s approach to distributed generation is becoming a consideration for investors. As residential and commercial customers continue installing intermittent generation by solar power, the impact on each utility will be magnified over time. Not only will the individual company’s policy affect future earnings, but also the state-approved financial aspects of distributed generation will influence investment decisions. Otter Tail Distributed Generation: OTTR is now subject to the first state-mandated and PUC-approved “Value of Solar Tariff” or VOST. This concept replaced the often used “net metering” approach to pricing power used by and sold by independent retail solar power generation, also known as distributed generation. The program in Minnesota is described in an article on utilitydrive.com : “VOST preserves much of the simplicity of net metering,” he explained, but “instead of netting the kilowatt-hours consumed and produced, the customer nets the dollars paid for energy [at the retail electricity rate] with the dollars earned selling solar energy to the utility [at the value of solar rate].” The other major difference is that VOST is “locked in by a solar energy producer on a 25-year contract,” Farrell wrote. Both NEM and VOST could go up or down over time, “but Minnesota’s law gives solar energy producers surety by guaranteeing their per-kilowatt-hour payment for the expected life of the solar panels.” Avista Distributed Generation: According to a publication from Western Energy Board: “The Company views DG as not a threat but as another choice available to the utility. In the future there will be a vibrant market for personalized power that uses DG technology.” Exelon Distributed Generation: EXC has been vocal on its position concerning distributed generation. CEO Crane offered the following quotes from an article last May in Forbes: “It has been a year of dire warnings for utilities as rooftop solar has begun to compete with the traditional electricity system, but it’s too early to start digging the grave for utilities, the CEO of Exelon Corp. said this afternoon at an appearance in Washington D.C. ‘At this point in all of the evaluations that we continue to do, we cannot see an economic focused technology that will replace the scale and the economy of central-station power,’ Chris Crane said… Crane called for developing a system ‘that enables distributed generation and supports it,’ but that also compensates utilities, and their shareholders, for their investment in the grid… ‘In our markets we don’t have the utility developing the distributed generation source. That is opened up to competition. We create the grid situation where they can sell that power back out onto the system. This is an Exelon opinion that’s morphing,’ he added. ‘I think right now that’s the opinion. I’m looking around at some Exelon eyes in the room to see if they’re saying, ‘You’re crazy,’ because that debate is not done yet.'” Distributed generation is important enough for EXC to occupy an entire page from their most recent investors presentation at the 2014 Edison Electricity Institute Financial Conference (pg. 12, link below): Distributed Energy is a Fast Growing Business: •On-site generation, including solar, quadrupled since 2006 (Wall Street Journal 2013) •US C&I customers are spending ~$5-6 billion per year on self-generation and energy efficiency programs (Bloomberg 2013) •Revenues from Distributed Generation are expected to reach $12.7 billion by 2018 (Pike Research, Navigant, 2012) Regulatory Environment S&P Credit offers an opinion of the regulatory environment by state for public utilities. In 2013, their categories underwent a dramatic shift and now utilities are classified into just three categories, down from the previous four. The best is now considered “Strong”, with a neutral rating as “Strong/Adequate” and the worst as “Adequate”. Prior to 2013, states were rated as “More Credit Supportive”, “Credit Supportive”, “Less Credit Supportive”, and “Least Credit Supportive”. Prior to 2013, 34% of states were less than credit supportive while the rework in 2013 dropped the number to just 6%. Being somewhat skeptical that there was a huge shift of favorable sentiment towards utilities by individual state utility commissions, the pre-2013 assessments could be considered as more accurate. Below are the respective state rankings prior to 2013. Source: Standard and Poors, MyInvestmentNavigator.com Regulated vs. Non-Regulated Businesses Going forward, Otter Tail offers interesting non-utility growth potential. While trailing 12-month revenues were 57% from non-utility businesses ($546 million out of $950 million), TTM operating profits still favor the regulated business. 67% of the $109 million in TTM net operating profits were generated from utility assets. This equates to net operating profit margins of 18.0% for utility vs. 10.4% for non-utility operations. Below is a breakdown of earnings per share estimates by OTTR operating segment, as offered in their latest investor presentation (link below). (click to enlarge) Avista offers diversity in regulated western states. As a small-cap utility with little revenues from non-regulated businesses, AVA offers the most “pure-play utility” of the three. In addition, AVA may be an intriguing acquisition candidate based on its geographic territory and its high exposure to renewable power generation using wind and hydroelectric assets. Exelon is the most unloved utility, not only of the three above but also within the entire sector as a whole. Its checkered past has led to many utility investors disillusioned and jilted concerning the firm’s future. While regulated utility operations comprise the vast majority of revenues and earnings for OTTR and AVA, Exelon’s regulated earnings will be about 55% of the total, even after the mostly regulated Pepco Holdings (NYSE: POM ) merger is complete. Summary More information in previous SA articles can be found in an AVA article from Aug. and an EXC article from Oct. The following are links for the most recent Investor presentations: Otter Tail , Avista , and Exelon . Based on a turn in Northeast, Mid-Atlantic and Midwest wholesale power markets, driven by new PJM pricing models for reliability and a rising natural gas price, EXC should offer the best potential for rising stock prices. However, it also carries the most risk if anticipated electricity pricing does not improve. My money is on EXC for the longer term. Author’s Note: Please review important disclaimer in author’s profile.