Unitil’s (UTL) CEO Bob Schoenberger on Q3 2015 Results – Earnings Call Transcript

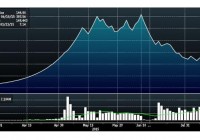

Unitil Corp. (NYSE: UTL ) Q3 2015 Results Earnings Conference Call October 22, 2015 2:00 PM ET Executives David Chong – Finance Director Bob Schoenberger – Chairman, President and CEO Mark Collin – Senior Vice President, Chief Financial Officer and Treasurer Tom Meissner – Senior Vice President and COO Larry Brock – Chief Accounting Officer and Controller Analysts Operator Good day, everyone. And welcome to the Third Quarter 2015 Unitil Earnings Conference Call. At this time, all participants are in listen-only mode. [Operator Instructions] As a reminder, this call is being recorded for replay purposes. I would now like to turn the call over to Finance Director, David Chong. David Chong Good afternoon. And thank you for joining us to discuss Unitil Corporation’s third quarter 2015 financial results. With me today are Bob Schoenberger, Chairman, President, and Chief Executive Officer; Mark Collin, Senior Vice President, Chief Financial Officer, and Treasurer; Tom Meissner, Senior Vice President and Chief Operating Officer; and Larry Brock, Chief Accounting Officer and Controller. We will discuss financial and other information about our third quarter on this call. As we mentioned in the press release announcing the call, we have posted that information, including a presentation to the Investor section of our website at www.unitil.com. We will refer to that information during this call. Before we start, please note that comments made on this conference call may contain statements that are commonly referred to as forward-looking statements, which are made pursuant to the Safe Harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements regarding the company’s financial condition, results of operations, capital expenditures and other expenses, regulatory environment and strategy, market opportunities, and other plans and objectives. In some cases, forward-looking statements can be identified by terminologies such as may, will, should, estimate, expect or believe the negative of such terms or other comparable terminology. These forward-looking statements are neither promises nor guarantees, but involve risks and uncertainties, and the company’s actual results could differ materially. Those risks and uncertainties include those listed to — listed or referred to on slide one of the presentation and those detailed in the company’s filings with the Securities and Exchange Commission, including the company’s Form 10-K for the year ended December 31, 2014. Forward-looking statements speak only as of the date they are made. The company undertakes no obligation to update any forward-looking statements. With that said, I will now turn the call over to Bob. Bob Schoenberger Thanks, Dave. Thank you for everyone for joining us today. I will begin by discussing the highlights of our past quarter. If you turn to slide four of our presentation, today we announced net income of $1.7 million or $0.12 per share for the third quarter of 2015, an increase of $0.1 million or $0.01 per share, compared for the third quarter of 2014. For the first nine months of this year, we reported net income of $17 million or a $1.22 per share, an increase of $1.7 million or 11% and $0.12 per share, compared to prior year. We continue to produce sustained and predictable growth in earnings per share and net income. We are strengthening our distribution infrastructure and expanding our natural gas utility business, which combined with our ongoing regulatory agenda is driving consistent growth for the company. Turning to slide five, the graph shows that our financial results have increased sharply over the past few years with net income growing at an annual rate of 15% since 2012. Our financial results have been driven by the strong demand for natural gas in the areas we serve, our growing investment in our gas and electric utility distribution systems and the successful execution of our regulatory strategy. On slide six, as we have discussed in the past, we currently have a customer penetration rate of only 60% on our existing distribution system as a result of historical and economic factors, somewhat unique to northern New England. The relatively low customer penetration on our existing system provides us with low-cost opportunities to add customers along or near our distribution base. This customer growth has contributed significantly to our operating results. In the third quarter, we experienced over 6% unit sales growth in Northern. To further enhance our expansion opportunities, we recently filed a regulatory mechanism in Maine requesting approval to replace upfront customer contributions often required to expand into new areas, with a rate surcharge mechanism where we can economically extend our gas mains to serve new areas. We expect that offering customers and neither is the ability to pay a rate surcharge rather than an upfront payment will help facilitate customer conversions and will help us reach new areas of geographic expansion beyond their existing distribution system. We hope to receive approval of the surcharge mechanism in the fourth quarter of this year. On slide seven, our utility rate base continues to grow as we add in customers and improve both the gas and electric distribution systems. On the gas side of our business over the next several years, we will continue to see considerable investment related to customer addition as customers continue to seek the long-term benefits of natural gas. In addition, we have considerable investment in cast-iron pipe replacement across all three of our operating states as we modernize and upgrade our distribution system. This pipe replacement activity is expected to continue for the next several years, providing for uninterrupted long-term investment opportunities. On the electric side of our business, we have similar investment plans. Currently, we are building two substation projects, which will enhance reliability and provide capacity to meet forecasted low growth in New Hampshire. In Massachusetts, we recently filed a Grid Modernization plan with our regulators. This initiative provides for a 10-year plan, outlining enhancements to our electric system to improve reliability, reduce the effects of outages and optimize demand and expand customer services. Over the past three years, our gas rate base has grown at an annual rate of 10%, and our electric rate base has grown 4%. Our investment opportunities are significant and we believe we can continue to grow our rate base at these rates well into the future. Finally, slide eight highlights our return on equity, which has steadily increased over the past three years. To support our rate base growth and to ensure sufficient revenue to meet our obligations and earn a reasonable rate of return, our regulatory strategy is complementary to our investment strategies. Earlier this year, we filed for a $6.8 million in rate relief for the electric and gas divisions of our Massachusetts utility. We expect these rate cases to help bridge the gap between actual and allowed ROEs. Also this year, we completed a settlement agreement for our interstate transmission pipeline, which provides a long-term rate plan with a capital tracker mechanism. In fact, much of our investment is covered on the long-term capital tracker mechanisms such as our cast iron replacement programs in Maine and Massachusetts. Looking forward, we will continue to evaluate the need for rate relief. Overall, we believe the combination of rate case activity, including capital tracker mechanisms along with the customer growth will help us to keep pace with the rate base growth and achieve our elaborative return on these investments. Now, I will turn the call over to Mark who will discuss the financial results for the quarter and our current case proceedings. Mark? Mark Collin Thanks, Bob and good afternoon, everyone. Let’s start on slide nine and take a look at our natural gas utility sales margin. Natural sales utility sales margins were $16.2 million and $73.1 million for the third quarter and the nine months periods, reflecting increases of $1 million and $5.1 million, or up 8% for the year so far compared to prior year. The increases in the third quarter and the nine months period reflect higher natural gas distribution rates and higher unit sales volumes. For the nine months ended September 30, 2015, gas therm sales increase 4% compared to the same period in 2014 and excluding decoupled gas sales, were up 6% in the quarter. The increase in gas therm sales year-do-date in the company’s utility service territories was driven by the colder winter weather in the first quarter 2015 compared to 2014, coupled with strong growth in a number of customers. There were 3% more Heating Degree Days in first nine months of 2015, compared to the same period in 2014, which we estimate positively impacted earnings per share by about $0.02. Compared to normal, there were 13% more heating degree days in the nine months of 2015, which we estimate positively impacted earnings per share by about $0.09. Excluding the effect of weather on sales, estimated weather normalized gas therm sales were up 3% for the nine months of this year, compared to last year. Now turning to slide 10, we highlight our electric utility sales margin. Electric sales margins were $22.2 million and $63.9 million for the third quarter and the nine month periods, reflecting a decrease of $0.4 million for the quarter and an increase of $3.2 million for the year, or up 5% for the year so far compared to prior year. For the third quarter the decrease in electric sales margin reflects lower electric billing demand units to Commercial & Industrial customers. For the nine month period, the increase in electric sales margin primarily reflects higher electric distribution rates and total electric unit sales. Electric kilowatt hour sales increased 1.1% and 0.5% in the three and nine month periods ended September 30, 2015 compared with the same periods in 2014. Now turning to slide 11. In addition to the increases in electric and sales margins shown here and those that I just discussed, Usource, the company’s non-regulated energy brokering business recorded revenues of $1.6 million and $4.7 million for the third quarter and the nine month periods, representing increases of $0.1 million and $0.2 million respectively compared to the same periods in 2014. Continuing on, operation and maintenance expenses decreased $0.1 million and increased $0.7 million for the third quarter and nine month periods compared to prior year. The decrease in the three month period reflects lower utility operating costs of $0.9 million and lower professional fees of $0.04 million, partially offset by higher compensation and benefit costs of $1.2 million. The increase in O&M expenses in the nine month period reflects higher compensation and benefit costs of $2.4 million, partially offset by lower professional fees of $1.1 million and lower all other utility O&M costs, net of $0.6 million. Depreciation and amortization increased $0.6 million and $2.9 million for the third quarter and nine month periods compared to prior year. These increases reflect higher depreciation on normal utility plant assets in service, higher amortization on major storm restoration costs and an increase in all other amortization. Taxes other than income taxes increased $0.3 million and $0.2 million for the third quarter in the nine-month periods compared to prior year, primarily reflecting higher local property tax expense. Net interest expense increased $0.5 million and $1.8 million for the third quarter than nine-month period compared to prior year, reflecting higher levels of long-term debt and lower interest income on regulatory assets. Now turning to slide 12, we highlight our capital structure and recently amended credit facility. In December 2014, we are rated BBB+ by Standard & Poor’s. We’re able to take advantage of this rating and we renewed our corporate credit facility during July of 2015. We extended the term of our credit facility by two years to a new termination date of October 2020, which provides us with over five years of committed short-term financing. We also benefited from lower pricing and our interest margin dropped by 12.5 basis points to LIBOR plus 1.25. End of September 30, we had $4.1 million of borrowings on our credit facility, providing for a strong capital structure and significant liquidity for the foreseeable future to continue to execute on our growth strategies. Turning to slide 13, we provided an update on our financial results at the utility operating company level. The chart shows the trailing 12 months actual earn return on equity in each of our regulatory jurisdictions. Unitil on a consolidated basis earn the total return on equity of 9.7% in the last 12 months ended September 30, 2015. Also, as we discussed in the past, and as shown on the table on the right, we have a long-term capital cost trackers in place to recover significant portion of current and future capital spending, which we expect will help to maintain a level of earnings across our subsidiaries for the foreseeable future. Turning to slide 14, we highlights our recent electric and gas rate case filings in Massachusetts for our Fitchburg subsidiary. Both filings reflect 2014 test year, a capital structure with a 53% equity ratio and a 10.25% requested ROE. The electric division filing reflects a rate base of $57.3 million, a revenue deficiency of $3.8 million and includes a multiyear rate plan for recovery of future capital additions. Gas division filing reflects the rate base of $57.5 million and our revenue deficiency of $3 million. By statute, the Massachusetts Department of Public Utilities supported 10 months to act on request for a rate increase. The decision in these two proceedings is expected by the end of April 2016. Now this concludes our summary of our financial performance for the period. I will turn the call over to the operator. Thank you. Copyright policy: All transcripts on this site are the copyright of Seeking Alpha. However, we view them as an important resource for bloggers and journalists, and are excited to contribute to the democratization of financial information on the Internet. (Until now investors have had to pay thousands of dollars in subscription fees for transcripts.) So our reproduction policy is as follows: You may quote up to 400 words of any transcript on the condition that you attribute the transcript to Seeking Alpha and either link to the original transcript or to www.SeekingAlpha.com. All other use is prohibited. THE INFORMATION CONTAINED HERE IS A TEXTUAL REPRESENTATION OF THE APPLICABLE COMPANY’S CONFERENCE CALL, CONFERENCE PRESENTATION OR OTHER AUDIO PRESENTATION, AND WHILE EFFORTS ARE MADE TO PROVIDE AN ACCURATE TRANSCRIPTION, THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING OF THE SUBSTANCE OF THE AUDIO PRESENTATIONS. IN NO WAY DOES SEEKING ALPHA ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON THIS WEB SITE OR IN ANY TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE APPLICABLE COMPANY’S AUDIO PRESENTATION ITSELF AND THE APPLICABLE COMPANY’S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS. If you have any additional questions about our online transcripts, please contact us at: transcripts@seekingalpha.com . Thank you!