Tag Archives: argentina

Transener’s 2021 Yankee Bonds Yielding 12% Will Spark Your Portfolio

Summary High 9.75% coupon offers excellent cash flow. The company has had two years of improving net income. A virtual monopoly business, as it owns, operates, and maintains 90% of the high-voltage transmission system in Argentina. This week, we look to South America, where an Argentine utility monopoly continues to improve its profitability and ratios. This is our third look at Transener, which we first profiled in August 2014 , then again in June 2015 . After two solid, profitable years in 2013 and 2014, Transener has continued to improve its position with consolidated net income for first six months of 2015 of AR$ 117.5 Million (or $12.3 Million in USD) compared to a consolidated net loss of AR$ 4.0 Million ($0.4 Million in USD) for the same period in 2014. Interest coverage has also improved since our last review, going from 1.7x to its current level of 2.3x. At their current yield of 12.5%, these relatively short-term bonds exceed the current 5-year U.S. Treasury yield of 1.40% by nearly nine times. With Argentine elections leaning away from socialism, expectations are that the next ruling party will at last review and adjust the outdated tariff rates that have prevailed for over a decade. Investment interest in Argentina is growing, and these outstanding 12.5% yielding bonds present a perfect opportunity for investors to participate in Argentina’s recovery. Therefore we have marked these high cash flow, six year bonds for addition to our FX1 and FX2 portfolios. Essential Services for Argentina For any modern country and economy, electricity is absolutely essential for its citizens. Transener transports 90% of the electricity in Argentina. In spite of the tariff freezes imposed since the 2001/2002 economic crisis, Transener has continued providing this essential service, as it is virtually a monopoly. In addition, there is very little possibility for any competitor to enter this space, as the costs would be prohibitive (in excess of USD $1 M per mile according to a study by Black and Veatch). For the investor, a company with a virtual monopoly, providing an absolutely essential service in an industry with extremely high barriers to entry is a welcomed addition to any investment portfolio. About the Issuer Founded in 1993, Transener owns, operates and maintains 90% of the high voltage transmission system in Argentina. Prior to 1992, almost all of the Argentine electricity industry was owned and managed by the government. In the early 1990’s, a privatization program was initiated with the ultimate objective to protect consumer rights, encourage investment and improve the quality of service. Currently, Transener has over 11,000 miles of transmission lines within Argentina. Pampa Energia (NYSE: PAM ), the largest integrated energy company in Argentina, has a co-controlling stake in Transener, and has traded on the NYSE in form of ADRs since October 2009 (ticker PAM). Transener’s revenue streams are largely determined by the government via the Secretariat of Energy, who approves wholesale electricity prices. Transener receives monthly revenue for transmission, capacity charges and connection charges from CAMMESA, a national organization responsible for managing operations in the wholesale electricity market. Tariffs (what they can charge for electricity) have been kept artificially low since the 2001 / 2002 Argentine economic crisis, when Transener’s original concession agreement was renegotiated and tariffs of electricity distributors and transmission companies were frozen. As a result, the monies collected from electric customers and consumers did not cover Transener’s cost of operations. This rolling deficit has been continually covered by federal subsidies paid to CAMMESA. After years of petitioning the government to adjust payments from CAMMESA to reflect actual production costs, Transener received some financial relief in 2013. The Renewal Agreement compensates the company for cost variations (the cost of operations not covered by tariffs and subsidies) retroactive to December 2010 and continues to December 2015. At our last review of Transener in June 2015, we noted the excellent recent performance of Transener stock, which at that time had appreciated a whopping 210% over the previous 52-weeks. It is also worth noting that Transener stock was the top performer for 2014 in the Buenos Aires Merval Index with a gain of 206%. The stock is currently trading around AR$ 5.07, which is still well above its current 52-week low of AR$ 2.80. Argentina’s Elections There has been a great deal of interest from the financial investment world in the upcoming Argentine elections scheduled to take place in late October. (Preliminary results now require a run off vote.) The prevailing opinion is that the new ruling government will take the much needed steps to remedy the policies set in place by current President Cristina Fernandez de Kirchner that have damaged the Argentine economy and made it difficult for the country to gain access to international lending and international investment. This election optimism was evidenced earlier this year, when Transener bonds were up 23% for 2015 on the speculation of a more market friendly government once the elections are held. Financials As stated in our last Transener review earlier this year, the company was able to register profits in 2013 and 2014 thanks in part to the revenues from the Renewal Agreement. The company’s financials for Q1 and Q2 of this year continue to show solid growth as well. For Q1 2015, consolidated net sales increased 12.6% as compared to Q1 2014. Consolidated net profits showed even more impressive growth, with a profit of AR$18.2 Million ($1.9 Million in USD) compared to a net loss of AR$92.8 Million ($9.8 Million in USD) for Q1 2014. Transener’s last reported quarterly results (which include results from Q1 2015) should also encourage investors and bondholders. Consolidated net revenues for six months ended 6/30/15 were 32.1% higher than same period for 2014. (AR$ 823.9 M vs. AR$ 623.7 M) Consolidated net income for first six months of 2015 was AR$ 117.5 Million ($12.3 Million USD) compared to a consolidated net loss of AR$ 4.0 Million ($0.4 Million USD) for the same period in 2014. Operating income increased for six months ended 6/30/15 – registering at AR$136.1 Million ($14.3 Million USD) compared to AR$ 71.9 Million ($7.6 Million USD) for the same period in 2014. Transener’s interest coverage ratio has also improved. At our last review, the company had an interest coverage ratio of 1.7x for 2014. For the six months ended June 30, 2015, Transener had operating income of $14.3 Million USD and finance expenses of $ 6.2 Million USD, for an interest coverage ratio of about 2.3x. Transener also had cash and cash equivalents as of June 30, 2015 of $44.9 Million USD. Risks The default risk is Transener’s ability to perform. It is encouraging that the company has produced two profitable years, and continues to improve even in the wake of tariff rates that are still in need of adjustment to reflect market rates for the cost of electricity. With the election set for the end of this month and the expected tariff reviews that many expect will follow, Transener margins should continue to benefit from any action to move electricity rates closer to actual costs for transmission and distribution. Any investment in a company domiciled outside of the U.S also presents geopolitical risk. Argentina’s socialist government has long subsidized public utilities in the country, attempting to foster economic growth by freezing costs for basic services such as water and electricity. While this strategy did help the country to recover from the 2001/20012 economic crisis, recent growing budget deficits have meant the end of many long-running public utility subsidies giving way to higher utility bills for the consumer. Reliable electric power is of vital importance to Argentina’s growth and economic viability. With a new government poised to take control at the end of this year, there will certainly be positive changes on the horizon for Argentina’s many subsidized utilities. Transener’s business operates primarily in Argentina and as such, its revenues are received in Argentine pesos. This debt is issued in US Dollars so the company is exposed to risks in the fluctuations of the exchange rate between Argentine pesos and US dollars, especially as it relates to payments of interest and principal to bondholders. These 12.5% Transener 2021 bonds appear to have similar risks, features and maturities to other Yankee bond issues such as the 7.75% Hidroelectrica Piedra Del Aguila, the 9.5% Autopistas Sinking Bonds, and the 10% Transportadora de Gas Del Sur (NYSE: TGS ), previously reviewed on our Bond-Yields.com website. Summary and Conclusion Transener’s electrical distribution services are absolutely essential for Argentina. Without an option to replace or rebuild high voltage transmission lines, we think Argentina is highly likely continue to ensure that Transener remains a viable utility. As the country prepares for its next chapter with a new government later this year, Transener is also more likely reap the benefits of a reassessment of tariff rates and subsidy reductions. These relatively short-term 71 month bonds, which are currently yielding an outstanding 12.5% have been marked for addition to both our Fixed-Income1.com and Fixed-Income2.com managed portfolios. Issuer: Compania de Transporte Energia (Transener) Coupon: 9.75% Maturity: 8/2/2021 Ratings: CCC- CUSIP: P3058XAK1 Pays: Semi-annual Price: 88.5 Yield to Maturity: ~12.5% Disclosure: Durig Capital and certain clients may have positions in Transener 2016 bonds. Disclaimer: Please note that all yield and price indications are shown from the time of our research. Our reports are never an offer to buy or sell any security. We are not a broker/dealer, and reports are intended for distribution to our clients. As a result of our institutional association, we frequently obtain better yield/price executions for our clients than is initially indicated in our reports. We welcome inquiries from other advisors that may also be interested in our work and the possibilities of achieving higher yields for retail clients.

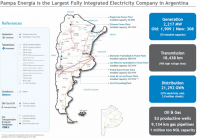

Pampa Energía Is A Good Option For Normalization In Argentina

Summary Pampa Energía works in a highly distorted regulatory framework, where frozen tariffs have led to a critical situation for the utility companies. Even in this scenario Pampa Energía has managed to reach a price earning of 5 years. With a new government about to be elected, great improvements could be in the way. Pampa Energía S.A. (NYSE: PAM ) is the largest integrated electricity company in Argentina and through its subsidiaries participates in the generation, transmission and distribution of electricity, as well as natural gas transportation and production. (click to enlarge) Source: Pampa Energía. Pampa Energía owns indirectly: 84% of the generation assets. 26% of the transmission business (TRAN.BA). 52% of the distribution business with Edenor (EDN). 26% of the natural gas transportation business with Transportadora de Gas del Sur (NYSE: TGS )(pending government approval). 50% of the Oil and Gas exploration and production business with Petrolera Pampa (PETR.BA), associated with Yacimientos Petrolíferos Fiscales (YPF). As of August 17th, 2015 the market cap of the above mentioned: (click to enlarge) Source: Yahoo Finance Reminder: Transener and Petrolera Pampa stocks are only listed in the Merval Index, the market cap is expressed in Argentine Pesos -AR$-. Exchange rate as of August 17th: ARS/USD= 9.15. Updated quotes and market cap expressed in USD here . Scenario: Pampa Energía works in a highly distorted regulatory framework where frozen tariffs have led to a critical situation for the utility companies. From 2001 onwards the tariff was converted to AR$ and had practically no adjustments and no longer provides for a reasonable return on capital/assets. Full tariff reviews are pending. High inflation and regulated tariffs that took place since 2006 and 2001 respectively, have led to deep margin erosion for utility stocks. The Argentine utility stocks have underperformed their Latam and EM peers since 2001, these poor returns are explained by significant erosion in real electricity tariffs (frozen since 2001). Gross margin captured by utilities as a percentage of the GDP fall from 0.3% to 0.02%, setting the scope for a possible recovery in profits, if the upcoming political situation leads to a normalization of the current imbalances. For example, the comparison between the residential electricity cost in Argentina and regional peers shows clearly how distorted the public services tariffs are. (click to enlarge) Source: Pampa Energía. Subsidies for electricity and gas purchases cost the government around 4.5% of GDP, and the burden is growing. Some tariffs would need to triple or even be multiplied by seven times to reach market prices. With just a small correction, companies like PAM will perform better. A presidential election is coming in Argentina as of October 25, and the main contenders (Daniel Scioli, Mauricio Macri and Sergio Massa) have expressed its understanding about the need to lift some tariffs caps, in order to reduce the fiscal deficit, which is unsustainable at these levels. As the company’s aren’t capable of fulfilling the investment needs in electricity of the country, and several blackouts occur during the last quarters, the actual government is taking some measures to improve the situation. Two relevant facts take place during 2Q15 for Pampa Energía: 1) “SE Resolution No. 482/15: Increase in the Electricity Generation Remuneration Scheme On June 10, 2015, the Secretariat of Energy issued SE Resolution No. 482/15, in which it updates retroactively the remuneration for electricity generation as of February 2015 commercial transactions.” 2) “Gas Transportation Tariff Increase for Transportadora de Gas del Sur S.A. On June 8, 2015, the National Gas Regulatory Authority -ENARGAS- issued Resolution No. 3,347/15, which grants TGS a tariff increase for gas transportation and operation and maintenance fees of 44.3% and 73.1%, respectively, both retroactive to May 2015.” Source: Pampa Energía 2Q15. This and other measures have improved Pampa´s EBITDA and Profits. In the 2H15 : Consolidated sales revenues of AR$3,457.6 million ($378 million) for the six-month period ended on June 30, 2015, 18.4% higher than the AR$2,921.4 million ($319 million) for the same period of 2014. Adjusted consolidated EBITDA of AR$1,693.3 million ($185 million) for the six-month period ended on June 30, 2015, compared to AR$27.1 million ($9 million) for the same period of 2014. Consolidated profit of AR$1,365.1 million ($149 million) during the six-month period ended on June 30, 2015, of which a profit of AR$963.0 million ($105 million) is attributable to the owners of the company, compared to an AR$80.4 million loss (-$8.8 million) attributable to the owners of the company in the same period of 2014. With a market cap of $900 million, earnings per ADR in the 1H15 of $1.7, and foreseeable earnings of nearly $180 million a year, the forward P/E looks compelling. Just thinking about the replacement cost of its fixed assets, it´s easy to see how PAM is undervalued, and this is mostly caused by a regulatory environment which could improve soon. As a change in the government is approaching, it could be expected that some distortions will disappear, I´m not talking here about free market prices, as it´s “politically incorrect” to raise tariffs by 200% in a single move, but given the current situation, where PAM is trading at a forward P/E of 5, and making money under this difficult scenario, any improvement will boost earnings and improve the company´s situation. Risks: Currency risks are present since it’s widely expected that the new government will depreciate the local currency, but that depreciation will certainly include better tariffs for the utilities as the energy price is partly dollar linked as well as the importations of energy. Political risks are another factor to bear in mind, but as the current government deficit is unsustainable, some adjustments are needed. To conclude PAM is under the current conditions deeply undervalued, and that could increase if the pending integral tariff revision comes in place. If the Argentinean economy is going to improve, massive capex in the electricity sector would be needed, and PAM is in the better position to profit from that. Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in PAM over the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.