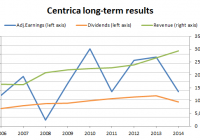

This week I was mildly surprised to see that Centrica ( OTCPK:CPYYF ) ( OTCPK:CPYYY ) (which I’ve owned since 2012) had cut its final dividend as part of a plan to rebase the dividend some 30% below its previous level. It wasn’t a complete surprise given the recent collapse in the price of oil, but it’s the sort of event which demands some sort of reaction. As I see it, shareholders have three main options: Panic sell: Break out in a cold sweat, curse Centrica’s management and place a sell order immediately. Do nothing: Be mildly miffed, but do nothing with the intention of holding the shares “forever”. Weekend review: Wait for the weekend and then review the company again in order to decide whether to keep holding, start selling or perhaps even buy more if the price drops enough. Reaction option 1: Panic sell If you’ve been reading this blog for a while, you’ll know that I am not a fan of panic selling, especially when it relates to an established, successful company like Centrica . Sure, panic sell an AIM-listed micro-cap mining company that operates in some country you’ve never heard of, but Centrica? I’ve written about this before, but in my view panic selling a defensive dividend payer like Centrica is like selling a buy-to-let property because its rental income drops for a year or two. Typically, rent will drop because there’s a void period, i.e. a period where one tenant leaves and another can’t be found immediately. The property sits empty for a few months and so rental income for the year is lower. Panic selling in that situation would mean putting the house up for sale immediately at a knock down price, perhaps 20% below its true market value, just to get rid of the place. To me that is just crazy. It locks in a massive capital loss just because income has dropped a little bit for a little while. The property is still there, its basic ability to generate an income is no different, and in time the income may well bounce back to where it “should” be. The same could easily be said of Centrica or any other defensive dividend payer. The same sort of situation led investors to sell Aviva (NYSE: AV ) after it cut its dividend in 2013, causing them to miss out when the share price rebounded massively shortly after (a roller coaster ride which I went through myself). Reaction option 2: Do nothing Now, this is much closer to my heart. I like to be efficient, i.e. to minimise the amount of work I need to do (which my wife describes as “lazy”). The minimum amount of work in this situation is to simply do nothing at all. In fact, this is a popular strategy which generally falls under the banner of “buy and hold”. A good example of the buy and hold approach is the High Yield Portfolio strategy (HYP) developed by Stephen Bland, which has its spiritual home on the Motley Fool bulletin boards. With HYP, defensive dividend payers are bought with attractive yields and then left untouched for all eternity, and “tinkering” with the portfolio is a definite no-no. While this sounds more attractive to me than panic selling, and is for the most part a fairly sensible strategy if you’re buying the right sort of companies, it isn’t for me. I don’t like the idea that I would buy a company in 2010 and still be holding it in 2030 without ever having thought about whether it was worth holding on to. When a company is first bought, it is analysed to make sure it’s a defensive dividend payer. At the same time, its share price is analysed to make sure the yield is sufficiently good. So, if it makes sense to check those things when the shares are bought, why does it make sense to never check them again? What if the company goes down the pan, never to recover? Surely, at some point it makes sense to move on and buy another company that is far more successful? Or what if the company does okay, but the share price doubles or triples, dropping the dividend yield to well below the market rate? Wouldn’t it make sense in that case to lock in those excess capital gains by selling? The proceeds could be reinvested into another, equally solid company but with a more attractive valuation and dividend yield? That’s not to say buy and hold isn’t a good strategy. It can be, but only for those who really do never ever want to make any investment decisions ever again, or at least no more than once every few years. For me that is far too boring and leaves far too many potential returns on the table. So, while I think doing nothing is probably much better than panic selling, I’m not going to stick with Centrica forever and ever, regardless of how it performs. I want something in between those two extremes. Reaction option 3: Weekend review And so we come to my preferred approach, which is the weekend review. The idea with a weekend review is to take the middle path between an emotionally driven knee-jerk reaction on the one hand and a complete absence of reaction on the other. It may seem odd to wait for the weekend, but there are good reasons for doing so: The markets are closed so you can’t see the price ticking lower ever few seconds and you can’t execute a trade immediately, which means you can concentrate on doing a good review without distraction It will usually be a day or so since the original unpleasant results were announced so you will have had time to calm down (although if you get upset by bad news, you’re probably not diversified enough), which should help you to think more clearly Once the weekend rolls around you would just sit down and do a thorough review of the company (Centrica in this case) using its latest results and its latest share price (using this investment spreadsheet if you like). In my case, as a defensive value investor I would be looking to see: Defensiveness: Is Centrica still a relatively defensive dividend payer (despite the dividend cut), with reasonable medium- and long-term growth prospects? Value: Is the valuation still attractive, given the company’s slower growth rate and reduced dividend? Here are Centrica’s results up to and including the dividend cut: The profits are a bit jerky but the general trend is upward, although of course there are no guarantees for the future. At 255p, the company and its shares have the following metrics, which I have compared against the FTSE 100: Growth: 10-year revenue/earnings/dividend growth rate = 8% (FTSE 100 = 1%) Quality: 10-year growth quality (consistency) = 79% (FTSE 100 = 54%) Value: PE10 ratio (price to 10-year average earnings) = 11.3 (FTSE 100 at 6,850 = 14.4) Income: Dividend yield = 4.7% (FTSE 100 = 3.4%) Profitability: ROCE = 12.4% (using post-tax profit) (FTSE 100 = 10%) By those metrics, the company still has a better track record than the market average and its share price is still more attractively valued than the market by a considerable margin. After looking at the numbers, I reviewed the company’s operations and its market, and I think it is by no means clear how Centrica will perform in the medium to long term. The oil price is uncertain, the political situation is uncertain, and the economy is uncertain. However, this degree of uncertainty is entirely normal as the future is almost always uncertain. Rather than try to predict an uncertain future, my approach is to defend against it instead. I think the best way to defend against an uncertain future is build a highly diversified portfolio of successful, established, dividend paying companies, and then for the most part to let them get on with it. On that basis, I will be holding on to Centrica for now, despite the dividend cut. Editor’s Note: This article discusses one or more securities that do not trade on a major exchange. Please be aware of the risks associated with these stocks.