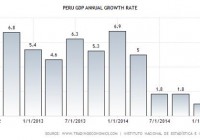

Summary Peru has consistently been one of the best performing countries in Latin America. The country is on track for recovery from decreased GDP growth experienced in 2014 and the beginning of 2015. The currently valuation of the iShares MSCI All Peru Capped ETF, combined with the future potential for growth, makes it a current attractive buy. The mining and banking industries will experience significant growth in the future; around 78% of the fund’s assets are invested in these industries. For those bullish on Latin America and searching for opportunities in this geographical location, Peru may be one of the best options at the moment. The best way to gain access to Peru is through the iShares MSCI All Peru Capped ETF (NYSEARCA: EPU ). In addition to the fund being attractively valued, with a P/E ratio of 12 , it is also trading very close to its 52 week low. Examining economic development in Peru, it is clear that growth is ahead and that the country is on track for recovery in areas that are currently unattractive. According to Peru’s monetary authority, Peru’s GDP will grow by 5.5% in 2015 . This will represent a significant recovery from GDP growth in 2014. Peru currently has a trade deficit of 647 USD million . Low commodity prices in 2014 attributed to Peru’s decrease in export earnings. Inflation has averaged at 3% . Poverty rates have fallen by more than half between 2005 and 2013, and the amount of people living in extreme poverty has fallen from 15.8% to 4.7% . GDP Growth 2012-2015 (click to enlarge) GDP growth has declined significantly since 2014. The sharp decline in GDP growth is attributed to the decline of the fishing and mining industries . A decline in metal prices and poor weather conditions attributed to the poor performance of these industries. Because of this, growth in 2014 was significantly lower than its average growth rate of 6.4%. Recovery of these industries is crucial for Peru to continue on its path as a key player in Latin America. Latin America GDP Growth GDP Growth in Peru has consistently outperformed Latin America, and has only been rivaled by Colombia. Even with slower growth in 2014-2015, Peru demonstrates tremendous potential compared to other countries in Latin America. The relatively poor performance of 2014 presents opportunity for investors who believe that Peru can rebound, and has the potential for higher growth in the future. iShares MSCI All Peru Capped ETF The easiest way to gain access to Peru is through the iShares MSCI All Peru Capped ETF, which provides exposure to a variety of industries in Peru that have the potential for growth. The holdings for this ETF are in the following industries: Basic Materials (Mining): 47.75% Financial Services: 30.1% Utilities: 7.2% The remaining companies are in the following industries: consumer defensive, consumer cyclical, industrials, and energy. It is very evident that the poor performance of the fund is correlated to the recent negative performance of the mining industry, as top holdings in the mining industry have not performed well in the past year. Southern Copper Corp (NYSE: SCCO ) has lost 0.68% in the past year, and Buenaventura Mining Company Inc (NYSE: BVN ) lost 4.93% in the past year. Future recovery of this industry would provide substantial returns for investors. Moreover, the financial services industry is a large component of this ETF, and its future potential for growth is also strong. Recovery in GDP growth seems to be ahead, as the ministry of finance has projected 4.2% economic growth for 2015 . Moreover, the Andean Development Corporation expects Peru to lead Latin America in growth this year, which will result from increased mining and infrastructure projects. Recovery and growth of the mining and banking industries in Peru are both two of the most important factors for a turnaround in this fund’s performance. Mining Industry Overview Peru is one of the most mineralized countries in the world, and currently hosts some of the largest metal mines in the world. Peru is the world’s third largest producer of copper, silver, tin, and zinc, and is also the world’s seventh largest producer of gold. The majority of the world’s largest mining companies have a presence in Peru; this includes Xstrata, Newmont Mining Corporation (NYSE: NEM ), Glencore ( OTCPK:GLNCY ), Gold Fields (NYSE: GFI ), Freeport-McMoRan (NYSE: FCX ), Rio Tinto (NYSE: RIO ), Anglo American ( OTCPK:AAUKY ), and Barrick Gold Corporation (NYSE: ABX ). Copper mining presents the most potential in Peru, as Peru is expected to double its copper output from 1.3 million MT to 2.8 million MT by 2016 . Moreover, out of all the mining investments expected to take place by 2020, $35 billion will be allocated towards copper projects; this represents 62% of the total investment . Five copper mines are expected to begin production before 2016, with a total investment of $13 billion. It is shocking to note that although Peru has large mineral resources, only approximately 0.32% of the country’s total territory was being explored in 2013. Risks in this industry that investors should be aware of and constantly investigate include the government’s response to illegal mining operations and negative local perception of mining operations . Illegal operations identified by the police are not only shut down, but the equipment is also destroyed. Mining operations have also resulted in protests from local citizens, who oppose the operations and seek to protect their farming and water resources. A large number of conflicts have resulted in local citizens being injured or killed. Lack of local cooperation has resulted in the delay of operations of some companies. Most recently, Southern Copper Corp plans to extend its initial 60 day pause so that it can build local support. The full potential of Peru’s mining industry is clearly not being realized, and there is growth ahead. Investors can profit long term by the turnaround in Peru’s economic performance and the development of the mining industry. Infrastructure/Construction The completion of infrastructure projects is another factor that is anticipated to attribute to Peru’s future economic recovery and growth. Credit Suisse projected economic growth of 5.6% in 2016 , which would be attributed to the vast infrastructure projects undertaken. Some of these projects include: Southern Gas Pipeline : This project consists of more than 1,700 kilometers of gas pipeline, designed to transport gas from the Camisea Field to Southern Peru. The Peru government, with the support of a consortium, agreed to invest $5.7 billion to build the capital’s first subway line . Recovery of the construction industry in 2015 may be one pillar of the economy in Peru that attributes to the country’s recovery. The government plans to embark on 22 large-scale projects in 2015 with a total value of $7 billion; some of these projects will be in the construction industry. Although it currently only accounts for 5% of the country’s GDP , its growth is significant, as it has consistently outperformed the country’s annual GDP growth. The construction industry is also expected to rebound for the following reasons : The Work for Taxes Law, which seeks to accelerate the growth of construction projects, by allowing private companies to implement projects chosen by regional and local governments. Peru’s president, Ollanta Humala, plans to pave 85% of the country’s roads by 2016. In 2015, the government expressed its plans to invest $2.8 billion in new hospital infrastructure, and to invest further into schools. Banking The banking industry has the advantage of high potential for expansion, due to the large unbanked population in Peru. This is also combined with the threat of overconcentration of banks in the industry, which attributed to the 1998 financial crisis the country experienced. Performance of the industry in 2014 makes it evident that the economic adversity in 2014 did not negatively impact the banking industry: Total direct loans expanded by 14.8% Total deposits increased by 18.4% Equity increased by 11.2% The industry is still in its infant stages , as only 20% of the population in Peru holds an account at a financial institution. The high growth potential of this industry has consequently encouraged the entrance of major foreign banks. Moreover, a 15-20% growth in the microfinance industry has been projected for 2015; microfinance will not only be beneficial for increasing the socioeconomic status of citizens of Peru, but will also increase their access to banking services. The growth of the microfinance industry will provide a major benefit to the banking industry as a whole, by increasing the banked population. The recovery and future growth of this industry is highly feasible, and the fund’s top holding in this industry is attractive based on its past financial performance. Credicorp Ltd. (NYSE: BAP ), the fund’s top holding in the banking industry, has had a negative return of 9.53% in the past year. However, the company was able to increase its net revenue by 46.1% in 2014 . Conclusion It is reasonable to assume that a rebound of Peru’s economy is highly feasible in the future, and that Peru is one of the most promising countries in Latin America. Recovery and growth for the country is inevitable, specifically in the industries that this fund invests into. Therefore, investing in the iShares MSCI All Peru Capped ETF is a wise endeavor for those having a long term vision for Peru’s economic growth and recovery. Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.