You Can Afford To Hold Cash

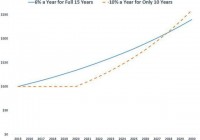

In my last post, I said stocks were too expensive. Instead of putting more of your money into diversified groups of stocks, you should just let cash build up in your brokerage account. A lot of people have a fear that those lost years of making zero percent on their idle cash can never be made up for. I’ve created a graph to show how much ground you’d have to make up. (click to enlarge) Let’s say you have two choices. One is to invest in an overpriced basket of stocks today and hold that basket from 2015 through 2030. This choice will compound your 2015 money at a rate of 6% a year. The second choice is to do nothing for all of 2015, 2016, 2017, 2018, and 2019. You just hold cash. That cash earns 0% for those 5 years. In 2020, you finally get an opportunity to make an investment that will return 10% a year from 2020 through 2030. If your investment horizon extends all the way out from today through 2030, the second approach overtakes the first approach about 15 years from now. Doing nothing for 5 years and then something smart for 10 years is a better 15-plus year strategy than “just doing anything” today. Here, we define something smart as 10% a year and “just doing anything” as 6% a year. You can decide for yourself whether your something smart is 10% a year or not. That’s subjective. What the “doing anything” returns is a lot more objective. So, let’s talk about that. Over the last 15 years, the S&P 500 (NYSEARCA: SPY ) returned about 5% a year. During that time period, the Shiller P/E ratio contracted from 43 to 27. The same percentage contraction – 37% – would be required to get the Shiller P/E down from today’s 27 to a historically “normal” 17. I see no reason why the S&P 500 should do better from 2015 to 2030 than it did from 2000 to 2015. That means I see no reason why buying the S&P 500 today and holding it through 2030 should be expected to return more than about 5% a year. (Almost all readers I talk to have a total return expectation for the S&P 500 that is greater than 5%, even for periods shorter than 15 years.) It’s also worth mentioning that while I have no predictions as to when idle cash would earn more than zero percent, the Fed does. And those predictions show cash earning a few percent in 2018 and 2019, instead of zero percent. For those reasons, the graph in this post is probably an underestimation of how quickly sitting and doing nothing till you can do something smart outperforms continuing to shovel cash into the S&P 500 at today’s prices. I think the reason people don’t feel secure in waiting for an opportunity to do something smart is that they’re not sure when that opportunity will appear. Maybe there will be no chance in all of 2015, 2016, 2017, 2018, 2019, 2020, or even 2021 to do something smart. If that’s true, isn’t it possible doing anything now could outperform waiting to do something smart later? If that later is sometime after 2021, couldn’t it be better to just buy the index today? Yes. I can only point to history. Pick any year in the past. Then move forward 6 years from that time. In the intervening years, was there an opportunity to do something smart? The hardest waiting period in history was during much of 1995 through 2007. Although stocks were often cheaper than they are today, the largest and best-known American stocks were almost always more expensive than they had been at any time before 1995. I think this is the real reason why investors I talk to are hesitant to hold cash. Much of their investing lifetime was spent during a time of high stock prices. There is no advantage in buying something that is unlikely to provide a good long-term return instead of holding cash till something good comes along. If we take 15 years as long term, we can say that the S&P 500 will not provide good long-term returns if bought today. You can afford to avoid 5%-a-year type long-term commitments if you have a real chance at finding 10%-a-year type long-term commitments sometime in the next 5 years. You don’t need to know exactly when or where this opportunity will come. A lot of investors who live outside the U.S. read this blog. They have an advantage. Their home countries’ stock markets might provide a 10%-a-year opportunity sometime in the next 5 years. American investors probably won’t notice such an opportunity when it appears. By buying into an index today, you are really saying you will just take whatever price Mr. Market gives you. You do this because you’re not sure he will ever give you a good price again. Or, if he does, it may come far more than 5 years in the future. Caving into Mr. Market’s mood is not something value investors think is appropriate when it comes to individual stock purchases. Yet, a lot of the people who read this blog – who are otherwise value investors – feel they have no choice but to continuously add to the actively and passively managed mutual funds in their brokerage account. The other choice is to hold cash. And the longer “long term” is for you, the more sense holding cash makes. It makes a lot of sense right now.