PHK: Is It Time To Get Out While You Still Can?

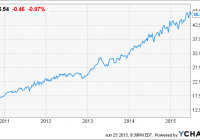

Summary Pimco High Income Fund’s premium has fallen from over 50% to around 30%. The net asset value isn’t the issue, investor perception is. I strongly recommend investors reconsider their position here before it’s too late. Pimco High Income Fund (NYSE: PHK ) is a risky investment. Although the fund has a solid performance history and has steadily paid dividends through even the “worst of times,” it trades at an extreme premium over net asset value, or NAV. It’s easy to give short shrift to that little issue when times are good, it’s harder to ignore when the tide starts to shift. And just such a shift may be taking place right now. OK, it’s got a good record I’m not going to argue that PHK is a poorly run fund. Quite the contrary, it is a well run fund. For example, over the trailing 10-year period through May, the fund’s annualized NAV total return was around 11%. Total return includes reinvested distributions. That puts the fund in the top tier of its Morningstar peers. It’s performance over the trailing three- and five-year periods were even more impressive, at 19% and nearly 18%, respectively. Equally important, the fund’s distribution has been maintained through thick and thin. That includes through the disastrous 2007 to 2009 recession that led to distribution cuts throughout the CEF industry. I have concerns with the level of the distribution , at nearly 13% based on market price and 19% based on NAV, but that doesn’t diminish the consistency with which the dividend has so far been paid. So, yes, PHK has been a well run fund. If this were an open-end mutual fund the discussion would stop right there. But it isn’t, it’s a closed-end fund. Supply and demand Closed-end funds trade on supply and demand, which means their prices can vary from their net asset values. When investors are enamored of a CEF, they bid the shares up close to or above the NAV. When investors are less sanguine they push CEFs to discount prices – often very deep discount prices. This isn’t news to anyone who follows CEFs. PHK has been a market darling. It started the year with around a 50% premium over NAV. That’s massive and only exists because of investor sentiment. Investors at the start of the year were willing to pay $1.50 for $1 worth of assets. I have suggested a couple of times that this is a big risk. That stance had garnered a mixture of agreement and hostility. Those who disagree with my concerns basically suggest that the fund is so good that it deserves the premium pricing. Looking at more recent performance, however, suggests exactly why such a rich premium is a huge risk. Over the trailing three months through June 23rd, PHK’s market price return was a decline of over 18%. That’s a rough stretch to have lived through, even if the dividend has remained stable. And while investors can argue that impressive share price gains over the years means those losses are only taking back house money that misses the point. You see, PHK’s NAV return was a positive 5.5% over that same span. And since PHK’s NAV performance was positive during this span, it’s hard to suggest that the market price performance had anything to do with the fund’s NAV performance. It seems pretty clear to me that a significant number of investors have soured on the fund. Yes, there have been changes in the number of shares of PHK that are sold short . That, presumably, should ease negative sentiment. But, in the long run, this is noise. The short interest is a symptom of the bigger issue, which is the extreme overvaluation. A warning shot If you still own PHK, look at this swift reversal of fortune as a warning shot. Could the premium go right back up to 50%? Yes. Will it? Who knows. The drop, however, is clear evidence that investor perceptions are shifting. The value of a PHK share is still roughly 30% lower than where the shares trade today. In other words, there’s still plenty of downside left before it reaches NAV. Don’t underestimate that risk. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.