Tough Choices: Alternative Funds In 2015

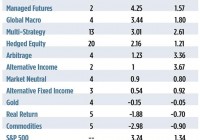

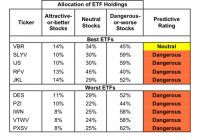

The Oxford English Dictionary provides two definitions of the adjective “alternative.” In one, the term is used to describe something “available as another possibility or choice.” The other, more proscriptive definition pronounces the choice between two things as “mutually exclusive.” In what context are we to view “alternative investments” or “alts”? Are they portfolio adjuncts or replacements? These nontraditional assets are, for the most part, utilized for risk diversification within a portfolio, not as a portfolio themselves, so it’s good to keep this in mind when reviewing performance records. Yes, returns are important but so, too, are correlation and other dynamics. Ideally, alts should be the yin to a portfolio core’s yang. Once available only to well-heeled investors through privately placed hedge funds, an increasing number of alternative investment strategies can now be found in mutual fund and exchange traded product wrappers. The array of retail-sized alts has, in fact, become dazzling. Last year, 109 liquid alt products debuted and this year’s shaping up to be similarly fecund. Through May, 54 new funds have been launched. This proliferation is a recent phenomenon, though. Relatively few liquid alt products can truly be considered seasoned. All told, when the alt universe is culled for funds with track records extending five years or more, just 68 candidates squeak through. So how have these time-tested funds fared in 2015? Just three categories–risk parity, managed futures and global macro-have outdone the broad-based domestic equity market through mid-year. In some cases, that’s to be expected; the idea is that these funds will dampen volatility of an overall portfolio and provide some cushion for a falling market. For many alts, that thesis has yet to be tested, of course, and in an extended bull market, it gets harder to make the case for funds that don’t keep up. So here, we’ll concentrate on the strategies that have enhanced returns over the broader market. Risk Parity Risk parity? What’s that? An in-depth examination of risk parity strategies can be found in REP. ‘s March issue, but the quick-and-dirty is this: These portfolios allocate assets on the basis of risk, not dollars. Typically, risk is balanced by overweighting lower-volatility assets. The granddaddy of risk parity funds is the AllianceBernstein Global Risk Allocation Fund (MUTF: CABNX ), which keys on tail risk to invest in an array of global asset classes. “Tail risk” refers to the probability of a significant downside event. Allocations are made so that each class contributes equally to the fund’s expected tail loss. Through May, CABNX rose 4.51 percent, comfortably ahead of the 3.24 percent contemporaneous gain in the SPDR S&P 500 Trust ETF (NYSEARCA: SPY ). CABNX’s year-to-date gain came in second to that of its category mate, the AMG FQ Global Risk-Balanced Fund (MUTF: MMAFX ). The AMG portfolio, which recorded a 5.13 percent total return through May, primarily relies on derivatives to dynamically balance risk. Over a five-year span, these risk parity funds have done yeoman’s work, coming in second behind hedged equity products in average annual returns. Still, given the strength of the protracted stock market rally, alpha-positive alpha, that is-remains elusive. Managed Futures The case for short-enabled active management was emphatically made in the commodities sector this year. Unlike commodity index trackers, actively managed futures funds can short-sell with as much abandon as they can buy. Margin’s the same, and so too the practical risk for either a long or short market stance. And a good thing that was for fund runners this year. Most of 2015’s commodity price action has been to the downside, primarily led by plummeting tariffs for oil. The Equinox MutualHedge Futures Strategy Fund (MUTF: MHFAX ) capitalized upon this trend and other tactics by allocating its assets to several subadvisors with diverse trading styles. Through May, MHFAX gained 5.27 percent, outdoing the 3 percent earned by its single-manager category mate, the Guggenheim Managed Futures Strategy Fund (MUTF: RYMTX ). Over the long run, managed futures have been a middling performer on the alts stage, but still have handily outperformed long-only commodity actors. Global Macro Big picture investing paid off in 2015’s first half as global macro products collectively eked out a 20 basis point advantage over the gain earned by an S&P 500 proxy. Global macro strategies bank on forecasts and trends in systemic factors such as interest rates, policy changes and fund flows. Leading the charge, the PIMCO Global Multi-Asset Fund (MUTF: PGAIX ) returned a best-of-class 6.35 percent through May. PGAIX fund runners allocate assets across a spectrum of equities, fixed income securities and commodities, utilizing a top-down approach enhanced by some bottom-up alpha-seeking tactics. Tail risk hedging is also employed to insulate the portfolio. That said, PGAIX isn’t the least volatile fund in the category, but neither is it the most. The Ivy Asset Strategy Fund (MUTF: WASAX ) actually has the best five-year Sharpe ratio (0.74) in the category, but its inherent volatility can take investors on a bit of a roller coaster ride. What’s Not Hot This year’s laggards are physical assets-gold, real return assets and commodities. No surprise there, given the disinflationary mood in early 2015. All five seasoned commodities funds were under water through May, some significantly more than others. The tiny Rydex Commodities Strategy Fund (MUTF: RYMEX ) floated just below the surface with a -0.72 percent return while the Direxion Indexed Commodity Strategy Fund (MUTF: DXCTX ) foundered with a 5.54 percent loss. Such disparate performance arises because the funds track dissimilar indices: DXCTX a long/flat benchmark comprised of a dozen commodities and RYMEX a broader-based long-only construct. Real return funds pursue strategies that seek to outperform the broad equity market during periods of rising inflation. Typically, these funds invest in a portfolio of “real” assets including interests in residential property, energy, metals and agriculture. Three of the five real return portfolios were actually above water in May, but because the behemoth PIMCO Commodity Real Return Strategy Fund (MUTF: PCRIX ) commands an 89 percent market share, its 2.24 percent loss dragged the category return down. Three of four senior gold funds, tracking the metal’s spot price assiduously, ended May at pretty much the same level as the year’s start. One portfolio, the PowerShares DB Gold ETF (NYSEARCA: DGL ), which replicates the returns of gold futures rather than bullion, underperformed the others, largely due to the continuous costs of rolling expiring contracts forward. The Road Ahead If you look at the five-year track records recapped in Table 2, one thing becomes readily apparent: the higher a category’s correlation to the broad market, the better its performance. The average annual returns of the top five categories, all pegged against the S&P 500, line up perfectly with their r-squared correlations. No doubt, those funds have basked in the warmth of a torrid equity market. The stock rebound will one day turn to a dribble and when it does, the out-of-favor categories will have an opportunity to rise to the top of the league table. It’s then that the alpha column is more likely to be populated by positive numbers. This article originally appeared in the July issue of REP. Magazine and online at WealthManagement.com .