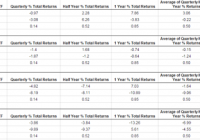

The price of UNG remains low and has declined by 2% since the beginning of the month. The weather is expected to heat up, but only in parts of the U.S. Will this be enough to drive up the demand for natural gas in the power sector? The natural gas market has started to cool down in the past couple of weeks, as the price of the United States Natural Gas ETF (NYSEARCA: UNG ) has declined by 2% since the beginning of the month. However, it’s still early to consider a downward trend in the price of UNG. And the market is still expected to remain soft in the near term, with higher-than-normal injections to storage, normal temperatures, robust production and low demand for natural gas. Unless the weather heats up, the price of UNG isn’t going anywhere. In the futures markets, contango has gone up mostly for the month of November – this is when the demand for natural gas is likely to pick up on account of higher consumption in the residential/commercial sectors (the start of winter). In November, the extraction season is expected to commence. (click to enlarge) (Data Source: EIA) But for the near-term contracts – September and October – contango hasn’t picked up by much, and as such, it’s not likely to have much of an impact on the roll decay of UNG. In the recent EIA weekly update , underground storage rose by 91 Bcf – a bit higher than market expectations, which stood at 86 Bcf. This was also higher than the 5-year average of 75 Bcf. Furthermore, in the coming weeks, analysts still project that the storage will rise at a faster pace than the 5-year average. Despite the higher pace in injections, the price of UNG has rallied in the past few days. Even the modest decline in natural gas consumption – down by 2% week on week, mainly due to lower consumption in the power sector – hasn’t driven down the price of UNG. The weather, which was expected to heat up, didn’t do so. The average temperatures were close to normal levels. Looking forward, the weather forecasts show colder-than-normal temperatures in parts of the west coast and the northeast. And warmer-than-normal weather throughout the south. Nonetheless, the cooling degree days (CDD) are expected to be higher: 19 degrees higher than normal and 27 degrees above 2014 levels. So we have a mixed signal about where the demand for natural gas in the power sector is heading this week. If the weather does turn out to be warmer than normal. The supply continues to slowly pick up, as production is still 5.4% higher than last year. Also, the number of rigs hasn’t changed much in the past few weeks: According to Baker Hughes , as of last week, the number of gas rigs slipped by 2 to 217. So far, this summer hasn’t been too hot. The power sector, which plays a more important role in this time of the year, relative to other sectors, has kept the price of UNG at its current low level. Unless the weather starts to heat up again, the injections will continue to be higher than normal and UNG will remain low. For more please see: ” On the Contango in the Natural Gas Market “. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.