Q2 Portfolio Update

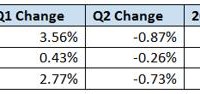

Summary Market was relatively unchanged during Q2. My portfolio saw moderate losses in Q2 due to outsized position in energy. Overall, my market strategy has been working with less volatility and slight SPY outperformance. (click to enlarge) Q2 for my portfolio saw my portfolio give back some of the strong gains I made in Q1. The market being approximately flat for Q2 is what I expected. Overall, the past six months has been characterized by the S&P 500 trading around the $207-208/share range for SPY. Breaks above 210 were short-lived in many cases, but pullbacks to 205/share were met with fierce buying. “Buy the dip” is the mantra, and thus far it has worked like a charm. (click to enlarge) Investors should expect this trend to continue through Q3, although I do finally expect SPY to break the 215 level and hold it going into year-end. Look for SPY to finish at around 217/share as we enter 2016, but not before testing 200/share in Q3, predicated on weakness going into the meat of Q2 earnings. So while the market behaved as I expected to, my picks for outperformance failed me. In many cases, this was simply me buying in too early. I look to see outperformance from my trades during periods of stagnant/declining markets. This is where portfolios with short exposure and solid picks should shine. However, my exposure to basic materials, a driver of performance in Q1, hamstrung my returns in Q2 even after closing some positions. The biggest weakness was my short positions which fared poorly outside of a few profitable trades. The trend is your friend was also a driving theme in Q2, with hot sub-sectors continuing to be hot and I unfortunately got burned a bit there. My sector diversification has remained relatively in-line with my prior update on this portfolio. The largest changes have been reductions in stakes in Basic Materials and Services while I have increased my Technology and Utility stakes. Consumer confidence has been up steadily as of late , but my feeling is this may end up being a short-lived trend. Domestic labor market weakness still troubles me. New Positions Tempur Sealy (NYSE: TPX ). Tempur Sealy is an activist target via HR Partners, but risks remain including commoditization of the company’s products which has been deeply impacting margins and poor top-level management. Overall, I think the company presents the opportunity to open a short position given its bleak prospects, heavy expectations, and current trading range near 52 week highs. I opened a short here on 7/1/15 at $67.15/share. Tyler Technologies (NYSE: TYL ) . I was looking for long exposure to an up-and-coming mid-cap technology company and Tyler Technologies jumped out at me as a fine choice. The company has a wide moat due to their focus on the public sector and a great reputation, but it has an unfortunate lack of analyst following. Shares will likely be a solid long-term play, even after the strength it has shown recently. My cost basis is $120.45/share. USG Corporation (NYSE: USG ) . USG Corporation has been divesting assets in its low-margin segments and focusing on the core business providing drywall. International expansion has begun through a key business partnership. This is a highly levered play that will benefit strongly if US housing can continue its slow turnaround, which I think it can. I recently opened a position with a $27.08/share cost basis. Closed Trades SDOW . On 5/22/15 I opened a position in SDOW at $17.89/share. I closed this position on 6/10/15 at $19.03/share. For those unaware, this is an inverse 3x ETF. So if the DOW is down 1% on a given trading day, this ETF looks to generate a positive 3% return. This was a short-term hedge that I opened as I felt the market was trading near resistance at its highs and I wanted broader short exposure than I had. I’ll occasionally make small short-term trades like this one (this was under 1% of portfolio weight). Wendy’s (NASDAQ: WEN ) . You can find my article on my Wendy’s short here . I opened this short @ $10.65/share and closed at $11.05/share for a small loss on 7/1/15. My choice to cover was almost solely based on not wanting to compete against management’s Dutch auction. Wendy’s has done these before and shares have outperformed after for some time before falling. I was looking to short again from a higher price. Unfortunately, the broad market downturn has hit Wendy’s hard and it looks like I may not get the opportunity. Shares now trade at $10.50/share as of this writing. Yelp (NYSE: YELP ) . Yelp is a short favorite of mine that I have written about before on Seeking Alpha . I went short at $49.76 share and covered at $38.45/share when news broke the CEO was not looking to sell, expecting the typical Yelp recovery post bad news. Thus far, that has not materialized and it looks like I may have left a little bit on the table on this one as shares are trading down near $35.00/share. Nordson (NASDAQ: NDSN ). This is a great stock that I have also written about on Seeking Alpha . My cost basis was $71.85/share and I closed my position at $80.98/share on 6/22/15. I think the company is great, but it trades at a premium in a currently weak sector. I felt it was one of my weaker positions and I wanted to raise additional cash. Shares are down nearly 6% since my trade. If shares come back down to around my original basis I will likely become interested in buying back in. LendingTree (NASDAQ: TREE ) . Every once in a while you get one terribly wrong. This is one of those. I went short TREE ( article here ) several months ago and have been thrashed since. I lost approximately 66% on this short with a cost basis of $44.98/share, finally covering at $74.91/share on 6/30/15. I’m still not a fan of the company and believe the valuation is out-of-wack, but sometimes it is best to cut your losses and move on, something I should have done long ago in this trade. Lesson learned. Even as a small position, this trade knocked 50 bps off my total returns. Aaron’s (NYSE: AAN ) . Like Nordson Corporation above, I’m still a fan of Aaron’s even after closing out my position. The company is making great strides, but the company has rallied strongly lately and even though I recently placed a $41 price target on the company for 2016 , I decided to close out this position for now at $36.50/share on 6/25/15. With a cost basis of $27.78/share under a year ago, this has been a strong pick for me and I would be interested in picking up shares in the company again at slightly cheaper prices. Helmerich & Payne (NYSE: HP ) . Helmerich & Payne is under most measures the most well-respected contract driller operating in the United States, but I had placed a limit order at $75.20/share to close out some exposure to the domestic energy production sector. I managed to close roughly half of my HP position at that limit. $75.25/share ended up being a recent high for the company and the shares have plummeted since then, now trading below $65/share. I think the company is best-of-breed but it will likely be a long road back up to $75/share again given the reversal in sentiment for oil. Current Positions Conclusion My trading activity was rather low this quarter. Overall, I’m happy with the positions I’ve set and the mix I have taken on, now it is time to sit back a bit and wait for each thesis to run its course. I expect the rest of summer to be mostly more of the same with averages staying within their respective trading ranges. As far as individual tickers go, I try to cover these tickers fairly well on Seeking Alpha and any move to sell will usually come with an article update on how and why my thesis has changed. Disclosure: I am/we are long AAL, AAPL, AES, AXP, BCR, BEAV, CPN, GWR, HP, OCN, PBI, PKX, PPC, PTEN, RDY, RF, SYNT, TRUP, TYL, USG, WCC, WLK, WSO, WYNN, ZBRA. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.