My Favorite Ratios – Part 1

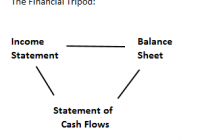

When the dog bites, when the bee stings, when I’m feeling sad, I simply remember my favorite things, and then I don’t feel so bad!” -The Sound of Music When Julie Andrews sings about bright copper kettles and whiskers on kittens, she’s trying to calm her charges during a violent thunderstorm. When the market gets turbulent and frightening, I turn to my favorite indicators of financial performance. I’ve noted before how – sooner or later – stock market performance has to come back to fundamentals. There has to be a way to evaluate how well a company is performing, whether it’s providing insurance or selling tractors. Most analysts use financial ratios. But there are literally hundreds of these, evaluating credit quality, efficiency, growth, even management’s language in their quarterly conference calls. Which ratios should we choose? I like to look at financial disclosures as a tripod, the three legs being the income statement, the balance sheet, and the statement of cash flows. The most basic analysis looks at earnings per share and (perhaps) sales as an indicator of how a firm is doing. But management sometimes manages those numbers. An investor once told of visiting a corporate loading dock on September 30th at lunch time. He asked the shipping manager how the quarter had gone. The manager looked at his watch and said he couldn’t tell, the quarter was only half over. Principal Financial Statements. Source: Douglas Tengdin But it’s hard to manipulate the entire financial picture. So I look at ratios that evaluate how these three principal disclosures interact. The most basic relationship is that between income and the balance sheet. This indicates how efficiently management is utilizing the assets that are under its control – how effective they are at turning an investor’s cash into earnings. So I use Return on Invested Capital – net earnings divided by the book value of equity and the market value of debt. I like to include debt in this analysis, because that doesn’t incent management to borrow money just to boost their return on equity. Second, I evaluate the ratio of cash from operations – part of the Statement of Cash Flows – to net income. This gives me, in broad terms, an indication of how much of the corporation’s earnings are based on cash receipts, versus accruals of one sort or another. Warren Buffett has said that cash is to a business as oxygen is to an individual. This relationship can give us a sense whether a company might need CPR soon. Finally, I examine the ratio of cash delivered to shareholders – both through dividends and net share buybacks – to the market value of equity. This ratio is the Shareholder Yield . This gives analysts a sense of how committed management is to returning cash to the company’s owners. We may be uncertain about many things that companies may disclose, but one thing we can be sure of is how much they pay us to hold their stock. And stock buybacks are important, as they can be a more tax-efficient way to return money to shareholders. Each of these numbers is independent of a company’s size. A mega-cap like GE (NYSE: GE ) with billions in capital is on the same footing as a 1000-person firm like Box. But taken together, they measure how efficiently a company is at generating cash from their businesses and how willing they are to send some of it to their investors. These indicators aren’t perfect. They are biased towards established companies that are in the process of paying shareholders – rather than taking in money and using it to grow, or even just redeploying their own internally-generated resources. And it’s important to look at footnotes as well, especially when accounting standards are changing. But when things go wrong, it’s comforting to know that a company’s management team is committed to distributing cash to me quarter after quarter. When a firm can do this from its own efficient operations, this can become an anchor of value in a storm of market turbulence. So, to paraphrase Maria (from The Sound of Music ), when the economy slows, when interest rates rise, when investors are feeling sad, I simply remember my favorite ratios, and – hopefully – my investments won’t do so bad.