2 Excellent Dividend Growth ETFs In Focus

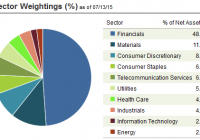

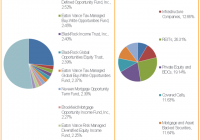

After a widespread sell-off last week in the wake of events in Greece and China, stocks have rebounded nicely this week. While in the shorter term, market volatility is expected to remain high, investors should focus on the longer-term picture. Here in the US, recent economic data has been mixed, pointing to a gradually recovering economy. If the economy perks up in the coming months, the Fed may start raising interest rates, even though the pace of hikes will most likely be very gradual. In any case, investors should start positioning their portfolio for the rising rate environment. Dividend stocks and ETFs have been extremely popular with investors over the past few years due to rock-bottom interest rates. Investors should however remember that most high yielding dividend ETFs focus on defensive sectors like Utilities and Telecom. In view of the rising rates scenario, investors may like to avoid ETFs that have a lot of focus on these rate-sensitive (bond-like) sectors, as these sectors underperform when rates start rising. On the other hand, cyclical sectors are likely to do well in the rising rate scenario Companies that consistently grow their dividends are usually high-quality companies that deliver excellent risk-adjusted return in the longer term. Further, many US companies have a lot of cash on their balance sheets and are likely to continue increasing their dividend payouts. Dividend Growth ETFs are excellent options for investors looking to invest in such companies. To learn more, please watch the short video below: Original Post Share this article with a colleague